Ford Motor Credit tapped the U.S. corporate bond market on Tuesday for $1.5 billion in funding, despite recession fears and major companies having to pay investors yields that have hit a 13-year high.

Even with tougher credit conditions, the vehicle giant’s financing arm attracted about $3.5 billion of investor orders for the new 5-year bond offering, helping to narrow pricing to 7.35% from an initial 7.625% area, according to Informa Global Markets.

That led to a bigger bond deal and slightly lower funding costs for Ford Motor Credit, which helps provide auto dealers and consumers with financing on Ford

F,

and Lincoln vehicles. The initial funding target was at least $1 billion.

Last week, Ford CEO Jim Farley said demand for commercial and electric vehicles was “through the roof,” during the company’s third-quarter earnings call, even though he said the auto maker will be closing startup Argo AI, pointing to there being too many challenges to running a profitable network of self-driving vehicles.

Bond issuance in recent months has slowed dramatically across U.S. markets as the Federal Reserve has sharply increased rates to fight inflation lingering near a 40-year high.

For U.S. high-yield, or the “junk bond” market, the Ford deal counted as the first new financing in two weeks, with 2022 issuance down 78.6% from the same stretch of last year, according to Informa Global Markets.

Expectations have been running high for the Fed to raise its policy rate by another 75 basis points on Wednesday, with the central bank also penciling in a “peak” or “terminal rate” in the 4.5%-4.75% range for this cycle, even though some expect it to climb above 5%.

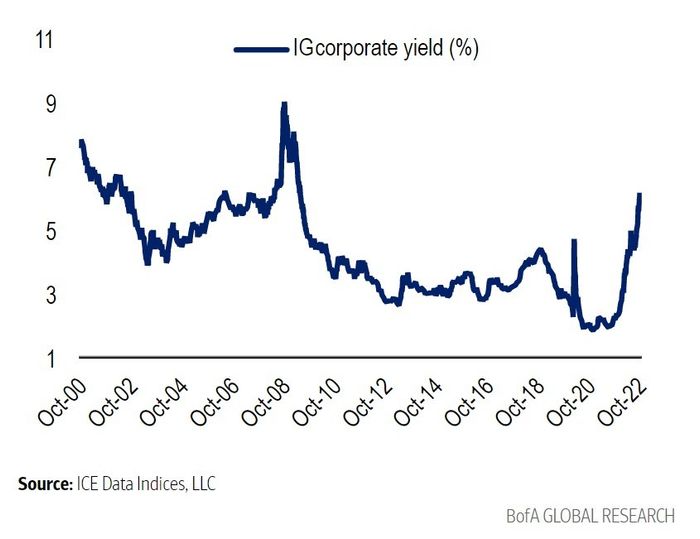

The pitched battle against inflation has pushed 30-year fixed mortgage rates above 7%, while also leading to a wobbly housing market and surging borrowing costs for U.S. companies and households. Yields on investment-grade corporate bonds now stand near 6% (see chart), their highest since 2009.

Investment-grade corporate bond yields soar to highest level in 13 years.

BofA Global Research, ICE Data Indices

Ford Motor was downgraded to “junk” status, or below investment-grade, in 2020 as the COVID-19 pandemic unfolded, which spurred temporary halts to U.S. auto manufacturing, chip shortages and months of record-high used-car prices. S&P Global currently rates the company BB+, and Moody’s rates it at Ba2.

Many investors, however, still consider Ford to be an investment-grade company over the long run, with analysts at CreditSights saying in a Tuesday report that they expect several major credit-rating firms to restore its investment-grade status next year, but with the chance of delays “should supply chain challenges persist.”

The rate for the ICE BofA US High Yield Index was pegged last near 8.9%, after hitting 9.5% in October.

Ford Credit didn’t immediately respond to a request for comment.

While deteriorating economic and credit conditions “could cause the Fed to pivot modestly at some point,” said Lauren Goodwin, economist and portfolio strategist at New York Life Investments, in a Tuesday client note, she also sees a “full pivot into accommodative territory” as unlikely in 2023, even though a recession “should be considered a base case.”

The new financing for Ford Credit comes as used-car prices have begun to retreat from peak levels. Still, households continue to experience high prices for everything from gas to groceries to shelter, even through wages have been increasing this year and the job market has remained hot.

Fed officials have been trying to cool demand through higher rates, and thus bring down inflation, while also aiming to avoid a hard landing for the economy.

That goal likely was complicated Tuesday with job openings showing an increase to 10.7 million in September, below its 11.9 million record in March, but still indicating a labor market that hasn’t cooled off enough for the Fed to stop tightening financial conditions. After the economic data, U.S. stocks lost a grip on earlier gains, with the Dow Jones Industrial Average

DJIA,

down less than 100 points, the S&P 500 index

SPX,

off 0.3% and the Nasdaq Composite Index

COMP,

0.6% lower.

Read: This reliable indicator of recession has yet to buckle, and so the Fed won’t either, strategist says