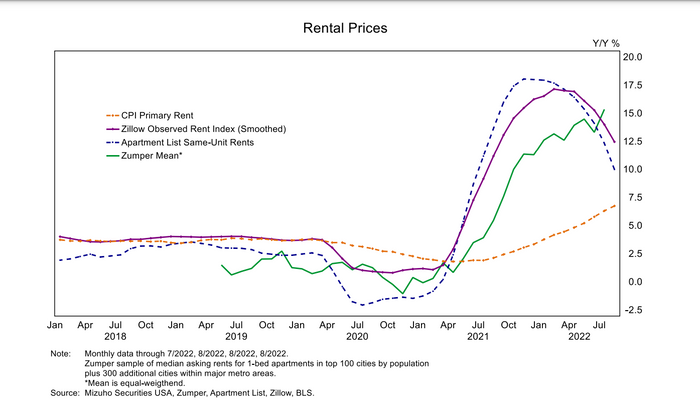

A look at Zillow Group’s closely followed rent index shows that last year’s roughly 17% yearly surge in rental prices was probably the peak, with the rate of increases dramatically receding in the past six months.

The trend might give renters moving to a new city more breathing room or someone a better shot at affording a place on their own. But here’s why a cooling rental market, evidenced by Zillow

Z,

metrics or others like it, won’t have a ton of sway with the Federal Reserve in its fight against inflation.

“We can cheer that in terms of how it directionally impacts us,” said Kevin Gordon, senior investment research manager at Charles Schwab & Co., speaking by phone. “But those metrics, those sources, aren’t the same as what the Fed is tracking, and what goes into CPI.”

The huge shelter component of the consumer-price index, a key inflation gauge for the Fed, largely hinges on this question to homeowners: How much do you think your house could fetch if it was rented out?

Zillow, however, relies on monthly changes in listing prices of rental properties, as do others that rent properties or track the data. That’s why Zillow’s metrics (purple below) show a retreat in growth, even though CPI (orange) has been climbing.

Rental data points to declines from a dramatic rise

Mizuho Securities USA

“It shows a real substantial rent inflation taking hold in the last couple of years, but it also shows, on an annual basis, that it peaked in February, according to our index,” said Jeff Tucker, senior economist at Zillow, by phone.

He also said it isn’t a surprise to see the rent component of CPI still accelerating on a yearly basis, since it tracks something else. “They are trying to capture the experience of all renters out there,” Tucker said. “But the majority of people didn’t move in the last year, and aren’t necessarily signing a new lease at prevailing rates on a listing platform.”

Indeed, instead of retreating as expected, CPI for August shocked Wall Street by rising to a 8.3% annual rate, propelled by increases in shelter, food and medical care costs. The climbing shelter component suggests homeowners have yet to feel the sting of lower property values, even through the housing market boom has fizzled in the face of increased borrowing costs.

Stocks were slightly lower in choppy trade Monday, with the Dow Jones Industrial Average

DJIA,

S&P 500 index

SPX,

and Nasdaq Composite Index

COMP,

flipping between gains and losses as investors waited for the Fed rate decision on Wednesday. The 10-year Treasury yield

TMUBMUSD10Y,

was near 3.5%.

Even before the Fed is expected on Wednesday to fire off another big rate increase, the 30-year fixed mortgage rate already climbed back to 6%. It’s sharp ascent this year slammed the brakes on roaring monthly sales and led mortgage applications to fall to their lowest level since 1999.

Schwab’s Gordon said the first signs of the sputtering housing market can be seen in the drop in home builder and consumer sentiment data, but also by recent sharp declines in home sales volumes. The pullback eventually is expected to bleed into property prices, with a lag, and then into rents.

“We are still in that first portion of the cycle,” Gordon said. “That’s the point we are trying to hammer home with inflation. It’s going to take longer for these lags of monetary policy to kick in, even if people are expecting it to change fast.”