Recession sirens have begun to blare louder in the bond market in November, even with a red-hot U.S. labor market that has made the likelihood of an economic downturn feel remote for many households.

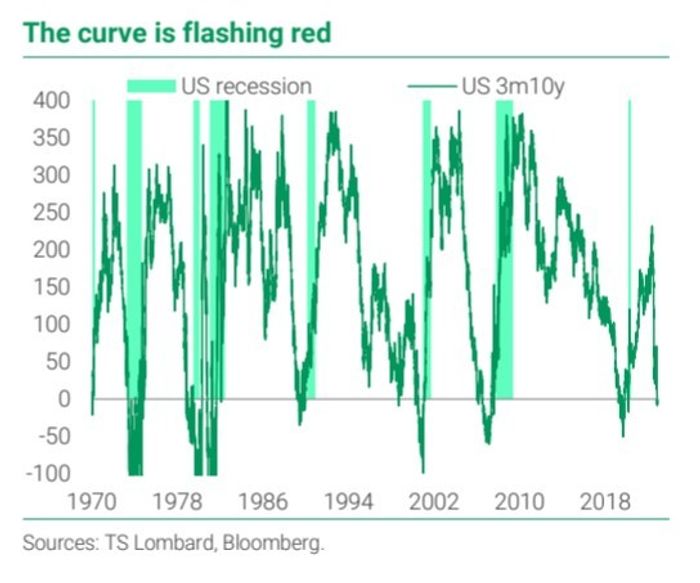

A closely watched plot of bond yields that compares 3-month Treasury bills

TMUBMUSD03M,

and 10-year Treasury

TMUBMUSD10Y,

notes has now “inverted” (see chart) for the first in this cycle, meaning investors can earn more on securities that mature in only a few months, rather than those coming due in a decade.

Another key part of the bond market is flashing recession warnings

TS Lombard, Bloomberg

In more normal times, investors typically are paid more to invest their money for longer stretches. But the rapid pace of rate hikes by the Federal Reserve this year has unleashed a torrent of market volatility and muddled the near-term outlook for the economy.

As a result, bond investors have grown skittish about investing in the short term, given the challenges of the Fed as it works to restrict the economy, tame inflation perched near a 40-year high and avoid throwing the economy into the ditch.

Those concerns became more evident in the $24 trillion Treasury market months ago when the 2-year Treasury

TMUBMUSD02Y,

yield eclipsed the rate of bonds maturing in 10-years, flashing an earlier recession signal.

“But the 3m10y [inversion] is important because it has historically been more accurate at predicting recessions,” wrote Skylar Montgomery Koning, senior macro strategist at TS Lombard, and Andrea Cicione, head of research, in a Tuesday client note.

“Both the market and consensus say in the next 12 months: the recession countdown has begun.”

Recession signals pile up

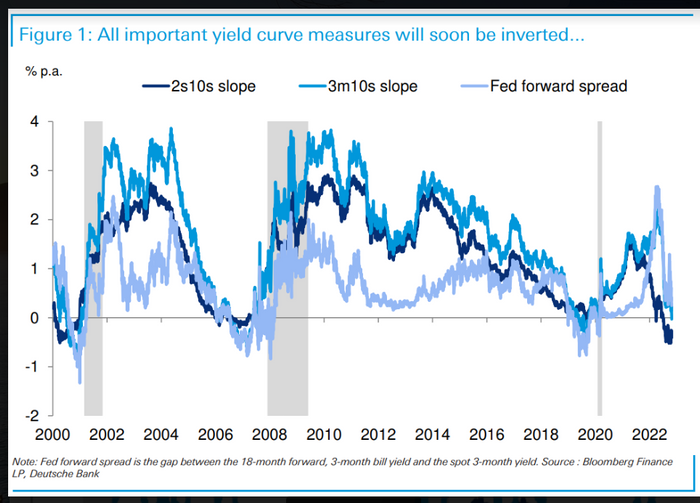

What’s more, the Fed’s preferred “forward spread,” a measure of the gap between 18-month forward, 3-month bill yield and the spot 3-month yield, has nearly inverted (see chart). It’s likely to soon tip over the line, leaving all important measures of the yield curve in inverted territory, according to Deutsche Bank.

Major points on the Treasury market’s yield curve line up for inversions in 2022, sending strong recession signals

Bloomberg, Deutsche Bank

“Essentially, it reflects where the market thinks policy rates will be in 18 [months versus] today, with an inversion indicating the market view that the Fed will have cut in a year-and-a-half,” the TS Lombard team wrote.

See: Recession ahead? This bond-market indicator is flashing a ‘code orange’ warning.

As part of its inflation fight, the Fed on Wednesday fired off its fourth straight jumbo rate increase of 75 basis points, bringing its policy rate to a range of 3.75% to 4%, the highest level in 15 years.

“No one knows if there is going to be a recession or not,” said Fed Chairman Jerome Powell, in an afternoon news conference Wednesday. “Our job is to restore price stability.”

Powell said the path to a soft landing for economy has narrowed over the course of the past year, while also signaling that monetary policy could stay restrictive for longer than anticipated as the central bank works to bring inflation down to its 2% target range.

He also said it was very “premature” to focus on a pause in the Fed’s tightening campaign, while declining to give specifics about the potential size of a December rate increase.

Of note, inversions of the 3-month/10-year yield curve have been an accurate predictor of past recessions since 1973, according to TS Lombard, which pegged them as occurring 12 months on average before past economic downturns over roughly the past 50 years.

Stocks buckled during Powell’s afternoon news conference, giving up earlier gains to end sharply lower. The Dow Jones Industrial Average

DJIA,

skid 505 points, ending down 1.6%, while the S&P 500 index

SPX,

fell 2.5% and the Nasdaq Composite Index

COMP,

shed 3.4%, according to FactSet.