As the Fed kicks off its two-day interest-rate setting meeting, the focus is on whether Jerome Powell & Co. stick to their hawkish tone or indicate the pace of rate hikes may slow down.

Certainly, there’s valid reason for at least slowing down, after another jumbo rate hike is delivered on Wednesday. Inflation at a headline level looks to have peaked, goods prices are starting to fall, the surge in commodity prices has unwound, and the housing market is deteriorating rapidly.

Keith Wade, chief economist and strategist at U.K. fund manager Schroders, says there’s one thing missing. “In many ways corporate behaviour has been puzzling this year as the consequence of slower growth and rising employment has been the weakest productivity growth on record,” he says.

But, outside of the tech sector, there just hasn’t been much talk of layoffs. “In our view firms have only been able to tolerate weak productivity and the subsequent surge in unit wage costs through being able to pass them on in higher prices. Otherwise margins would have been crushed as labor costs surged. Instead firms have been beneficiaries of high inflation. As a result, whilst household cash flows are under pressure, the corporate sector is yet to see the sort of squeeze which would trigger a retrenchment,” he said.

The flow of funds data from the Fed show this — that the corporate sector is running a financial surplus, where internal cash flow exceeds investment. “In previous cycles a deterioration in this balance and dip into deficit has been a reliable indicator of recession. This is the point at which companies begin to have funding problems as they have to tap into external sources to maintain current expenditure. Very often this results in a retrenchment as lenders and other capital providers seek reassurance that the business is viable,” he says.

Of course, if household finances keep deteriorating, then at some point consumers just won’t be able to tolerate higher prices. But not yet. The economic data is reinforced by the third quarter earnings season so far: “some downgrades, but no great calamities,” Wade says.

The markets

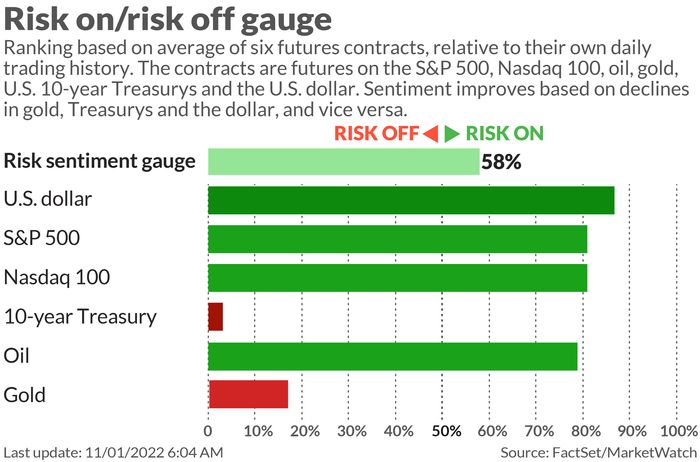

After the best month for the Dow Jones Industrial Average

DJIA

since 1976, U.S. stock futures

ES00

NQ00

were pointing to a good start for November as well. The yield on the 10-year Treasury

BX:TMUBMUSD10Y

fell below 4%, and the dollar

DXY

slipped.

The buzz

The Fed might get distracted this morning by a hefty set of data releases, including the suddenly important job openings report. The vacancies-to-unemployment rate is a key indicator of labor market tightness, a new study finds.

There’s also the Institute for Supply Management’s manufacturing index, construction spending and vehicle sales data to come.

Abiomed

ABMD

rocketed after Johnson & Johnson

JNJ

agreed to buy the company in a $16.6 billion deal.

Uber

UBER

shares jumped on an upbeat outlook. After the close, Advanced Micro Devices

AMD

reports results.

Chinese stocks rallied on hopes of an easing of zero-COVID policies, though an official denial reduced enthusiasm. U.S.-listed Chinese stocks rose in premarket trade.

The U.S. and the United Arab Emirates signed a deal they said will “catalyze” $100 billion in financing and investment for clean energy. Saudi Aramco

SA:2222

said it earned $42 billion in the third quarter, while BP

BP

reported forecast-beating profits, helped by gas trading.

Best of the web

States spent millions on Deloitte’s anti-fraud systems, and then suffered billions of losses from fraud.

How to supersize tax-deferred retirement savings.

As Israel conducts its fifth election in five years, the swing electorate may be the country’s Arab community.

Top tickers

Here were the most active stock-market tickers as of 6 a.m. Eastern.

| Tickers | Security name |

| GME | GameStop |

| TSLA | Tesla |

| AMC | AMC Entertainment |

| NIO | Nio |

| META | Meta Platforms |

| AAPL | Apple |

| MULN | Mullen Automotive |

| AMZN | Amazon.com |

| APE | AMC Entertainment preferred |

| BBBY | Bed Bath & Beyond |

Random reads

The entire top ten on the Billboard charts are claimed by Taylor Swift.

A planet-killing asteroid has been hiding behind the Sun. Clever.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.