Pour one out for the beleaguered economists, who for once got an important indicator, the consumer price index, right on the nose, after CPI fell 0.1% in December, while core prices rose 0.3%.

“The 2021 surge in durable goods demand normalized, and the resulting collapse in durable goods price inflation was stunningly fast,” says Paul Donovan, chief economist of UBS Global Wealth Management.

“The commodity wave of inflation is fading, and that leaves the profit margin expansion in focus,” he adds. What a good time for earnings season to be upon us, and what do you know, it is, kicking off with the banking sector on Friday before broadening out next week.

Strategists at Goldman Sachs have a new note out, saying that the market is pricing in a soft landing even though the trend of earnings revisions points to a hard landing.

They’re not that optimistic — even in the soft-landing scenario, the team led by David Kostin say the S&P 500

SPX

will end the year right around current levels, at 4,000. But they identify 46 stocks that could benefit — profitable, cyclical companies that are trading at price-to-earnings valuations below their 10-year median, among other factors.

One name jumps out: Tesla

TSLA,

which trades at 22 times forward earnings versus the 10-year median of 117 times. But the other 45 names are less flashy, ranging from Capital One

COF

and Carlyle Group

CG,

to a host of industrials including 3M

MMM,

Parker-Hannifan

PH

and Otis Worldwide

OTIS.

As a whole, these typically $10 billion companies are trading at 12 times earnings, versus 17 times usually.

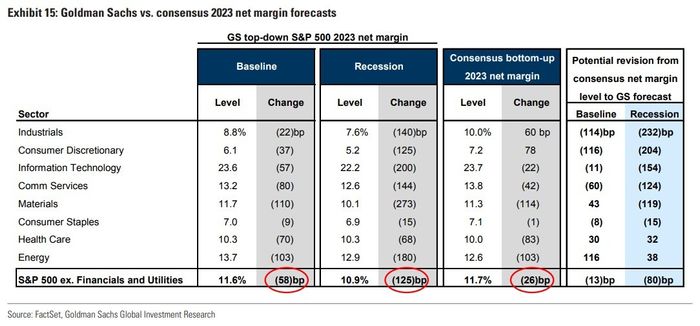

In the hard landing scenario, S&P 500 profit margins would shrink by 125 basis points, to 10.9% — about in line with the median peak-to-trough decline during the eight recessions since 1970, which has been 132 basis points. Consensus expectations are for a 26 basis-point margin decline.

The Goldman team also have a 36 stock screen for a hard landing — profitable companies in defensive industries with a positive dividend yield. They’re typically food, beverage and tobacco companies as well as software and services companies — including Costco Wholesale

COST,

Kroger

KR,

Altria

MO,

Tyson Foods

TSN,

Microsoft

MSFT,

MasterCard

MA

and Visa

V.

As a whole, these $37 billion companies are trading at 22 times earnings vs. a historical 24 times.

The market

After a 2.3% advance for the S&P 500

SPX

over the last three sessions, U.S. stock futures

ES00

NQ00

declined on Friday.

The yield on the Japanese 10-year bond

BX:TMBMKJP-10Y

exceeded 0.5%, the Bank of Japan’s yield cap, ahead of next week’s rate decision , prompting a second day of aggressive bond purchases from the central bank.

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

Fourth-quarter earnings were rolling out from Bank of America

BAC,

JPMorgan Chase

JPM,

Citigroup

C

and Wells Fargo

WFC,

and outside of banks, Delta Air Lines

DAL,

BlackRock

BLK

and UnitedHealth

UNH.

JPMorgan shares slumped after forecast-beating earnings, though investment bank revenue came in light of estimates. Delta shares also declined after topping earnings estimates.

Tesla

TSLA

cut prices of Model 3 and Model Y vehicles in the U.S. and elsewhere by up to 20%. The electric vehicle maker stock dropped 6%.

Virgin Galactic

SPCE

surged after saying it’s on track to launch space-tourism flights in the second quarter.

Apple

AAPL

says CEO Tim Cook requested, and received, a pay cut after investor criticism.

The University of Michigan’s consumer sentiment index is due at 10 a.m. Eastern, and Minneapolis Fed President Neel Kashkari and Philadelphia Fed President Patrick Harker are due to speak.

Tyler Winklevoss said charges by the Securities and Exchange Commission brought about Gemini Trust for allegedly offering unregistered securities were “super lame” as it seeks to unfreeze $900 million in investor assets.

Best of the web

There’s a bull market in swearing on corporate earnings calls.

The West is now preparing to send tanks to Ukraine in what could be another escalation of its conflict with Russia, which on Friday claimed victory in the eastern town of Soledar.

A look back at photos of Lisa Marie Presley, who died at age 54.

Top tickers

Here were the most active stock-market tickers as of 6 a.m. Eastern.

| Ticker | Security name |

| BBBY | Bed Bath & Beyond |

| TSLA | Tesla |

| GME | GameStop |

| AMC | AMC Entertainment |

| MULN | Mullen Automotive |

| NIO | Nio |

| APE | AMC Entertainment preferreds |

| AAPL | Apple |

| SPCE | Virgin Galactic |

| AMZN | Amazon.com |

Random reads

Like a scene out of Stranger Things — there’s uproar after new restrictions on the Hasbro

HAS

game Dungeons & Dragons.

Starting next month, Starbucks

SBUX

rewards will be less generous for most items, though iced coffee will be easier to get.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton.