A not-great start to the week is setting up for Wall Street, which is still smarting from too-strong jobs data and anxiously looking ahead to a CPI update. A fresh ratcheting up of tensions between Russia and Ukraine is not helping.

Yet another avenue of worry for investors is the start of earnings season, which is where lots of strategists are swiveling to right now. But alas, relief may not be coming. S&P 500 earnings growth estimates could reach levels not seen since the third quarter of 2020, notes John Butters, senior earnings analyst at FactSet.

Our call of the day has suggestions on stocks to help ride out this reporting season, kicking off, starting with Goldman Sachs’ chief U.S. equity strategist David Koston who says: “Own stocks with high U.S. sales vs. firms with high foreign sales.”

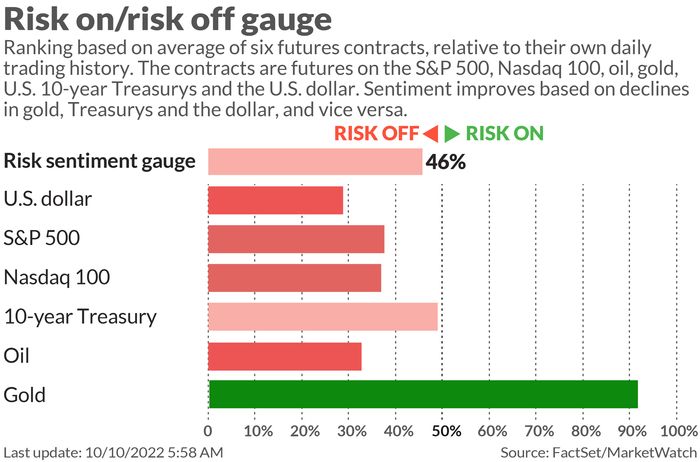

That advice may be obvious to some, given the dollar

DXY

has been a haven of choice in a turbulent 2022, up about 18%.

Goldman Sachs

Goldman says a strong dollar will weigh on company sales, while margins face rising inflation and higher inventories. “Continued USD strength would support the performance of stocks with 100% domestic sales relative to those with a higher proportion of foreign sales,” said Kostin.

The bank’s domestic basket of stocks has seen 3Q earnings per share estimates trimmed just 1% and those for 2023 unchanged, while the international counterpart has seen a respective 4% and 3% cut. Charter Communications

CHTR,

Dollar General

DG,

Chipotle

CMG,

Southwest Airlines

LUV,

Kroger

KR,

Truist Financial

TFC

and Southern Co

SO

are among the stocks they prefer.

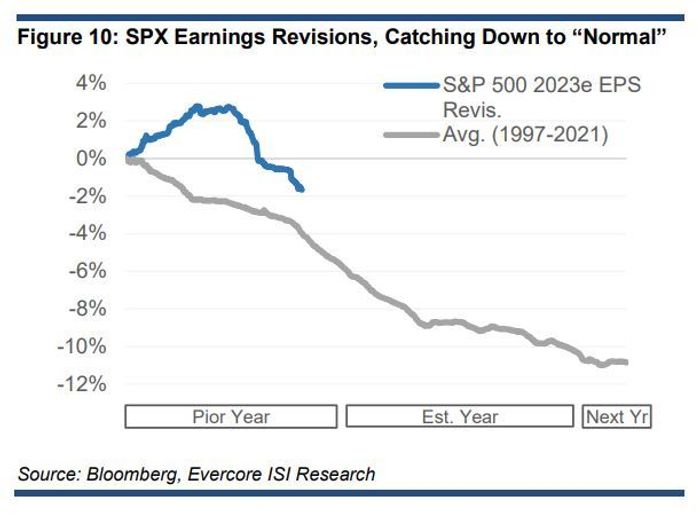

Meanwhile, over at Evercore ISI, senior managing director for research, Julian Emanuel, says the coming reporting quarter is “déjà vu all over again,” with the backdrop looking much like the second quarter in July — a sense of “unrelenting Fed hawkishness weighing on markets,” nonstop policy maker rhetoric and still too-strong data.

Emanuel and the team highlight stock ideas they call “déjà vu darlings.” Those are potential outperformers with $10 billion plus market cap, underperformance into the June S&P 500 low and outperforming since with no new low, positive 2023 EPS growth, upward revisions, below average 2023 price/earnings revisions and high short interest relative to the past year.

At the top of that list are Apple

AAPL,

Home Depot

HD,

Lowe’s

LOW,

Charles Schwab

SCHW

and Snowflake

SNOW.

Potential underperformers include Johnson & Johnson

JNJ,

Philip Morris

PM,

Raytheon

RTX,

Citigroup

C

and Electronic Arts

EA,

they say.

That latter group also has the same market cap, but outperformance into that June market low, and underperformance since, with stocks hitting a new lows and downward 2023 EPS revisions.

Read: 21 dividend stocks yielding 5% or more of companies that will produce plenty of cash in 2023

The markets

Stock futures

ES00

YM00

are headed south, with bond yields

BX:TMUBMUSD10Y

steady, as the dollar

DXY

rises. Oil

CL

is lower and bitcoin

BTCUSD

is hovering at $19,400. Hong Kong

HK:HSI

and China stocks

CN:510210

sank upon reopening after a holiday and mixed factory activity data.

The buzz

Explosions rocked central Kyiv and other Ukrainian cities on Monday, a day after Russian President Vladimir Putin accused the country of a “terrorist” attack on a Crimea bridge.

PayPal

PYPL

said a controversial new policy to fine users $2,500 for “misinformation” was a mistake.

UBS downgraded auto makers including Ford

F,

cut to sell, and GM

GM,

dropped to neutral, saying the industry is headed for oversupply amid rising costs and debt risks.

Tesla

TSLA

logged a record month for China-made EVs in September. Meanwhile, CEO Elon Musk drew some praise from China over his suggestions on how to fix Taiwan-tensions solution, though the other side was less pleased.

The week’s big data will come Thursday, with U.S. consumer price inflation. Monday brings appearances by Chicago Fed President Charles Evans and Fed Vice Chair Lael Brainard.

The Nobel economic prize went to former Fed chief Ben Bernanke and two others.

The Bank of England announced fresh market-supportive measures ahead of the end of its bond-buying program. And after much criticism, the U.K. will bring forward an independent review of its budget plans.

Best of the web

How mismanagement and ‘monster trains’ wrecked American’s rail system

The final minutes of a doomed Air France flight under scrutiny as trial begins

The chart

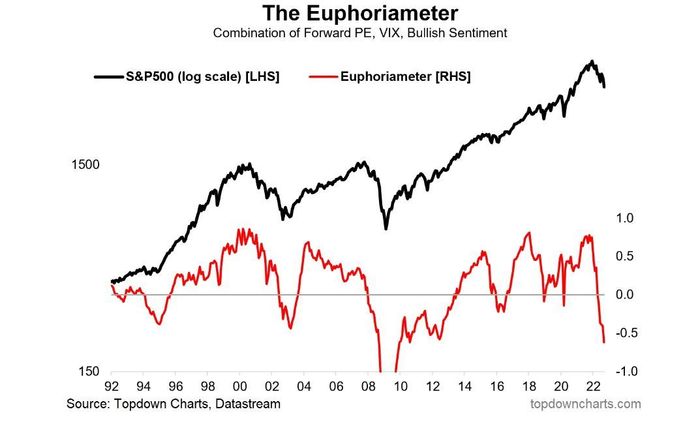

Definitely not euphoric would be an accurate description of the investor mood out there, according to this chart from @topdowncharts.

“The good news is that the previous market froth and ebullience has been deleted. The open question is whether it is enough of a reset to be contrarian yet… (I would say probably not, and technically speaking the indicator probably needs to actually tick up first to trigger a buy signal as such, judging by previous episodes),” writes Topdown Chart’s head of research and founder Callum Thomas:

Topdown Charts

The tickers

These were the top-searched tickers on MarketWatch as of 6 a.m. Eastern Time:

| Ticker | Security name |

| TSLA | Tesla |

| GME | GameStop |

| AMC | AMC Entertainment |

| AAPL | Apple |

| BBBY | Bed Bath & Beyond |

| AMD | Advanced Micro Devices |

| APE | AMC Entertainment Holdings preferred shares |

| DWAC | Digital World Acquisition Corp. |

| AMZN | Amazon.com |

| NVDA | Nvidia |

Random reads

U.K. bakeries offer ‘warm rooms’ for those who can’t afford heating costs.

The glorious return of a giant pumpkin sculpture in Japan.

Barely back on Twitter, artist Kanye West has been suspended again.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton.