It’s the end of what felt like another very choppy week in stocks. And yet the S&P 500

SPX

is in line to start the final session only about 1% or so below last Friday’s close.

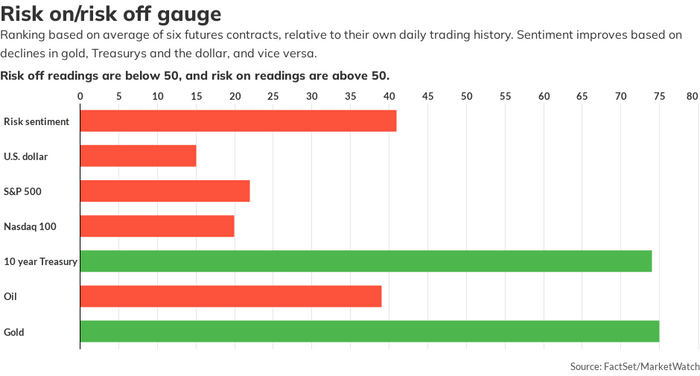

Uncertainty is hobbling the bulls. Many traders seem minded. given that the S&P 500’s year-to-date drop of 23% has improved valuations. to embrace a mostly positive earnings season.

But a 10-year Treasury yield

BX:TMUBMUSD10Y

surging to 4.25% for the first time since the great financial crisis is a looming reminder that to do so would be fighting the Fed.

As Tom Lee, head of research at Fundstrat says after conversations with clients this week: “The main question is why should any investor expect equity prices to stage any meaningful gain from here, in the midst of a Fed tightening cycle and in the midst of great uncertainty around the Russia-Ukraine war, increasing stress in financial markets (UK issue tabled for now) and in the midst of massive gloom of CEOs and Americans and investors.”

To make them feel better the market needs a cathartic blowout. A last frenzy of selling that exhausts the bears and sets the stage for a sustainable rally. In other words, yes: capitulation!

The problem, says Lee, is that investors reckon that the path of least resistance in the market is for equities to capitulate. A scenario where the CBOE Vix index

VIX,

the gauge of expected S&P 500 volatility, spikes above 40, stocks drop another 20% and there is some sort of financial accident, like a hedge fund imploding.

“But this is not the only ‘capitulation’ that could lay ahead,” he argues in his latest note. “There are other forms of ‘capitulations’ that could similarly boost investor confidence, in turn, fueling a firm footing for equities.”

And he has a list. First, “Inflation ‘hard data’ could capitulate, syncing up with the ‘soft data’ which have been showing growing signs of falling inflation.”

This in turn could cause the Fed reaction function to capitulate and shift the central bank from hiking by 75 basis point after every strong consumer price index report.

Next, another type of Fed capitulation is if it shifts “to a more ‘inflation tolerance’ view, acknowledging part of core inflation reflects supply chain tightness (transportation services) and recognizing severe lags in data such as shelter/rent CPI component”.

How about the tight labor market finally capitulating, says Lee, with falling job openings and less wage growth pressures (though he accepts that currently strong jobless claims data don’t presently support this scenario).

Also, it may be possible that given the surge in yields of late, fixed income bulls start finding the bond market increasingly attractive even before data turns or the Fed signals pivot. “Interest rates could stop powering higher,” a “capitulate on yield” if you will.

Finally, investment sentiment has largely already capitulated. “The BofA fund manager survey shows that institutional investors most underweight equities in more than 20 years,” Lee notes.

He summarizes: “There are multiple pathways for markets to move higher. And while investors are mostly expecting equity markets to capitulate. There are other capitulations that could drive asset prices higher.”

Markets

Benchmark 10-year Treasury yields

BX:TMUBMUSD10Y

rose 4.3 basis points to 4.276%, their highest since 2008, as investors priced in stubborn inflation and more Federal Reserve rate hikes. The move up in yields hit S&P 500 futures

ES00,

down 0.7% to 3650 and lifted the dollar index

DXY,

up 0.6% to 113.51. Worries about slowing demand pushed WTI crude futures

CL

down 0.3% to $84.25 a barrel.

The buzz

Snap shares

SNAP

are slumping more than 25% to trade at their lowest since early 2019 after the messaging app, following Thursday’s close, announced widening losses and said revenue growth would slow.

Twitter shares

TWTR

fell more than 8% to around $48 a share in premarket action after reports Elon Musk said he would cut 75% of the workforce. Musk is supposed to be paying $54.20 a share so that he could carry out any such threat, so it’s thought the slide has more to do with reports the U.S. is considering national security reviews for some of Musk’s ventures.

The U.S. third quarter earnings season continues, with Verizon

VZ,

American Express

AXP,

Seagate

STX,

and Schlumberger

SLB

among those presenting their figures.

The dollar moved above 150 yen

USDJPY

as the Bank of Japan’s determination to maintain its loose monetary policy pushed the yield spread between 10-year U.S. and Japanese government bonds

BX:TMBMKJP-10Y

above 4%.

Weeks of political and financial market turmoil, with inflation back to a 40-year high of 10.1%, has pushed U.K. consumer sentiment to its worst in half a century. Little surprise then that the country’s retail sales fell 1.4% in September, much worse than the expected 0.5% decline.

Gilts

BX:TMBMKGB-10Y

and the pound

GBPUSD

were in retreat after the sales data and ahead of a weekend of jostling to be the next leader of the governing Conservative Party, and thus the new U.K. Prime Minister.

Best of the web

Toxic workplaces are bad for your health, says Surgeon General.

Six ways to protect yourself from online scammers.

The lessons from Liz Truss’s downfall to other European leaders.

The chart

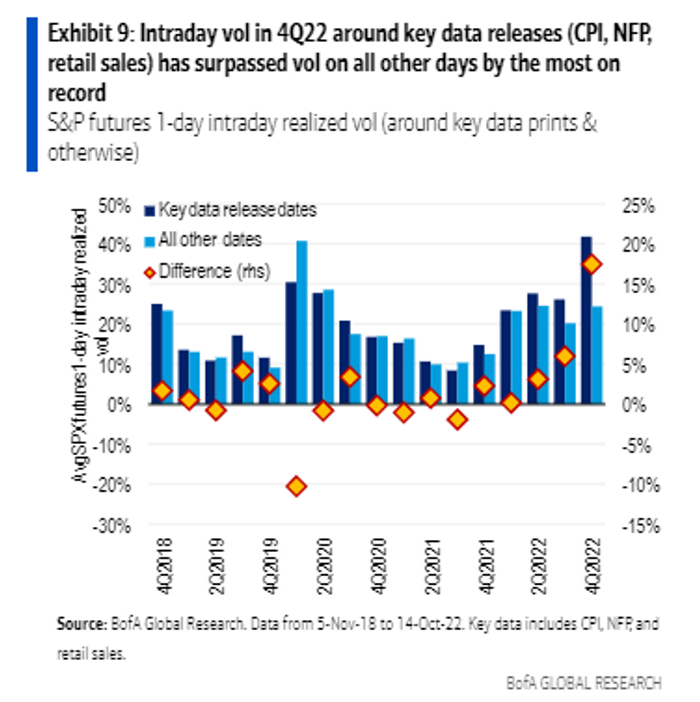

“Equity investors seem sharply focused on timing the peak in inflation and central bank hawkishness. And with economic data remaining historically volatile and difficult to forecast, the importance of economic data releases has grown to levels not seen in years, if ever,” says the global equity derivatives team at Bank of America.

As the chart below shows, this has left the stock market becoming increasingly reactive to economic data surprises. “The last two quarters saw the most ‘excess’ S&P futures intraday realized volatility around key data prints since at least 2018, and the last three quarters have been among the five highest,” says BofA.

Source: Bank of America

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security name |

| TSLA | Tesla |

| GME | GameStop |

| AMC | AMC Entertainment |

| MULN | Mullen Automotive |

| SNAP | Snap |

| APE | AMC Entertainment preferred |

| NIO | NIO |

| AAPL | Apple |

| TWTR | |

| META | Meta Platforms |

Random reads

Eve the Kelpie dog sells for $49,000.

Chess prodigy accused of cheating files $100 million defamation suit.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton