Harris Kupperman, the president of Praetorian Capital, made a couple of interesting calls heading into 2022. He predicted that stocks of the giant tech-oriented companies that led the bull market would be sold off, and that oil prices would continue to rise through the end of 2022.

The first prediction came true, while the second one for oil prices fizzled. After rising to $130 in March, oil prices have fallen back to where they started the year. Then again, that second prediction still could have made you a lot of money because the share prices of oil companies kept rising anyway.

That leads to a new prediction for 2023 and a related stock screen below.

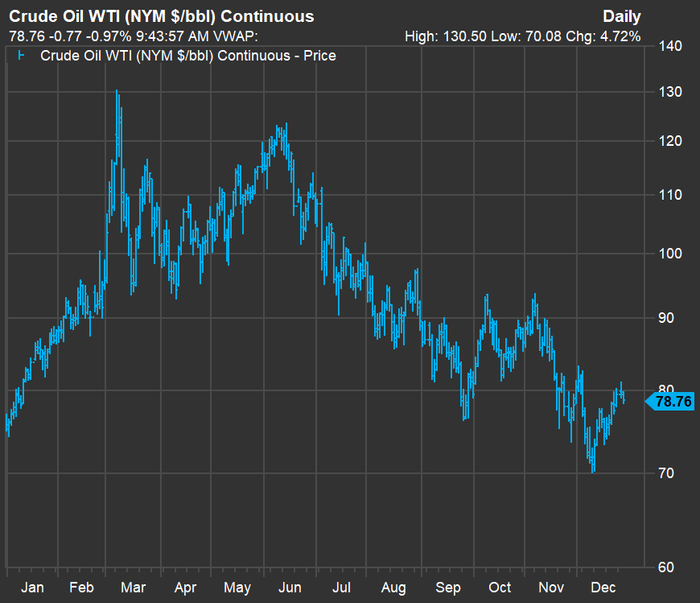

Here’s a chart showing the movement of front-month contract prices for West Texas Intermediate (WTI) crude oil

CL

since the end of 2021:

FactSet

Even though Kupperman didn’t get his oil price call right, the energy sector of the S&P 500

SPX

was up 60% for 2022 through Dec. 27, excluding dividends. That is the only one of the 11 S&P 500 sectors to show a gain in 2022. And the energy sector is also cheapest relative to earnings expectations, with a forward price-to-earnings ratio of 9.8, compared with 16.7 for the full S&P 500.

WTI pulled back from its momentary peak at $130.50 in early March, but that didn’t reverse the long-term trend of low capital spending by oil and natural gas producers, which has given investors confidence that supplies will remain tight.

Vicki Hollub, the CEO of Occidental Petroleum Corp.

OXY

— the best-performing S&P 500 stock of 2022 — said during a recent interview that there was “no pressure to increase production right now,” citing a $40 per barrel break-even point for oil prices.

Kupperman now expects strong demand and low supplies to push oil as high as $200 a barrel in 2023.

At the end of November, these 20 oil companies stood out as reasonable plays for 2023 based on expectations for free-cash-flow generation and dividend payments.

For this next screen, we are only looking at ratings and consensus price targets among analysts polled by FactSet.

There are 23 energy stocks in the S&P 500, and you can invest in that group easily by purchasing shares of the Energy Select SPDR ETF

XLE.

We can expand the list of large-cap names by looking at the components of the iShares Global Energy ETF

IXC,

which holds all the energy stocks in the S&P 500 plus large players based outside the U.S.

The top five holdings of IXC are:

| Company | Ticker | Country | % of portfolio | Share “buy” ratings | Dec. 27 price | Price target | Implied 12-month upside potential |

| Exxon Mobil Corp. | XOM | U.S. | 16.4% | 54% | 110.19 | 118.89 | 7.89% |

| Chevron Corp. | CVX | U.S. | 11.5% | 54% | 179.63 | 190.52 | 6.06% |

| Shell PLC | UK:SHEL | U.K. | 7.8% | 83% | 23.67 | 29.82 | 25.99% |

| TotalEnergies SE | TTE | France | 5.6% | 62% | 59.63 | 64.40 | 8.00% |

| ConocoPhillips | COP | U.K. | 5.4% | 83% | 118.47 | 140.84 | 18.88% |

| Source: FactSet | |||||||

Prices on the tables in this article are in local currencies.

IXC holds 51 stocks. To expand the list for a stock screen, we added the energy stocks in the S&P 400 Mid Cap Index

MID

and the S&P Small Cap 600 Index

SML

to bring the list up to 91 companies, which we then pared to 83 covered by at least five analysts polled by FactSet.

Here are the 20 companies in the list with at least 75% “buy” or equivalent ratings that have the most upside potential over the next 12 months, based on consensus price targets:

| Company | Ticker | Country | Share “buy” ratings | Dec. 27 price | Price target | Implied 12-month upside potential |

| EQT Corp. | EQT | U.S. | 83% | 36.34 | 59.14 | 63% |

| Green Plains Inc. | GPRE | U.S. | 80% | 29.80 | 43.40 | 46% |

| Cameco Corp. | CA:CCO | Canada | 100% | 30.48 | 44.25 | 45% |

| Talos Energy Inc. | TALO | U.S. | 86% | 19.77 | 28.67 | 45% |

| Ranger Oil Corp. Class A | ROCC | U.S. | 100% | 41.33 | 58.00 | 40% |

| Tourmaline Oil Corp. | CA:TOU | Canada | 100% | 71.40 | 98.83 | 38% |

| Civitas Resources Inc. | CIVI | U.S. | 100% | 58.82 | 80.83 | 37% |

| Inpex Corp. | JP:1605 | Japan | 88% | 1,477.00 | 1,965.56 | 33% |

| Diamondback Energy Inc. | FANG | U.S. | 84% | 137.58 | 181.90 | 32% |

| Santos Limited | AU:STO | Australia | 100% | 7.20 | 9.26 | 29% |

| Matador Resources Co. | MTDR | U.S. | 79% | 57.59 | 73.75 | 28% |

| Targa Resources Corp. | TRGP | U.S. | 95% | 73.89 | 94.05 | 27% |

| Cenovus Energy Inc. | CA:CVE | Canada | 84% | 26.24 | 33.22 | 27% |

| Shell PLC | UK:SHEL | U.K. | 83% | 23.67 | 29.82 | 26% |

| Ampol Limited | AU:ALD | Australia | 85% | 28.29 | 35.01 | 24% |

| EOG Resources Inc. | EOG | U.S. | 79% | 132.08 | 157.52 | 19% |

| ConocoPhillips | COP | U.S. | 83% | 118.47 | 140.84 | 19% |

| Repsol SA | ES:REP | Spain | 75% | 15.05 | 17.88 | 19% |

| Halliburton Co. | HAL | U.S. | 86% | 39.27 | 45.95 | 17% |

| Marathon Petroleum Corp. | MPC | U.S. | 76% | 116.82 | 132.56 | 13% |

| Source: FactSet | ||||||

Click on the tickers for more information about the companies.

Click here for Tomi Kilgore’s detailed guide to the wealth of information available for free on the MarketWatch quote page.