The good news about this bear market in stocks is that we’re more than halfway through it. The bad news is that we’re getting close to the final stage, when “everything must fall.”

That’s according to the blogger behind Irrelevant Investor and the director of research at Ritholz Wealth Management, Michael Batnick.

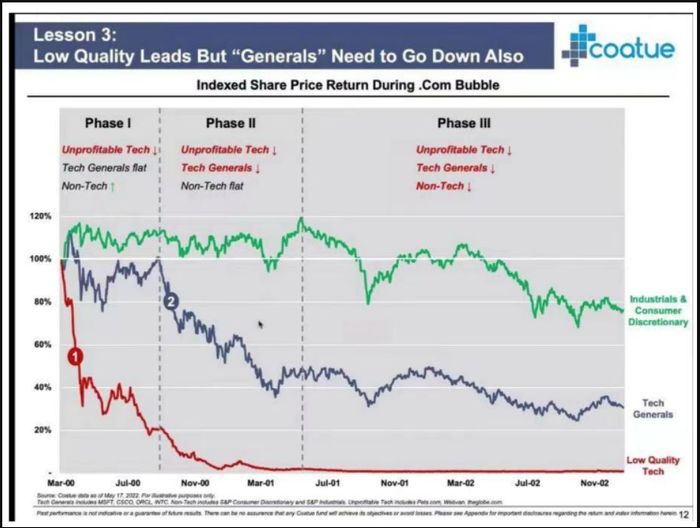

He first explains the order of “indiscriminate selling” in a such a down market — speculative names, the leaders, the rest. That has been the playbook in the past, as shown by his chart from hedge fund Coatue (via Eric Newcomer) that breaks down the dot.com bubble bursting:

Irrelevant Investor/Eric Newcomer

A selloff in mid-2021 marked phase one, said Batnick. Meme stocks and some special-purpose acquisition vehicles got hit, along with Cathie Wood’s ARK Innovation ETF

ARKK,

which lost 24% in 2021 and is down 54% this year.

Earlier this year phase two swept in when the “tech generals fell one by one. Microsoft

MSFT

hasn’t been this far below its 200-day moving average since 2021. The uptrend that it’s enjoyed over the last decade is decidedly over,” wrote Batnick.

Read: Here’s why Britain’s Warren Buffett is sticking with Facebook’s parent and other beaten down techs

That brings us to the “everything” or phase three, and Batnick points out that only nine stocks representing $1 trillion in market cap were within 5% of their 52-week highs as of early Thursday, while 145 names representing $9 trillion are within 5% of 52-week lows.

He describes his list of more than 50 stocks in the latter camp as a “who’s who of American business.” They include Berkshire Hathaway

BRK,

BlackRock

BLK,

JPMorgan

JPM

and Morgan Stanley

MS

— a pair that got second-quarter earnings season off to a lousy start — then Facebook

META,

Microsoft

MSFT,

eBay

EBAY

in the tech space, other “generals” such as Caterpillar

CAT,

Deere

DE

and General Motors

GM.

Also on that list are Nike

NKE,

Disney

DIS,

3M

MMM,

Honeywell

HON

and Delta Air Lines

DAL.

There are “no winners,” in this last lap of the bear market, as Batnick reminds us. “A new bull market will begin eventually, but right now, we’re in the ‘everything must fall’ phase.

Read the full blog post here.