Some professional investors in the bond market expect interest rates to peak soon. If they are correct, the time to pile into bonds is now.

Kevin Loome, the lead portfolio manager for T. Rowe Price’s U.S. High Yield Bond Strategy, explained why junk bonds have fared better than investment-grade corporate bonds this year. He also described the opportunities and risks in that asset class through an economic cycle.

When interest rates rise, bond prices fall. That may be seen as bad news, but it also makes bonds more attractive to investors who make new purchases because their yields have risen.

So the environment for investors seeking income is much better than it was at the end of 2021. But for investors seeking capital gains, this also may be a good time to scoop up bonds at discounted prices. When interest rates eventually decline, bond prices will rise. Meanwhile, the higher yields will make waiting easier.

For high-yield bonds — those rated below investment grade, also known as junk bonds — the opportunity may be even greater than it is for more conservative bond choices, because greater risk can mean greater reward through higher price appreciation. Investment-grade bonds are those rated BBB- or higher by Standard & Poor’s and Fitch, and Baa3 or higher by Moody’s. Fidelity breaks down the credit agencies’ ratings hierarchy.

The ratings reflect the agencies’ opinions about the bond issuers’ risk of default — the failure to make interest or principal payments. The risk of default is higher for high-yield bonds, which is why they trade more on fundamental financial health than on interest rates, and can provide returns that are “competitive with equities, with much lower volatility,” according to Loome.

High-yield bonds have held up relatively well

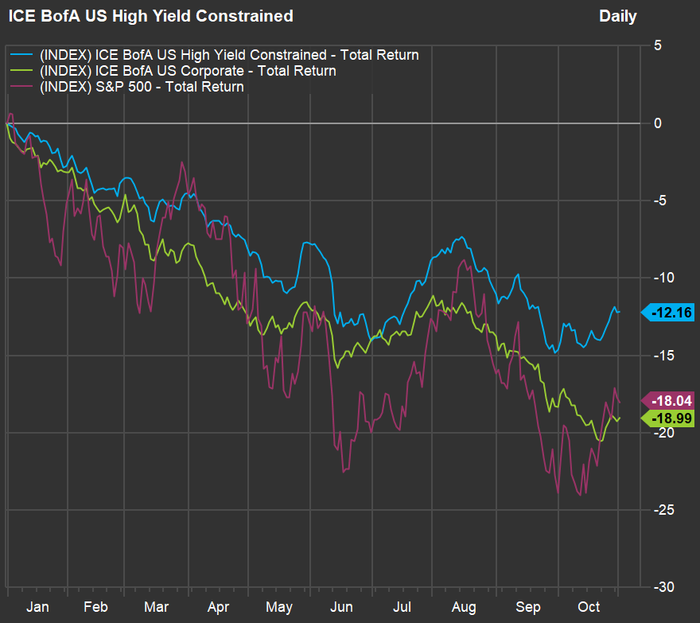

So far this year, the ICE BofA U.S. Constrained High Yield Bond Index has declined 17%, although its total return with dividends reinvested has been 12.2%. This bond index is “constrained” because no issuer’s bonds can make up more than 2% of the index’s principal value.

Now check out this chart comparing year-to-date returns of the ICE BofA U.S. Constrained High Yield Bond Index, the ICE BofA Corporate Index (which holds bonds rated investment-grade) and the S&P 500

SPX,

through Nov. 1:

FactSet

During an interview, Loome said high-yield bonds were performing better than investment-grade bonds and the broader stock market because of their higher interest payments.

And this illustrates how much more attractive this space has gotten: The weighted yield to maturity for the ICE BofA U.S. Constrained High Yield Bond Index has risen to 9.10% from 4.92% at the end of 2021, while the yield to worst, which factors-in call dates when issuers can first redeem bonds, has increased to 9.07% from 4.33%.

The credit cycle

If a bond is trading in the open market at its face value, we say it is trading for par, or 100. If it trades below 100, it is at a discount. If it is above 100, it is at a premium.

Loome said the average bond in the ICE BofA U.S. Constrained High Yield Bond Index was trading at 85.5 cents to the dollar as of Sept. 30, down from $103.25 at the end of 2021.

So the average junk bond in the index is trading at a 14.5% discount to its face value, which will eventually be repaid, unless the issuer defaults.

Loome said it is impossible to predict default rates because they can vary significantly depending on the nature, duration and magnitude of an economic crisis. But he cited a Bank of America statistic that over the long term, the average default rate for the index had been just under 4%. He also said that recovery rates for high-yield bonds have historically averaged around 40% following defaults, which can help support a floor for junk bond prices.

“This year the default rate is going to be really low,” he said, reflecting the growing economy and the slowdown in issuance of new high-yield bonds.

During the Covid-19 pandemic and its aftermath, high-yield bond issuers took advantage of low interest rates to lock in financing, Loome said, adding that “maturities in aggregate don’t really heat up until 2025.”

So much depends on what you, as an investor, expect. Do you see the Federal Reserve curtailing its cycle of interest rate increases soon? Do you think there will be a soft landing or, at worst, a relatively mild recession? Both of those scenarios would favor a recovery of bond prices.

The Federal Open Market Committee on Wednesday gave an update on the economy after raising its target range for the federal-funds rate by another 75 basis points to 3.75% to 4.00%. Federal Reserve Chairman Jerome Powell said the window is narrower for a soft landing, even as the economy grew 2.6% in the third quarter. He also said interest rates were likely to end up “higher than previously expected.”

Bond funds and ETFs

Loome manages the T. Rowe Price High Yield Fund

TUHYX,

which has about $422 million in assets under management and a 30-day dividend yield of 7.79% as of Sept. 30. The fund’s weighted average duration was 4.3 years as of Sept. 30. Duration is a measure of volatility, explained in detail here.

The T. Rowe Price High Yield Fund was originally the Henderson High Yield Opportunities Fund, which T. Rowe Price acquired in 2017. Loome has managed the fund since the predecessor fund’s inception on April 30, 2013. From that date through Sept. 30, 2022, the annualized average total return for the fund’s retail shares was 3.65%, ahead of the 3.24% average return for the ICE BofA U.S. Constrained High Yield Bond Index.

For the T. Rowe Price High Yield Fund’s Class I shares

PRHIX,

the average annualized return from inception through Sept. 30 was 3.84%. The class I shares have annual expenses of 0.61% of average assets under management, while the expense ratio for the retail shares (TUHYX) is 0.75%.

Loome also manages the T. Rowe Price U.S. High Yield ETF

THYF,

which was established on Oct. 26 and is managed with the same strategy as the mutual fund. He manages a total of $2.3 billion under a high-yield strategy, including money in separate client accounts.

He said that actively managed exchange traded funds aren’t common in the high-yield space.

The two largest passively managed competing ETFs are the $14.2 billion iShares iBoxx $ High Yield Corporate Bond ETF

HYG,

and the $8.6 billion SPDR Bloomberg High Yield Bond ETF

JNK,

HYG’s 30-day yield was 8.13% and its weighted average duration was 4.2 years as of Sept 30. JNK’s 30-day yield was 8.78% and its weighted average duration was 4.2 years.

Over long periods, it is difficult for an actively managed high-yield bond fund to outperform the index because of expenses, but also because an index has no difficulty adding newly issued bonds, while a fund manager may be competing to buy them when supply is limited, Loome said. He added that active managers tend to outperform passively managed funds over long periods.

He said that the actively managed funds have advantages, including lower trading costs, because investors were less likely to move in and out quickly than they were with the passive funds.

So far this year, the T. Rowe Price High Yield Fund has fared worse than the ICE BofA U.S. Constrained High Yield Bond Index and the two ETFs:

FactSet

Loome explained this year’s underperformance sprang from his decision to load up on CCC-rated bonds late in 2021, aiming for higher yields.

“Usually what happens is that when the market recovers, people focus on the safe side, BB, and B. But in the later end of the recovery, they come into CCCs. We have to be patient for that to happen, but we think it will happen in 2023,” he said.

Don’t miss: 20 dividend stocks that may be safest if the Federal Reserve causes a recession