When MarketWatch first started reporting on markets and investing, there was a general consensus among the biggest Wall Street firms that private equity and software didn’t mix. The billionaire buyout barons didn’t think lenders would ever extend them credit against assets that boiled down to lines of code. Even if they could find financing, the risk of investing in something that could be made obsolete by a programmer working in a garage seemed too great.

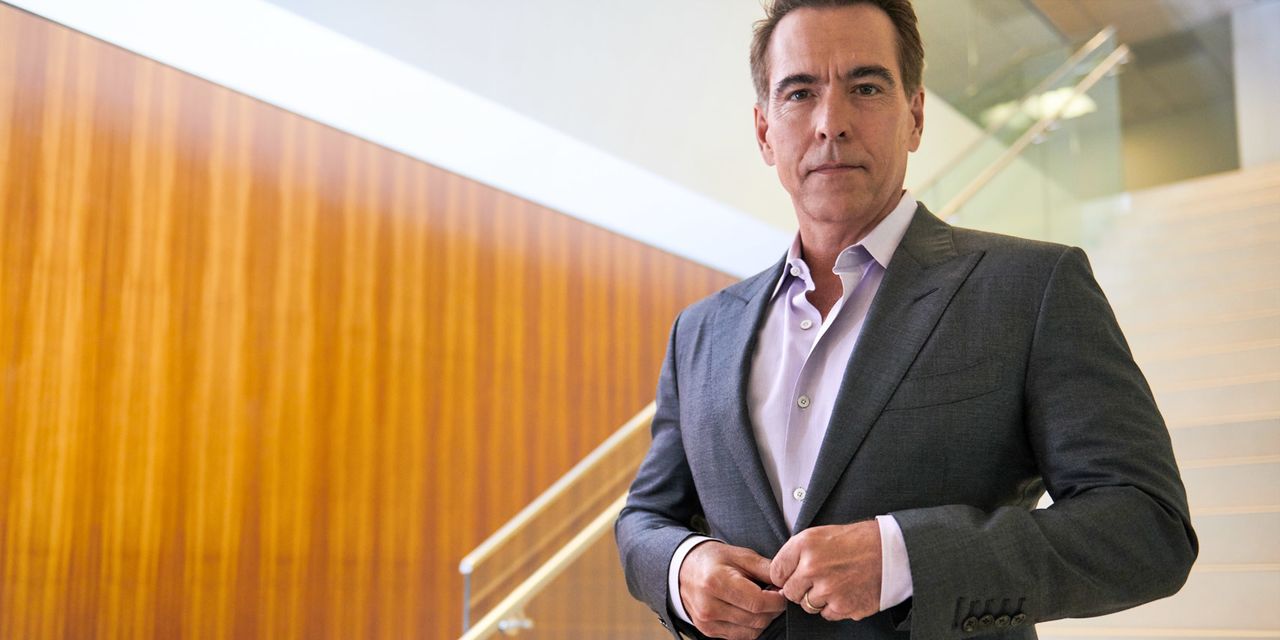

But a young and ambitious former teen tennis prodigy from Puerto Rico saw things differently. Orlando Bravo figured out that software maintenance agreements could become a private equity goldmine. He built a new private equity firm, Thoma Bravo, to invest exclusively in enterprise software companies. Today, Thoma Bravo has $122 billion in assets under management and some of the best returns in the buyout business. On Tuesday, the firm inked a deal to buy identify management company ForeRock

FORG,

in a $2.3 billion deal.

As MarketWatch turns 25, we wanted to ask Bravo what’s next for software and private equity. Here are his lightly edited comments:

What do you think you will be reading in MarketWatch about software and private equity in five years?

You will be reading about how private equity is reshaping the software industry. Our industry runs software how it’s supposed to be and does a phenomenal job in turning these companies — as great innovators — [into also producing] for their shareholders — versus great innovators that lose money for their shareholders everyday in the public markets. This is a long-term trend. This has been creeping up and up and up. But now there’s going to be a big moment in the next five years in private equity and software. All the investors finally want profitability. They are unwilling to forever fund money-losing enterprises just because they’re growing fast, or because they are delivering value to their customers, or solving their problems. And the public market has no answer to that.

What is private equity’s answer?

First, alignment. Absolute alignment between the people running the company and the ultimate shareholders. In public companies, restricted stock practices are out of control. You see that when the stock goes down, they dilute you even more because they need more and more stock. You face this enormous dilution constantly. That’s really a big lack of alignment. Two, is the value of fundamentals. Many of these companies do need help from very experienced owners and very experienced executives because they’re younger companies and many of them want to learn. Many of them are run by founders, who are doing this for the first time and are great. But they need to have a structure and an ownership structure that allows them to be successful. Not a structure with 10,000 owners that change their minds and the stock trades regardless of where the real business economics are.

Why can’t Oracle do that? Why does private equity need to do that?

Oracle definitely does that. Oracle

ORCL,

is one of the best at doing that for sure. That’s actually one of the role models that we learned from 22 years ago by talking to other executives and managers on how you really run a software company. That’s 1,000% right. But now remember, there’s a $5 trillion market cap in software. One company can’t do it all and it’s a very fragmented industry. Extremely fragmented.

Is this really a new development? Your firm has been in business for more than two decades?

Private equity, overall, has been a very small factor and has played mainly on the fringes — important fringes — of technology. The opportunity now is at these much lower valuations, especially for people that have the capability of absorbing these assets and turning them into highly profitable growth engines. Now, is the first time that there’s the opportunity to buy the absolute market leaders, the best companies, to be at the forefront of technology. That was never available before. Because private equity was too small to actually buy the leader, buy the best innovator, buy the top player. That’s no longer the case. And second, the valuations of those best innovators, despite their money losing structures, was unaffordable by a fundamental investor and now they are affordable. Third, those companies are looking for a solution to consolidate…as a recession comes and growth slows down and their stock prices suffer. It is the first time ever that we see that opportunity and it is so clear.

What do you fear you will be reading in MarketWatch in five years?

Why am I going to have to make something up? I would be making something up about fearing stagflation. This is my answer: I don’t spend my time worrying about things I cannot control. I don’t have any fears because I would be making it up because I think things are going to be positive for private equity and software. It’s just better.

Can we try to put some fear into you? How much of the Thoma Bravo run-up has to do with ultra-low interest rates and quantitative easing? How does that model work if you have higher interest rates and less accessibility to cheap debt?

We do much better in a down market. If you look at our history, our best times by far were in the years 2000 and 2008. It’s not even close. Let me put it this way: Venture capital and some growth equity is about momentum. You buy high and sell higher. In a forgiving environment that goes on. We don’t do that. We take a company, we try to buy it at a fundamental price, and we create earnings that did not exist before. In an environment of high interest rates, low valuations and low growth, both high interest rates and low growth lead to lower valuations. It allows us to have a really attractive entry point so that when we produce those earnings, we own it at a really high yield of those earnings. On top of that, what we then do is focus on having the best run company versus the public comps so that we can then consolidate the industry versus them. I would love for the environment to go into a low valuation, lower growth environment, absolutely love it. And private equity, at least in software and tech, has nothing to do with debt. Look at our deals over the last five years, debt is about 25% of the purchase price. Look at the public documents. You can see it is all very narrow.

Even as recently as 10 years ago, when your firm was relatively smaller, the biggest private equity firms in the world missed the opportunity to do software buyouts. Now, you are raising software buyout funds that are as big as their biggest private equity funds. What opportunities exist today that people are missing?

In 1997 I had a meeting once with the head of a large private equity firm. I was trying to get a job. And in 1997, that person said private equity was taken. It was a job interview and now we are much bigger than that firm. Actually, that’s a fear that I have. That we miss something like that because we don’t stay on our toes and we’re not looking forward. We need to continue to be forward-looking as we’ve gotten bigger and have more people. So notice how into crypto I am, trying to understand that environment. Despite the industry being in a crypto winter, despite some problems that the industry is facing from an ethical standpoint and transparency standpoint. Another example is, will social media be like enterprise software was? Is there something there? We look at it. We don’t see it yet because it’s not nearly as stable. But can somebody find some elements of big stability there, underwrite it thinking differently, and create a better economic business model? That’s what private equity incentivizes people to do. How can I take an asset and make a lot more money?