Slowing economic growth and a softer job market could allow the Federal Reserve to pivot, marking a peak for the U.S. dollar as inflation stabilizes, according to strategists at JPMorgan.

“The worsening in Growth-Policy trade-off seen so far year-to-date, from both sides will be changing as we move through 2H,” said JPMorgan strategists led by Mislav Matejka in a note on Monday. “Crucially, this could open the doors to a more balanced Fed, and is driving a rollover in bond yields, potentially peaking USD and a leveling off in inflation. All four of these variables were relentlessly marching higher in the 1H, and the turn will be welcomed.”

As inflation has proved to be persistent at a four-decade high, the Fed’s aggressive tightening of monetary policy is seen threatening to tip the economy into recession. Policy makers prepared to meet this week with market participants expecting another 0.75 percentage point rate hike that would push the fed-funds rate up to 2.25%-2.5%.

Read more: Four things you will want to listen for at Wednesday’s Federal Reserve meeting

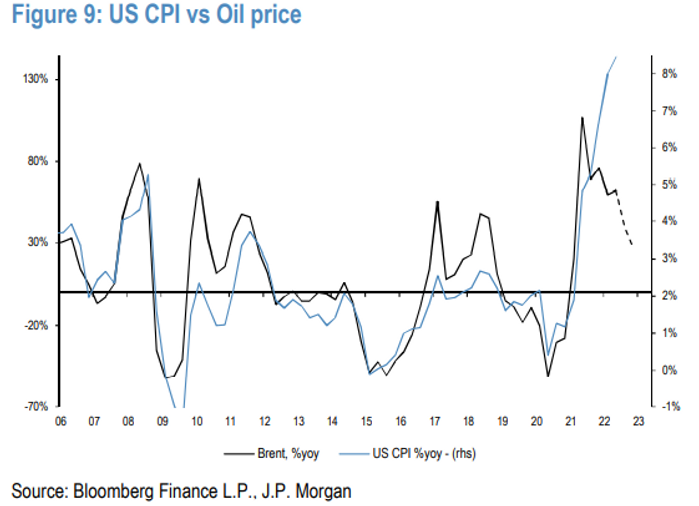

However, the JPMorgan strategists contend that a rollover in commodity prices will help ease some inflationary pressures as Brent crude, the global benchmark, typically has a strong correlation with headline CPI (see chart below).

SOURCE: BLOOMBERG FINANCE LP, J.P. MORGAN

“Inflation forwards remain closely tied to the level of Brent, and the broader pullback in commodity prices should be interpreted not only as a traditional indicator of softer demand, but also as bringing the relief in inflation pressures,” said strategists.

“This is one of the angles which is ushering the phase of ‘bad data is starting to be seen as good’, in the same way that the resiliency earlier in the year was not rewarded, as it enabled the Fed to keep focusing solely on the inflation risk,” they wrote.

Oil futures have retreated sharply in July, with pressure tied in part to fears that a potential recession would undercut demand.

Earlier this month, data from University of Michigan showed that consumers see prices rising 2.8% over the next five years, down from 3.1% in June. That matched the lowest reading in 16 months. Another survey of consumer sentiment rose slightly to 51.1 in July.

“Investor sentiment is also near multidecade lows,” the strategists noted. “A reset in activity levels is what many investors are highlighting to us is needed for them to be able to step back into the market, as that may offer an opportunity for investors to start positioning for an inflection higher, being able to look through.”

Stocks ended a choppy session mostly higher on Monday as investors awaited a hectic week of earnings, a Fed decision and key economic data. The Dow Jones Industrial Average

DJIA,

ended with a gain of around 91 points, or 0.3%, on Monday, while the S&P 500

SPX,

ticked up 0.1% and the Nasdaq Composite

COMP,

shed 0.4%.

See: Stock-market investors face crucial week: Fed, earnings deluge, GDP

Although Wall Street strategists have sounded the recession alarm, their forecasts vary wildly.

Morgan Stanley’s Michael Wilson, the head of U.S. equity research and one of Wall Street’s most prominent bears, argued in a Monday note hat equity investors have been too eager to price in a “pause” to the Fed’s rate-hike cycle this week.

Strategists at BlackRock also warned in a note on Monday that they “think the Fed will overtighten rates and cause acute damage to growth before pivoting.” They expect more volatility ahead if policy makers think they could tame inflation without driving the economy into recession.

Read more: Big Tech earnings are about to determine the direction of the market