The Federal Reserve still likely needs to tame the roaring car market before the central bank can start going easy on its inflation fight, according to Pat Ryan, CEO and founder of CoPilot, a car-pricing app.

Higher interest rates have slammed the brakes on the once-booming U.S. housing market, with 30-year fixed-rate mortgages pegged near 7% this week, up from about 3.1% a year ago.

But higher borrowing costs, so far, have done little to temper America’s demand for vehicles, one of the big-ticket items most households tend to finance.

Households kept on spending during the pandemic, with the car-loan market now reaching $1.5 trillion, according to the New York Federal Reserve.

“The used-car market is much stronger than I think people expected,” Ryan told MarketWatch. “Car prices for dealers are dropping, but that’s not true for consumers.”

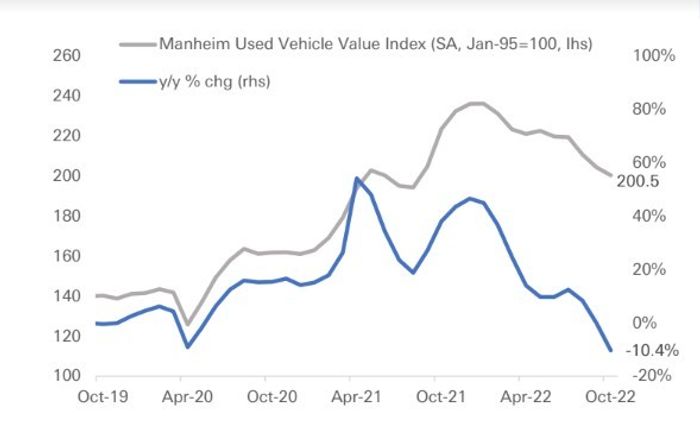

The Manheim Used Vehicle Value Index through mid-October marked a 10.4% drop (see chart) from a year before, spurring hopes that the Fed’s rapid pace of rate hikes this year might be dulling consumer demand.

Used car prices tumble 10.4% as of mid-October, from a year before.

Manheim, Bloomberg, Deutsche Bank

The index tracks prices that car dealerships pay for used cars at auctions. But a look at average retail prices, or what vehicles fetch off the lot, point to only a 3.7% retreat from their $33,505 peak in March, according to CoPilot data, which tracks daily sales and pricing activity at car dealerships nationwide.

“They only dropped enough to make up for the increase in interest rates,” Ryan said.

He used the example of a typical $546 monthly payment on a used-car loan in March rising to $564 in October, given the price declines but also accounting for higher borrowing costs.

“In real terms, prices have barely dropped, but sales are up,” Ryan said. “That’s what scares the Fed.”

Car sales rise

After contending that inflation would be transitory, the Federal Reserve in March began to quickly raise its benchmark rate, which hit 3.75% to 4% this week, the highest in 15 years.

Car loans are often for six-year terms or longer, and are based off Treasury rates, not the Fed’s short-term policy rate, meaning the central bank only indirectly influences the auto loan market. The benchmark 10-year Treasury rate

TMUBMUSD10Y,

was at 4.12% Thursday, up from a December low of 1.34%, making it far more expensive for households and companies to borrow.

Still, Fed Chairman Jerome Powell on Wednesday described inflation as growing “more and more challenging” this year, with demand from consumers keeping prices high, despite an easing in some pandemic supply-chain issues fueling shortages, including at car manufacturers.

October sales climbed 28% at Toyota Motor Corp.

TM,

and 32% at Subaru America

FUJHY,

7270,

from a year before, but slipped 10% at Ford Motor Co.

F,

and 16% at Honda Motor Co.

7267,

according to Automotive News. Edmunds said last month it expects sales of new U.S. automobiles to fall 0.9% in the third quarter, on a year-over-year basis.

Powell’s comments followed the central bank’s decision Wednesday to fire off its fourth-straight interest-rate hike of 75 basis points, while signaling rates could stay high for an extended period. He also repeated a vow to bring inflation that’s near a 40-year high down to the central bank’s 2% target.

“This market will be the one to watch month to month,” Ryan said, saying the Fed hasn’t blinked even though the housing market has cooled significantly. “I think it will be the harbinger of when the Fed can start to soften its rate stance.”

Read: Fed says it may hike interest rates at slower pace, but destination is now 5% or higher

Related: Why an Arkansas town could provide a grim road map for America if car repos blow up