Tom DeMark, a widely followed technical strategist, says bitcoin is at risk of taking out the low it registered in mid June.

DeMark’s indicators place great importance on the number of days, which don’t have to be consecutive, in which there was a close lower than the close two days ago. Subject to various conditions, when the countdown reaches 13, a buy signal is triggered. (The opposite applies to sell signals.) Put more simply, his analysis looks for both overbought and oversold signals.

He says his observations are that markets rarely bottom on good news or top on bad news. Instead, they usually top on positive news when buyers complete purchases, and vice versa.

Ahead of the June 18 low in bitcoin

BTCUSD,

DeMark said there was an unprecedented 12 consecutive down closes. Often after an uninterrupted extended series, a short-term rally occurs — such as what has taken place — followed by an upcoming final lower closer, said DeMark, whose charts and analytics service is at Symbolik.com.

He’s more optimistic on stocks, though he sees some volatility ahead.

“At market tops and bottoms, both price and time should align. Nasdaq Composite

COMP,

and QQQ

QQQ,

buy countdown 12 and 13 were recorded on the day of their lows two weeks ago, but their short term downside price objectives were not reached— 10515 and 268.57,” he says in an analysis provided to MarketWatch.

“They should be once the current decline is completed. Then both indexes, as well as the overall market, should record multiweek rallies, after which they should record new lows, and then decline one more time to fulfill the long term Nasdaq Composite and QQQ long term downside price projections 9798 and 246.77.”

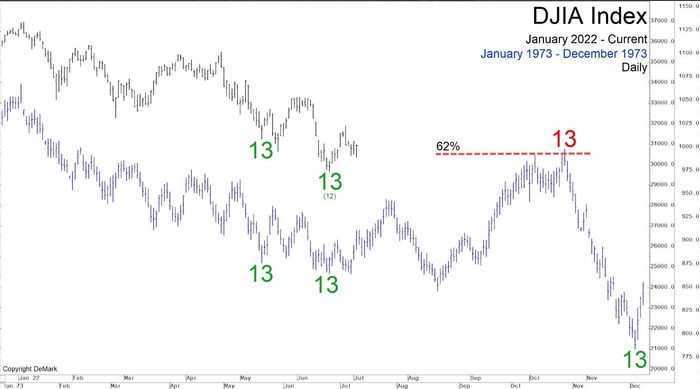

On the Dow Jones Industrial Average

DJIA,

he says after an upcoming near-term new low, a rally should occur into the end of July, followed by a decline into the end of August to a new lower low, followed by a sharp rally into late October, recovering 55% to 60% of the entire 2022 decline.

The Dow is down 16% from its January peak, and the S&P 500

SPX,

is down 20% from those levels.

DeMark had identified the March 2020 low. “In hindsight, it was clear the excessive liquidity supplied by the Federal Reserve due to COVID served as a booster to the stock market and accounted for its sharp upside trajectory,” he says.

“The current market bottom and subsequent near term trading is expected to require more time due to the Federal Reserve’s inability to flood the market with liquidity like it did in 2020 due to inflationary and interest rate risks. Fiscal interference should be subdued and more calculated and the upside, at least initially, less panic and emotionally driven,” he writes.

He says this is the first opportunity the stock market has to record a sustainable bottom since the November and December tops of 2021.