Many investors are talking about the potential for Tuesday’s midterm congressional elections to spark a stock-market bounce, arguing that the potential for a divided government if Republicans take control of one or both chambers would be positive news.

According to one market watcher, the bounce is already under way.

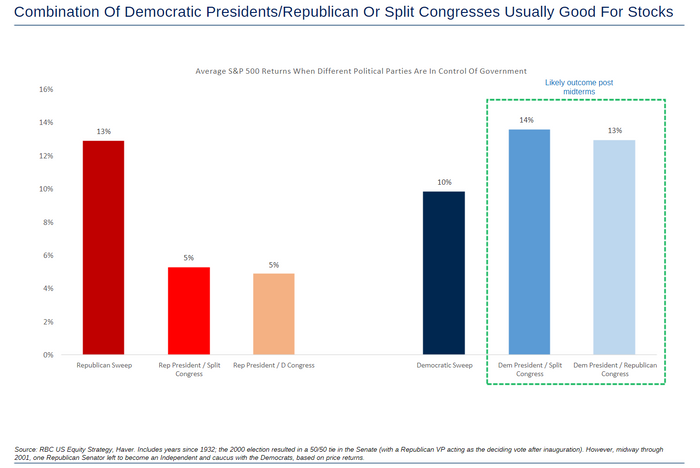

“At its recent high, the S&P 500 was already up about 9% off of its mid-October low, exceeding the typical bounce of about 7%. We believe the October move was fueled in large part by the shift in momentum away from Democrats and back towards Republicans that we started to see in polling data and betting markets that was building in August and September,” said Lori Calvasina, head of U.S. equity strategy at RBC Capital Markets, in a Monday note.

If so, the bounce, which comes after the bear market for equities took the S&P 500

SPX,

to its lowest close in nearly two years, is in keeping with market history that shows equities tend to see their best post-election performance in split-government scenarios, particularly when a Democratic president is paired with a congress in which either the House or Senate or both are controlled by Republicans (see chart below).

RBC Capital Markets

More broadly, stocks have done well in the one-year period after a midterm election dating back to 1950, with nearly identical figures under Democratic and Republican presidents, LPL strategists Barry Gilbert and Jeffrey Buchbinder observed in a Monday note.

They acknowledge, however, that the sample size is nonetheless limited. And past results, of course, are no guarantee of future results.

Related: What midterm election results mean for the stock-market bounce, according to Morgan Stanley’s Wilson

Democrats hold a slim majority in the House and control a 50-50 Senate by virtue of Vice President Kamala Harris’s tiebreaking vote. Polls and prediction markets point to Republicans likely taking control of the House and holding a good chance of winning control of the Senate.

So what do the possible outcomes of the election mean for equities?

A split Congress, with Republicans winning the House but the Senate staying under Democratic control would likely result in a “mild rally,” said Tom Essaye, founder of Sevens Report Research, in a Tuesday note. A Republican sweep of both houses would likely produce the same result, he predicted.

“Markets in general prefer split governments as it reduces any policy risk from increases in taxes, but that’s especially true now as any increases in spending could also add to inflation and spike rates,” he wrote. “A split government eliminates that risk and markets will embrace that likely via a mild rally,” if the GOP takes the House but not the Senate.

“We’d expect stocks to rally broadly but not materially,” he said.

In that scenario, technology could outperform over the short term, bouncing back from oversold conditions. Treasury yields and the ICE U.S. Dollar Index

DXY,

should decline modestly, while commodities would likely be in for a small bounce.

RBC’s Calvasina argued that a Republican sweep of both the House and Senate would be more significant for the stock market since GOP chances of taking back the Senate have generally been viewed as lower than their chances of taking back the House.

“We also think that if Republicans take back control of both chambers, it will be viewed by equity market participants as pointing to good momentum for Republicans heading into the presidential race in 2024,” she said. “To the extent that 2022 turns out to be a wave election for Republicans, the bigger the wave, the more impactful we think it will be for U.S. equities in the short term and into next year.”

Essaye, however, argued that if Republicans win both the House and Senate, he would “expect almost the exact same market reaction as if the Republicans win just the House, because winning the Senate won’t result in any practical difference,” he said.

For a Republican sweep to make a material difference, the part would need a two-thirds veto-proof majority in both the House and Senate, “and there is literally 0% chance of that happening,” Essaye wrote.

If Democrats managed to hold off Republicans in both the House and Senate, the reaction is likely to be a “moderate decline,” he said. A broad fall for equities would likely be led by tech and high-growth sectors, while Treasury yields would likely see a modest rise and the dollar index would bounce, putting pressure on commodities.

There’s also the possibility that the full outcome of the election won’t be known soon. A close-fought Senate election in Georgia could go to a December runoff. It’s possible Senate control could hinge on the result.

The bottom line, Essaye wrote, is that the election is unlikely to be a bullish game-changer for stocks still mired in a bear market.

“The key to a real, sustainable rally in this market remains a decline in CPI (coming Thursday) and a Fed pivot (not coming anytime soon). So, any market bounce on this outcome should not be chased,” he wrote.

The S&P 500

SPX,

was up 0.9% ahead of Tuesday’s closing bell, while the Dow Jones Industrial Average

DJIA,

advanced 442 points, or 1.3%.