Exasperated observers -– probably those who have made the wrong bet — often claim that markets are incapable of absorbing more than one important thing at a time.

Well, inflation was so last Wednesday. Now it’s all about the earnings. The macro guys hand the baton to the micro. Top down to bottom up, allowing the stock pickers to take the spotlight.

For Terry Smith, one of the City of London’s most high profile fund managers, equity investment is straightforward: “Buy good companies, don’t overpay, do nothing”.

It’s a mantra that has encouraged some to describe the star fund manager as Britain’s Warren Buffett – a sobriquet that has made his flagship Fundsmith Equity fund, worth some $27 billion and with 74% exposure to the U.S., particularly attractive to retail investors.

And it’s this stoic approach which Smith says is all the more important during the current troubled times, when investors may be encouraged to bail out of good companies just because their share prices are struggling.

“In inflationary periods, an acronym which is sometimes used to describe the investment options is TINA — There Is No Alternative,” writes Smith in his latest letter to investors.

“It refers to the concept that equities will be the least poorly performing sector in such conditions because of the ability of at least some companies to continue to grow revenues in real terms and generate real returns on capital above the rate of inflation.”

Bonds with fixed income are not now the place to be, he says. Real estate might offer some safety but offers poor liquidity and high trading costs.

Commodities have done well of late, but he is wary that they offer no inherent return, with no interest coupon, dividends, or profits reinvested.

“Investing in them is pure Greater Fool Theory — you can only make money by selling them to someone willing to pay more than you did. I have no confidence in my ability to accomplish that. All of which may point to the fact that There Is No Alternative to equities even though they have performed poorly so far this year,” writes Smith.

He recognizes that it may be tempting for some to sell equities and move into cash in order to avoid more declines in the market. The Fundsmith Equity fund is down nearly 17% so far this year – though it has outperformed the S&P 500 and is up about 65% over the past 5 years.

But he adds: “Timing is of the essence in doing this and if you haven’t done it already I think we can safely say you missed the top. Getting the other side of the trade roughly right will almost certainly mean buying back into equities when economic conditions are at their most bleak. This is a skill which few, if any, possess. Meanwhile, time spent in cash whilst waiting is hardly a good bolt hole from inflation.”

Going back to his fund’s performance, Smith notes that the five biggest detractors over the first half of the year were PayPal

PYPL,

Meta

META,

IDEXX

IDXX,

Intuit

INTU

and Microsoft

MSFT.

Of Meta he says it is now the fund’s lowest rated stock, trading on a free cash flow yield of more than 8%. “At this level it is either cheap or a so-called value trap. We will let you know which when we find out, but we are inclined to believe it is the former.”

“Sooner or later share prices reflect fundamentals, not the other way around.”

The buzz

After poorly-received earnings from JPMorgan

JPM

and Morgan Stanley

MS,

Friday sees Citigroup

C

and Wells Fargo

WFC

step up to the plate.

More concerns about prospects for global growth after data out of China showed the world’s second biggest economy expanded by just 0.4% in the second quarter. In the U.S., the economics calendar includes retail sales, as well as the latest University of Michigan consumer sentiment report shortly after the open.

Big tech companies may appear cautious about hiring, but Amazon

AMZN

is adding 4,000 workers in the U.K. Separately, The Wall Street Journal reported Amazon is scaling back its private-label business.

Pinterest shares

PINS

are up 14% in pre-market trading after a report that activist investor Elliott Management Corp. has built a stake of more than 9% in the social-media company.

Burberry

UK:BRBY

results disappoint after China COVID-19 restrictions.

Aston Martin

UK:AML

stock accelerates on news of £653 million ($772m) injection as Saudi Arabia takes 17% stake.

The markets

A choppy week on markets is ending on a muted note, with S&P 500

ES00

futures up just 0.1% to 3797. The dollar index

DXY

is steady at 108.55, holding near 20-year highs and putting pressure on buck-denominated commodities, such as oil

CL,

up just 0.2% to $95.99 a barrel, and gold, off 0.2% to $1702 an ounce.

Copper

HG00,

the industrial metal bellwether, fell 1.4% to $3.168 per lb, its cheapest in 21-months on worries about demand from China.

The chart

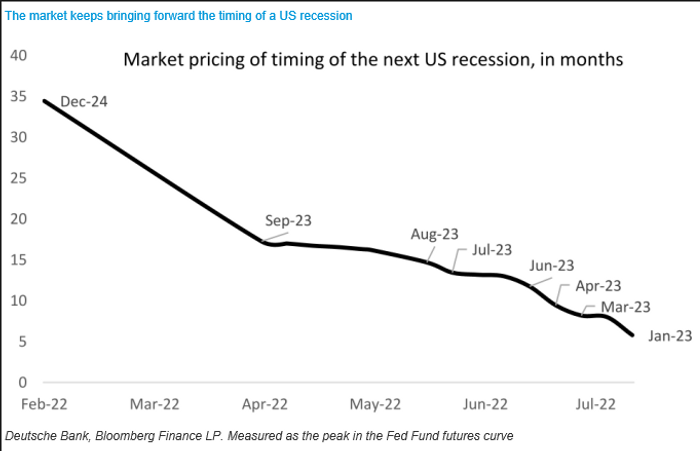

“It is all about recession risk in the market right now,” argues George Saravelos, strategist at Deutsche Bank. The chart below shows how sharply expectations have evolved this year. “Following Wednesday’s US inflation report, the market is now pricing a full US recession by the end of 2022,” he says.

Deutsche Bank

Top tickers

Here are the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

Random reads

What does the Twitter Sentiment index say about the market wisdom of crowds?

An apparently friendly mammal.

An apparently unfriendly human who wants a dog.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.