The stock market always looks ahead — anticipating any signs of economic changes that may lead to a tightening or loosening of Federal Reserve policy.

The Fed is obviously in tightening mode in an effort to reduce inflation. But Jonathan Golub, chief U.S. equity strategist and head of quantitative research at Credit Suisse, looks out one year and says “inflation expectations are collapsing.”

This leads him to believe the Fed may not need to prolong its cycle of tightening. Joseph Adinolfi looks deeper into inflation indicators and what they might mean for stocks.

More for bulls and bears:

Apple rolls out iPhone 14 with one big surprise

Apple has expanded its color palette of the iPhone 14.

Apple

Apple

AAPL,

CEO Tim Cook decided to give consumers a break when the company rolled out its iPhone 14 and other new or updated products.

Leslie Albrecht can help you decide whether it is worth upgrading to the iPhone 14.

More Apple coverage:

Here’s why you should avoid meme-stock hype and consider this lower-risk approach

MarketWatch photo illustration/iStockphoto

Mark Hulbert looks into the meme-stock phenomenon and points to a simple, low-volatility approach that is outperforming this year and may serve you better over the long haul.

More investing coverage:

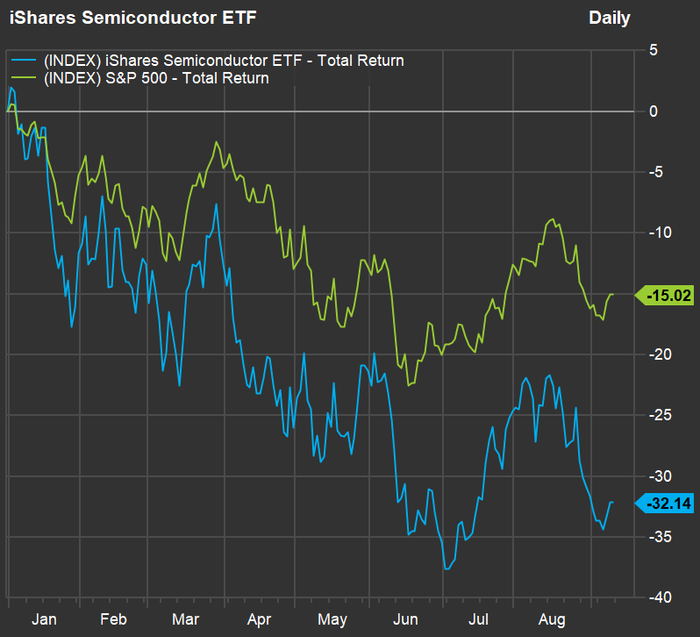

Chipmakers languish in the down cycle

The iShares Semiconductor ETF, which tracks the PHLX Semiconductor Index of 30 manufacturers of computer chips and related equipment, has fallen more than twice as much as the S&P 500 this year.

FactSet

This has been a difficult year for investors holding shares of semiconductor manufacturers. The iShares Semiconductor ETF

SOXX,

has dropped more than twice as much as the S&P 500. Consensus sales and earnings estimates have declined tremendously over the past two months for Nvidia

NVDA,

Intel

INTC,

and Micron

MU,

for example.

But these 12 semiconductor companies have bucked that trend.

Three cheers for the beleaguered Intel

Getty Images

When a cyclical industry is in a difficult part of the cycle, there are opportunities for long-term investors. There are also special cases, as the one Cody Willard describes for Intel, which is spending billions — with generous government subsidies — to build out its chipmaking capacity in the U.S. and Western Europe.

Willard makes the long-term case for Intel’s stock, and readers chime in with thoughtful comments.

The housing market shows signs of softening

AP

Mortgage-loan rates have hit their highest levels since 2008, but there was a slight decrease in U.S. home prices in July from June, according to CoreLogic. Meanwhile, the rental market may be starting to cool.

More housing coverage:

- ‘No sign of a rebound’: Mortgage applications hit 22-year lows, as home buyers pull back

- ‘Extreme buyer hesitation’ pushes home sellers to rent instead of sell, as builders eye rentals as a hedge against a housing recession

Nearly everyone faces this challenge

Getty Images/iStockphoto

Anyone caring for an elderly relative will suffer burnout, according to Susanne White, author of “Self-Care for Caregivers: A Practical Guide to Caring for You While You Care for Your Loved One.”

In an interview with Alessandra Malito, White explains how to “manage the damage.”

More on retirement-related subjects:

- 5 tips for retiring in a volatile market

- Want to write a book? Experienced authors share the perks and pitfalls of self-publishing

Thoughts about Queen Elizabeth

Queen Elizabeth II visited Brisbane, Australia, in October 2011.

Getty Images

Laura Clancy, a media lecturer at Lancaster University, explains how the United Kingdom change during Queen Elizabeth’s reign.

Leslie Albrecht lists Queen Elizabeth’s favorite charities.

Arianne Chernock, a professor of history at Boston University, describes the queen’s influence on American women.

Andrew Keshner shares thoughts about how Queen Elizabeth was an authority role model for women.

Brett Arends points to a survival skill everyone can learn from Queen Elizabeth.

Hear from Ray Dalio at MarketWatch’s Best New Ideas in Money Festival on Sept. 21 and Sept. 22 in New York. The hedge-fund pioneer has strong views on where the economy is headed.

Want more from MarketWatch? Sign up for this and other newsletters, and get the latest news, personal finance and investing advice.