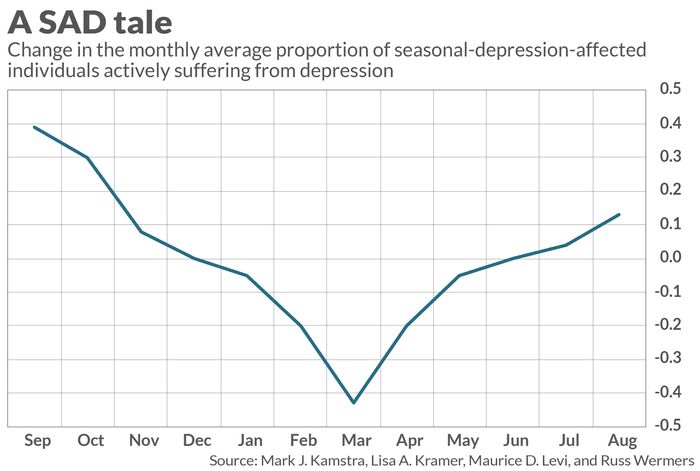

September appears to be the worst month for Seasonal Affective Disorder, which may be the missing link for why the month is so bad for the stock market.

Seasonal Affective Disorder, or SAD, is a depressive mood disorder related to the change of seasons. While most of us have heard of SAD, few associate it with September. When we think of SAD, we instead think of the shortest days of the year in December and January. We’re not wrong. More people suffer from SAD during the winter months than in September.

What affects the stock market isn’t the absolute number of those suffering from SAD — but changes in that number. And the biggest month-to-month change in those suffering from SAD occurs between August and September, according to an analysis of data compiled by Dr. Raymond Lam, a Professor and Leadership Chair in Depression Research at the University of British Columbia.

The monthly composite data are plotted in the chart above. Notice that the highest reading is in September. I suspect you already know intuitively that the picture this chart is painting could be accurate, since many of us begin to experience the depressive effects of SAD around Labor Day — when summer comes to an end, the days shorten and children return to school. Even though the weather remains warm and the hours of daylight nearly as long as in August, our psyches are already anticipating the coldest and shortest days in the dead of winter.

Researchers were able to connect these monthly SAD changes with the stock market by measuring flows of cash into and out of equity mutual funds. Perhaps the most prominent study establishing this connection appeared in 2017 in the Journal of Financial and Quantitative Analysis. Entitled “Seasonal Asset Allocation: Evidence from Mutual Fund Flows,” the study was conducted by Mark Kamstra of Canada’s York University; Lisa Kramer of the University of Toronto; Maurice Levi of the University of British Columbia, and Russ Wermers of the University of Maryland.

The researchers went to great lengths to eliminate the possibility that monthly changes in the incidence of SAD were a proxy for some other factor previously found to explain stock market changes. After controlling for those other factors, they found a high correlation between the data in the accompanying chart and flows into and out of equity mutual funds. The month experiencing the biggest net outflow is September.

That’s strong circumstantial evidence. Even more compelling is what emerged when the researchers studied the correlation between SAD and mutual fund flows in Australia. Since that country is in the southern hemisphere, the incidence of SAD should be the mirror opposite of the U.S. pattern. Sure enough, mutual fund flows in Australia follow the same pattern as in the U.S., shifted six months forward.

The September effect

One of the more intriguing implications of this research is its ability to explain the strong historical tendency for September to be the worst month for the stock market. Though this pattern is strong statistically, I have argued before that you shouldn’t bet on its persistence unless a plausible and convincing explanation for its existence could be found. Up until now I was not aware of any such explanation.

While recognizing that there are no sure bets in the stock market, this research correlating SAD with mutual fund flows provides this otherwise missing explanation. That in turn should increase our confidence when betting on September weakness.

So far this year’s September is adhering to form. As of Sept. 19, the S&P 500

SPX,

is down 1.4% from where it stood at the end of August, while the Nasdaq Composite

COMP,

is 2.4% lower.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at [email protected]

More: If you need one more reason why stocks will likely lose money in September, here it is.

Plus: What history says about September and the stock market after summer bounce runs out of steam