Europe’s auto industry faces not only a difficult winter but a tough 2023 as well, with potential output loss of one million cars per quarter, as companies struggle to stay online amid possible energy shortages and supply chain issues.

That’s according to S&P Global, which predicted “extensive pressure in terms of energy costs” in coming months for some OEM’s (original equipment manufacturers) and suppliers who run energy-intensive factories.

“The combined black swan events of the COVID-19 pandemic and the Russian invasion of Ukraine have already stretched the automotive supply line, especially in regards to semiconductors,” said Calum MacRae, director, supply chain & technology, S&P Global Mobility, in a note on Tuesday.

McRae said this could mean potential losses of more than one million units per quarter from European-based OEM final-assembly plants, starting in the fourth quarter of 2022 and running through the entire next year. He cited forecasts by S&P Global Mobility and S&P Commodity Insights.

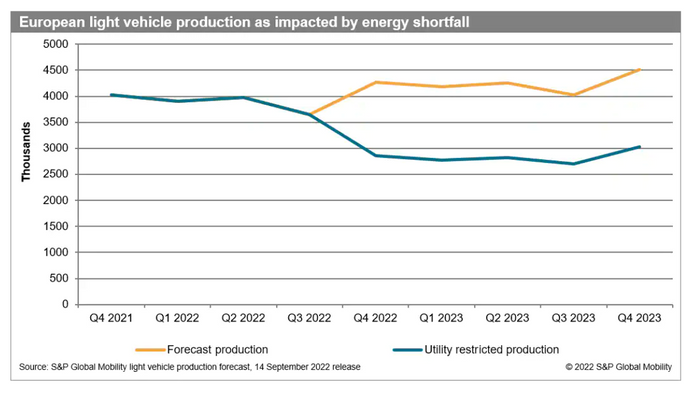

Europe’s auto based industry had predicted output in the 4-4.5-million-unit range per quarter through 2023, which would indicate moderate growth. “However, with potential utility restrictions, that OEM output could be reduced to as low as 2.75-3 million units per quarter,” said the analyst.

European light vehicle production as impacted by energy shortfall

S&P Global Mobility

A cold, wet European La Niña winter, combined with energy shortages, could see a similar effect on the industry, he said, adding that recent leaks in Baltic Sea natural gas pipelines only adds to risks and the likelihood that S&P’s worst predictions will likely come true for auto and parts makers.

S&P Global Mobility sees “significant supply chain disruption from November through spring. We also anticipate disruption of the traditional just-in-time supply model due to some suppliers implementing a schedule of working fractional-months on a 24/7 setup – which can be more energy-efficient than traditional weekly shifts due to the latter’s higher start-up and shut-down energy costs.”

Expectations that Europe will see mandatory rationing of energy supplies is the basis for their pessimistic scenario, which takes into account an industry struggling with low supplies in dealer showrooms. An “additional crisis could be incapacitating on a global scale,” they said.

“European suppliers send parts, components, and modules to OEMs around the world – thus impacting all automakers, not just regional ones,” said the analyst, who noted that the U.S. could see fallout from this as EU/UK manufacturing plants are currently exporting about 7,000 units per month to American shores.

The supply chain, involving metallic structure forming or welding is already seeing some dramatic changes, said Edwin Pope, Principal Analyst, Materials & Lightweighting at S&P Global Mobility.

“Total energy usage in these companies could be up to one-and-a-half times what we’re seeing in vehicle assembly today. Anecdotally, we’re hearing that some of this manufacturing capacity is becoming so uneconomic that companies are simply shutting up shop.”

S&P Global Mobility modeled the impact of the looming energy crunch on 11 European countries, and found that auto industries in Spain, Italy and Belgium were most vulnerable. The Czech Republic and Germany ranked the highest, thanks to current gas levels and little reliance on gas-derived electricity.