Russia’s seaborne crude oil exports have actually climbed since Moscow’s invasion of Ukraine in February this year, with India topping China as a major destination so far this month, according to data from Kpler.

That poses challenges to Europe’s plan to impose a price cap on Russian oil, as well as its agreement to ban Russian oil imports by the end of the year.

“Russia has swiftly become one of the biggest suppliers of crude into India, after only being a sporadic buyer prior to the invasion of Ukraine,” said Matt Smith, lead oil analyst, Americas, at Kpler, a commodity data and analytics firm.

Also read: How investors may benefit from a dive in natural-gas prices as winter looms

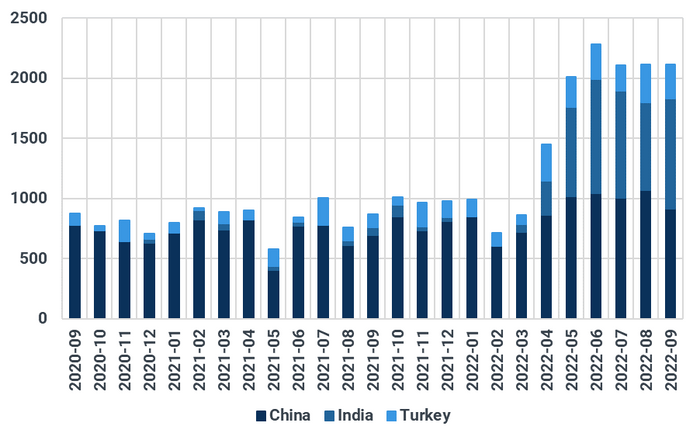

This month as of Sept. 21, India has imported 918,162 barrels per day of oil from Russia, more than the 913,120 barrels per day imported by China, Kpler data show. In March 2022, after the Feb. 24 Russian invasion of Ukraine, India imported just 67,612 bpd and China brought in 720,669 bpd of Russian seaborne crude.

China has increased oil imports from Russia since Russia’s invasion of Ukraine on Feb. 24, but it likely would have imported even more if “it weren’t for widespread lockdowns, demand destruction, and lower refining activity” this year, said Smith.

Overall, “the starkest change has been the pickup in Russia crude to India,” he said. “There has not been sufficient pressure placed on India by the U.S. administration to deter them from buying Russian crude.”

Seaborne Russian crude exports to China, India and Turkey, in thousands of barrels per day.

Credit: Kpler

Turkey has also stepped up to buy discounted Russian barrels, with purchases so far in September at 284,417 bpd, up from just 77,074 bpd in March, data show.

China, India and Turkey now account for over 2 million barrels per day of Russian crude imports — two-thirds of all seaborne flows, said Smith.

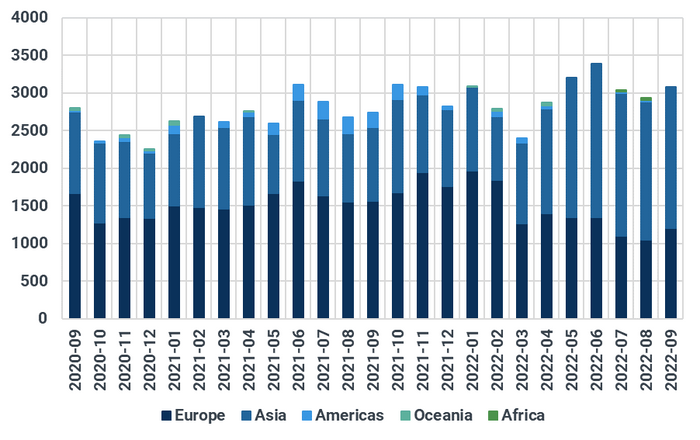

The data from Kpler also showed that Europe has imported 1.202 million barrels per day of Russian seaborne crude oil this month, down from 1.841 million in February.

Seaborne Russian crude exports to Europe, Asia, Americas, Oceania and Africa, in thousands of barrels per day.

Credit: Kpler

European Union countries are still importing over 1 million barrels per day of seaborne crude from Russia, but that will “have to be halted by early December due to sanctions,” said Smith.

The EU also confirmed in early September its intention to implement a price cap on Russian oil and petroleum products.

Even so, a price cap would require a “united front with the commitment of all global buyers,” said Smith. That “seems highly unlikely.”

“ “The West may want a price cap, but Russia has allies in the Middle East and Asia.” ”

“The West may want a price cap, but Russia has allies in the Middle East and Asia,” he said.

In total, Russia crude exports by sea are still holding above 3 million barrels per day — higher than the 2021 average, said Smith.