U.S. stock-index futures on Tuesday pointed to Wall Street bouncing off a 21-month low and snapping a five-day losing streak as recent volatility in global bond and currency markets subsided.

How are stock-index futures trading

-

Futures on the Dow Jones Industrial Average

YM00,

+1.12%

climbed 321 points, or 1.1%, to 29,664. -

S&P 500 futures

ES00,

+1.40%

rose 50 points, or 1.4%, to 3,720. -

Nasdaq 100 futures

NQ00,

+1.66%

jumped 185 points, or 1.6%, to 11,501.

The Dow

DJIA,

entered a bear market on Monday, having fallen 20.5% from its record close on Jan. 4, while the S&P 500

SPX,

took out its 2022 low from June 16 to end at its lowest since Dec.14, 2020 and the Nasdaq Composite

COMP,

fell 0.6%.

What’s driving markets

The mood across global markets was more composed, encouraging investors to nibble at stocks, bonds and commodities on Tuesday.

“We are seeing some recovery in the risk sentiment today after a very weak start to the week yesterday,” said strategists at Citi in a morning note.

Wall Street’s benchmark S&P 500 index was down 5.7% over the last five trading days, as investor concerns about the economic impact of high inflation and rising interest rates resulted in signs of stress in the bond and currency markets.

“Heightened volatility in the currency markets has exacerbated what was already a [difficult] time in most asset classes, with equities reeling from the prospect of a global recession as central banks continue their aggressive monetary policies,” said Richard Hunter, head of markets at Interactive Investors.

Chicago Fed President Charles Evans on Tuesday said rates may need to plateau next year. Loretta Mester, president of the Cleveland Fed on Monday reiterated it was necessary to slow the economy to damp inflation. St. Louis Fed president James Bullard is due to give a speech on the economic outlook and monetary policy at 9:55 a.m. Eastern.

However, relative calm returned to the U.K. gilt market

TMBMKGB-10Y,

after its rout, caused by fears about the government’s fiscal strategy. This in turn has helped steady the pound and halted the rally in the dollar

DXY,

whose recent surge to 20-year highs caused fretting about its impact on U.S. company earnings.

The less febrile tone comes amid evidence that parts of the market are exhibiting extreme bearishness.

The S&P 500’s 14-day relative strength index, a closely watched momentum barometer, finished Monday around 25, where any point below 30 is considered in oversold territory. The CBOE Vix index

VIX,

a measure of volatility known as Wall Street’s fear gauge, remained elevated above 30.

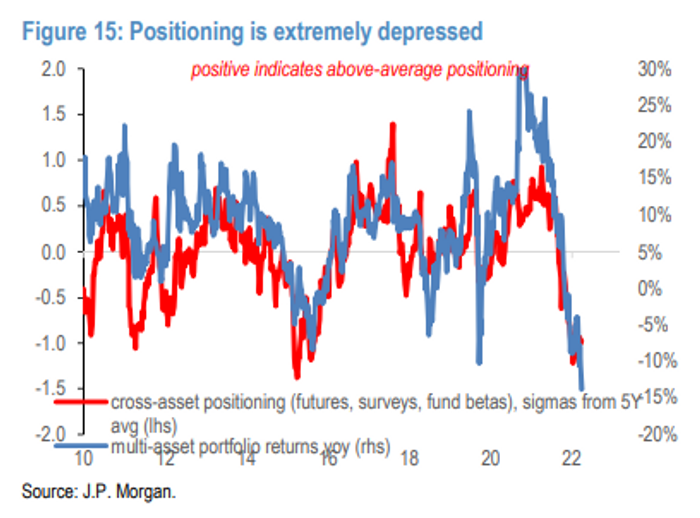

Meanwhile, Marko Kolanovic, market strategist at JPMorgan, notes that investor positioning is notably pessimistic.

“Our chosen positioning metrics comprise an eclectic mix of futures positions, hedge fund/mutual fund return betas and JPM client surveys,” he said in a note. “This indicator is mean reverting and close to its all-sample lows suggesting that that investors’ positioning is almost as defensive as it can get.”

Source: JP Morgan

And in a possible example of wholesale bearishness signaling a market bottom, BlackRock analysts said they were concerned that investors were not properly discounting the risks that central banks will deliver recessions in developed markets.

“Markets haven’t priced that so we shun most stocks,” said BlackRock.

U.S. economic updates set for release on Tuesday include August durable goods orders at 8:30 a.m.; the July S&P Case Shiller U.S. home price index at 9 a.m.; and the Conference Board consumer confidence for September and new home sales for August, at 10 a.m. All times Eastern.

Companies in focus

-

Shares of Nautilus Inc.

NLS,

-3.47%

rose 10% in premarket trade after the fitness-products company said late Monday that a potential sale of the company was being considered, part of a broader review of strategic alternatives launched by its board. -

Hertz Global Holdings Inc.

HTZ,

-4.18%

and BP PLC

BP,

+0.53% BP,

-2.92%

said Tuesday they have signed a memorandum of understanding for the development of a network of electric vehicle charging stations in North America. Shares of Hertz rose 2.9%, while BP’s U.S.-listed shares rose 2.8%.