Oil-market analysts don’t expect the Organization of the Exporting Countries and its allies on Wednesday to agree to sharply boost production in September — but members could take steps that serve to incrementally bolster supply.

“In my opinion, there is a chance that OPEC+ puts out a plan that would raise production for the entire group, eliminating individual quotas for member states,” said Robert Yawger, executive director for energy futures at Mizuho, in a note.

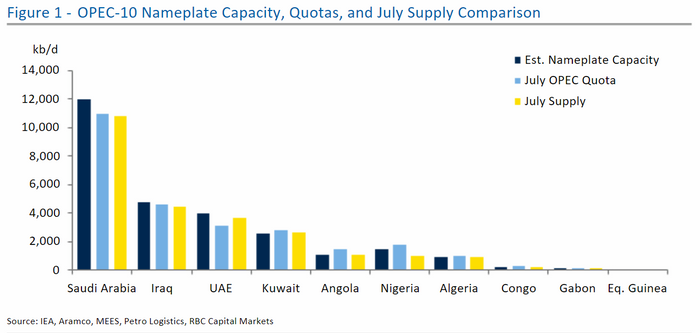

Eliminating quotas would allow countries with spare capacity — the Gulf states of Saudi Arabia, the United Arab Emirates, and Kuwait — to increase production, at the expense of producers pumping below quota, such as Nigeria, Algeria, and Angola, Yawger said.

Such an outcome would also cater to U.S. President Joe Biden’s plea to the producer group to increase output, giving Biden room to claim that his July trip to Saudi Arabia wasn’t in vain, he said.

Biden traveled to Saudi Arabia last month, greeting Crown Prince Mohammed bin Salman with a fist bump after having promised to treat the kingdom as a “pariah” during his 2020 presidential campaign. The White House in 2021 cleared the release of an intelligence report that asserted the crown prince ordered the operation that led to the death of journalist Jamal Khashoggi in 2018.

During the trip, Biden said he was doing all he could to boost U.S. energy supplies and that the Saudis “shared that urgency.” Biden added that he expected to see “further steps in the coming weeks.”

OPEC+ has been boosting its production targets in monthly increments, unwinding output cuts implemented following the onset of the COVID-19 pandemic, in an agreement that expires at the end of August. Several OPEC+ members, however have struggled to meet the increased production. The group meets Wednesday to decide on its next move.

RBC Capital Markets

OPEC+ is unlikely to take any big steps, said Vikas Dwivedi, global oil and gas strategist at Macquarie Group, in a phone interview.

OPEC+ last month cut its estimate of the global oil surplus to 800,000 barrels a day. Another round of COVID-19 infections or an issue in any producing region could leave that surplus much bigger or smaller than the baseline OPEC+ is assuming heading into Wednesday’s meeting — a prospect that will likely make members reluctant to shake things up, he said.

While Biden’s visit to Saudi Arabia produced no immediate boost in output, Riyadh is likely to reciprocate by continuing to gradually increase output, said Helima Croft, head of global commodity strategy at RBC Capital Markets, in a note.

“Though some media commentators claimed that the president returned to Washington empty-handed, we think it was well understood by the White House that the Kingdom would work within the OPEC+ framework and would not pursue unilateral action while the current agreement remains in place through the end of the year,” Croft wrote. “A failure to add any more barrels to the market, however, would undoubtedly be viewed as a major disappointment in Washington given the expectation of additional incremental increases.”

At the same time, the White House also likely recognized Riyadh’s concerns about exhausting remaining spare capacity when there is so much uncertainty surrounding the production outlook for producers such as Russia and Libya. As a result, the Biden administration was likely not anticipating a major supply surge, Croft said.

West Texas Intermediate crude for September delivery

CL00,

CLU22,

rose 53 cents, or 0.6%, to end at $94.42 a barrel Tuesday on the New York Mercantile Exchange. October Brent crude

BRN00,

BRNV22,

the global benchmark, rose 51 cents, or 0.5%, settling at $100.54 a barrel on ICE Futures Europe.