The Deuterium Global Dynamic Allocation Fund is what its fund managers like to say is a glass, rather than black, box. It’s built around a macroeconomic model that forecasts a host of economic variables across multiple countries, and then combined with separate models for central bank policy, market valuation and price trends.

What the model pushed the fund into doing — the managers do have a limited amount of discretion — is get back into bonds when the yield on the 10-year Treasury

BX:TMUBMUSD10Y

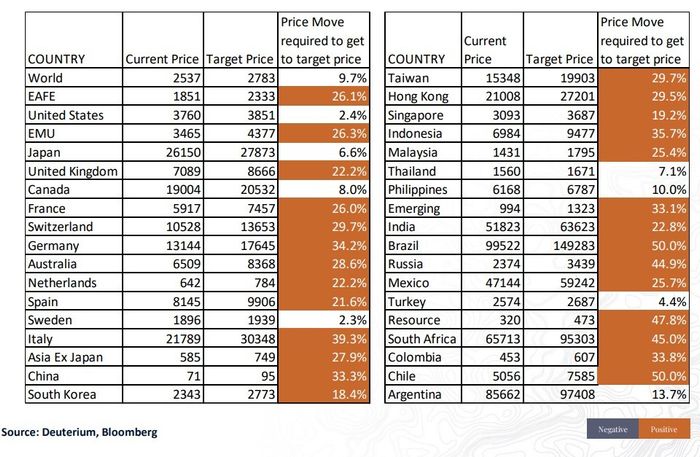

was over 3%, and flag U.S. equities as undervalued for the first time in nearly two years. Its dollar-denominated fund has dropped 7% this year, which nonetheless is an outperformance of the flexible allocation category of Morningstar.

And what it’s now projecting is some good and bad news. The good news is its model forecasts that inflation is right around its peak. “The important thing is that it won’t be accelerating from here,” said John Ricciardi, the lead manager of the fund and head of global asset allocation at the firm. “We think that investors are quite frightened of higher prices, more aggressive central bank tightening and elevated recession risks, and they will lessen as CPI flattens.” The bad news is the model expects output to slow, particularly near the end of the third quarter, and for corporate earnings expectations to deteriorate.

Its model is spelling more times ahead for technology. “The typical IT companies like Apple, they sell to consumers, and obviously consumers are not spending as much because of inflation and [declining] real wage growth,” said Vijay Modhvadia, managing director and head of risk. And even the tech companies selling to businesses are struggling as IT companies cut costs. The fund also is out of the energy sector, but likes healthcare and finds the telecommunications sector attractive. It finds European equities are undervalued, though there isn’t strong macro support for the fund to allocate more to the region.

The dollar, the firm says, is still undervalued even after its rally this year due to interest-rate expectations, while commodity prices will continue to fall as factory orders contract.

As for the coming Federal Reserve decision on Wednesday, the focus will be more on the commentary from the central bank than the likely decision to hike by 75 basis points. “If you look at the forward-looking indicators, including the PMIs and the announcement of many job cuts that have been happening in the tech sector, it’s all bad,” said Modhvadia.

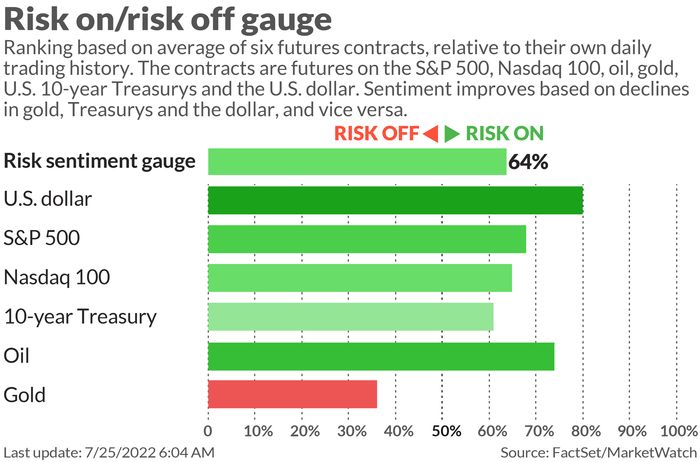

The market

U.S. stock futures

ES00

NQ00

strengthened heading into the open. Oil futures

CL

rose, the dollar

DXY

fell, and the yield on the 10-year Treasury

BX:TMUBMUSD10Y

edged up to 2.80%.

The buzz

There’s a light slate of earnings releases before companies ranging from Alphabet

GOOGL

to Exxon Mobil

XOM

report later in the week. Philips

PHG

shares slumped 10% in Amsterdam after cutting sales guidance.

Treasury Secretary Janet Yellen said the U.S. wasn’t in recession though she acknowledged a slowing economy.

China has been threatening the U.S. over a planned visit by House Speaker Nancy Pelosi to Taiwan.

Ukraine is still working to resume grain exports, after Russia attacked the Black Sea port of Odessa less than a day after agreeing to let shipments go through.

Best of the Web

Convicted leaker Reality Winner gave an interview to 60 Minutes.

Summer internships aren’t the same with no one in the office.

Elon Musk allegedly had an affair with Sergey Brin’s wife, ending the friendship between the two tech billionaires.

Big Tech reckons with the end of fantasyland.

Top tickers

Here are the most active stock-market ticker symbols as of 6 a.m. Eastern.

Random reads

Here’s the latest winner of the Ernest Hemingway look-alike contest.

Forget air conditioners. Beavers help wildlife survive the heat.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.