Hi! In this week’s ETF Wrap, you’ll see that demand for equities was sluggish even as stocks surged in July. Investors were defensive, largely shunning thematic ETFs.

Please send feedback and tips to [email protected]. You can also follow me on Twitter at @cidzelis and find me on LinkedIn.

Stocks have been rallying, but investors in exchange-traded funds aren’t exactly clamoring for equities.

“The overarching theme continues to be a risk-off tone,” said Matthew Bartolini, head of SPDR Americas research for State Street Global Advisors, in a phone interview. “Buying behavior sentiment did not align” with July’s strong stock-market gains, he said, pointing to “a lack of conviction” in buying the rally.

Equity ETF inflows last month were 64% below their typical monthly average, attracting just $14 billion, according to Bartolini’s report tracking U.S.-listed exchange-traded fund flows in July. Investors favored defensive sectors — which saw a record ninth straight month of inflows — while broadly pulling capital from thematic ETFs for a third consecutive month.

A significant portion of stocks held by thematic funds are unprofitable, making them riskier bets at a time of economic uncertainty as investors worry about high inflation and the potential for a recession as the U.S. economy slows, according to Bartolini.

Those funds tend to hold “growth stocks,” he said, an area of the market

IWO,

IWF,

that has been badly bruised this year but surged in July. Slightly more than half of U.S.-listed thematic ETFs beat the S&P 500 last month, compared to just 13% so far in 2022, his research found.

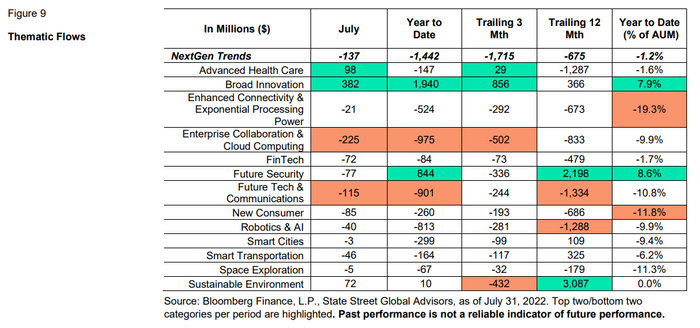

Thematic ETFs, which invest in “NextGen” trends, had outflows in July in all but two of the 13 sectors broken out by State Street under the category. Investors added capital to broad innovation and advanced healthcare themes, also the only two areas with inflows over the trailing three months, the report shows.

STATE STREET GLOBAL ADVISORS REPORT ON JULY 2022 ETF FLOWS

Broad innovation funds have also seen inflows so far this year, attracting $1.9 billion, the above table in State Street’s report shows.

The SPDR S&P Kensho New Economies Composite ETF

KOMP,

which holds more than 500 stocks and falls under the broad innovation category, has had inflows every month this year even as thematic funds have been under pressure, according to Bartolini. The fund gained 10.7% in July but for 2022 remained down 21.7% through Wednesday, FactSet data show.

Sector flows point to ‘risk-off’

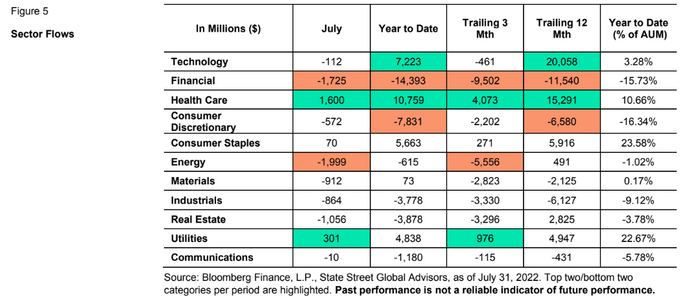

Meanwhile, investors last month contributed to ETFs focused on traditionally defensive sectors of the stock market: healthcare, consumer staples and utilities, according to State Street. But sector funds overall saw a net $5 billion of outflows in July, with investors pulling capital from the category for a third straight month.

STATE STREET GLOBAL ADVISORS REPORT ON JULY 2022 ETF FLOWS

“Sectors really paint a picture of risk-off, a lack of willingness to express risk in this market,” said Bartolini.

Investors also got defensive by adding to $12 billion to government bond ETFs, a large portion of the total $26 billion flowing into fixed income last month, the State Street report shows.

Karen Veraa, head of U.S. iShares fixed-income strategy at BlackRock, said by phone that the asset manager has seen a “pretty big” uptick in interest from financial advisors about iBonds ETFs, which span across Treasurys, municipal debt, investment-grade corporate bonds and high-yield.

Investors may use iBonds as a fixed-income allocation or to build ladders across bond maturities in their portfolios.

Now that the Federal Reserve has raised interest rates, “the yield has come back to the market,” said Veraa, spurring increased demand. She said BlackRock’s iBonds had about $3.8 billion of inflows across the suite this year” through Aug. 1, up from $1.8 billion in 2021.

“The investment-grade corporate bonds are the most popular,” followed by Treasurys, said Veraa. “People are just a little bit worried about recession risk.”

U.S. stocks were trading mixed Thursday afternoon after a Labor Department report showed initial jobless claims climbed by 6,000 to 260,000 in the week ended July 30 to remain around a nine-month high. The Dow Jones Industrial Average

DJIA,

was down 0.2%, while the S&P 500

SPX,

slipped less than 0.1% and the technology-laden Nasdaq Composite

COMP,

gained 0.4%, according to FactSet data, at last check.

As usual, here’s your weekly look at the bottom and top ETF performers over the past week through Wednesday.

The good…

| Performance | %Performance |

|

ARK Fintech Innovation ETF ARKF, |

11.8 |

|

WisdomTree Cloud Computing Fund WCLD, |

9.9 |

|

ARK Next Generation Internet ETF ARKW, |

9.8 |

|

Global X Cybersecurity ETF BUG, |

8.2 |

|

ARK Innovation ETF ARKK, |

7.8 |

| Source: FactSet data through Wednesday, Aug. 3, excluding ETNs and leveraged products. Includes NYSE, Nasdaq and Cboe traded ETFs of $500 million or greater. |

…and the bad

New ETFs

-

Schwab Asset Management, the asset management arm of Charles Schwab Corp., announced July 29 that it was launching the Schwab Crypto Thematic ETF

STCE,

-3.47%

to provide exposure to companies that may benefit from the development or use of cryptocurrencies and other digital assets. The new fund began trading Thursday. -

Sprott Asset Management announced on Aug. 2 that it launched the Sprott ESG Gold ETF

SESG,

+1.59%

to invest in gold bullion that meets the environmental, social, and governance criteria developed by the firm.