Many corporations would have you believe that the strong U.S. dollar is why earnings targets likely will be missed. Yeah, and the dog ate my homework.

The reason I’m skeptical of making a strong dollar the culprit for earnings misses is that there is no statistically significant correlation between dollar strength and slower earnings growth. This isn’t to say that there is no individual company that’s vulnerable to dollar strength; but for every one that is there are others that actually benefit from dollar strength.

To measure the relationship between dollar strength and earnings growth, I measured the correlation coefficient of quarterly changes in the U.S. Dollar Index

DXY,

and contemporaneous changes in the S&P 500’s

SPX,

earnings per share (EPS).

This coefficient ranges from a theoretical maximum of 100% (which would be the case if the two data series moved up and down in perfect lockstep with each other) to a theoretical minimum of minus 100% (which would mean that the two move perfectly inversely to reach other, with one rising every time the other declined, and vice versa.) A coefficient of 0% would mean there is no detectable relationship between the two.

Over the past four decades, the correlation coefficient was a statistically insignificant 2.2%, according to my calculation. Furthermore, the coefficient has been declining: Prior to 2000 it was 13.2%, versus 2.0% for the years since. I reached the same conclusion upon focusing on trailing two- and four-quarter correlations.

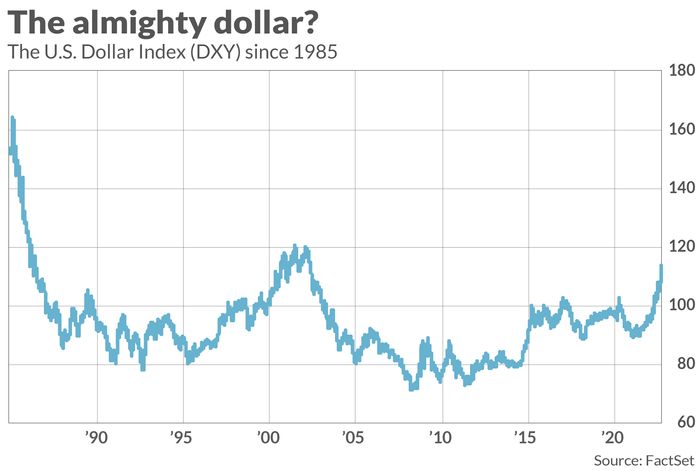

The low correlation coefficient makes sense visually when we eyeball a long-term chart of the U.S. Dollar Index. Notice in the above chart that the index has been rising during the 2022 bear market, and it rose during the bursting of the internet bubble two decades ago. That seems ominous, but the index also rose during the last five years of the 1990s as well as the decade prior to the COVID-19 pandemic — both periods of outstanding bull markets.

I don’t think we should be surprised by the lack of a correlation, for a couple of reasons:

First, while a strong dollar does reduce the dollar-value of foreign sales, that’s only half of the story. It is this half of the story that corporations inevitably mention in complaining why dollar strength has impacted their earnings.

But a strong dollar also reduces the dollar-denominated cost of their foreign operations. Given U.S. multinationals’ increasing global diversification, it stands to reason that a strong dollar should have relatively little net impact on market-wide earnings per share — and why what little impact it does have has declined over time.

Second, to the extent a corporation is particularly exposed to either a stronger or weaker dollar, it typically will hedge that exposure with currency futures or other derivatives. Otherwise, an investment in that company becomes an implicit bet on currency fluctuations.

This last point is especially important to keep in mind in the upcoming earnings season. To the extent that a corporation is correct in blaming the strong dollar for its earnings miss, that means its currency exposure is unhedged. That in turn means an investment in its stock is a bet that the dollar will decline in value. That may be a bet you want to make, but don’t confuse that bet with an investment in the company’s core operations.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at [email protected]

Also read: Don’t look for a stock market bottom until a soaring dollar cools down. Here’s why.