Shares of United Parcel Service Inc. got a nice lift Tuesday, after the package delivery giant came up a bit shy on revenue but beat profit expectations, and because the company showed that it was managing a difficult macro-environment by affirming the full-year outlook.

UPS’s

UPS,

earnings report was in stark contrast to what FedEx Corp.

FDX,

said last month, when it warned of a fiscal first-quarter profit and revenue shortfall, and predicted that fiscal 2023 would be worse, citing economic weakness in Asia and service challenges in Europe.

UPS seems to be on top of the slowing economy and is executing on cost controls, better than its rival, said Cowen analyst Helane Becker.

“3Q results fit our view fit with [our] view that UPS got ahead of the slowing freight cycle and has a better grip on costs than FedEx,” Cowen analyst Helane Becker wrote in a note to clients. “The company encouragingly reaffirmed their [fiscal] 2022 guidance.”

The results also show that the U.S. economy has held up much better than other regions, especially Europe, Becker said.

UPS Chief Financial Officer Brian Newman said on the post-earnings conference call with analysts that in the U.S., a continued strong job market and healthy consumer spending offset higher inflation and interest rates. But overseas, the economic environment weakened more than expected due to high inflation, volatile energy prices, COVID-related lockdowns in Asia and the Russia-Ukraine war.

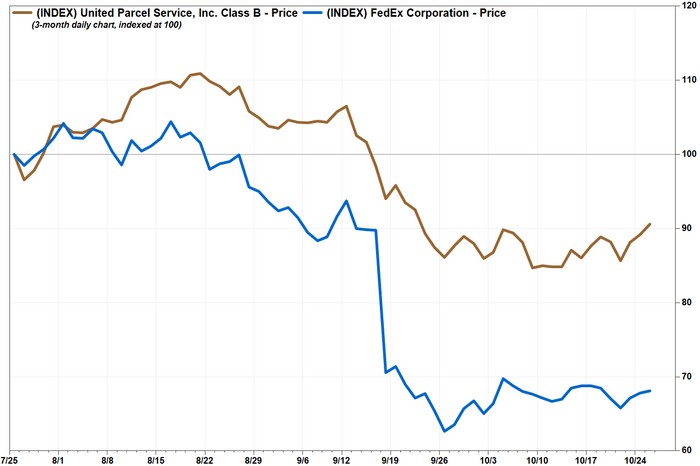

The stock rose 1.8% in morning trading. It has lost 9.3% over the past three months, while FedEx shares have plunged 32.0%. In comparison, the Dow Jones Transportation Average

DJT,

has lost declined 4.9% in the past three months and the Dow Jones Industrial Average

DJIA,

has slipped 1.0%.

FactSet, MarketWatch

UPS reported before Tuesday’s opening bell net income that rose to $2.58 billion, or $2.96 a share, from $2.33 billion, or $2.65 a share, in the same period a year ago. Excluding nonrecurring items, adjusted earnings per share (EPS) of $2.99 beat the FactSet consensus of $2.84.

Total revenue grew 7.4% to $24.16 billion, just shy of the FactSet consensus of $24.31 billion.

U.S. domestic package revenue rose 8.2% to $15.37 billion, above the FactSet consensus of $15.12 billion, but International revenue fell 1.7% to $4.80 billion to miss expectations of $4.89 billion and Supply Chain Solutions revenue dropped 6.3% to $3.99 billion to miss forecasts of $4.29 billion.

Total package volume declined 2.1%, with U.S. volume down 1.5% and international volume falling 5.2%. However, average revenue per piece (RPP) increased 8.6%, including a 9.8% jump in the U.S. and 6.4% increase internationally.

CFO Newman said about one-third of RPP growth came from continued strength in pricing, another third was from changes in fuel price per gallon and the final third was from a combination of mix and fuel-pricing actions.

In terms of costs, operating expenses rose, but less than sales, up 3.7% to $21.05 billion. That led to total operating profit as a percentage of sales improving to 12.9% from 12.5%.

For 2022, the company said it still expects revenue to be around $102 billion, and adjusted return on invested capital to be above 30%. The company did cut its outlook for capital expenditures to around $5.0 billion from around $5.5 billion. UPS said it now expects to repurchase “at least” $3 billion of its shares this year, after saying in July that its repurchase target was $3 billion.

“Collectively, the beat and reiterated guidance is clearly a positive in a slowing macro environment, and Domestic appears to be capturing share given the sequential improvement in [year-over-year] volumes and widening spread vs. FedEx,” Citigroup analyst Christian Wetherbee.

UPS’s third-quarter volume decline of 2.1% was better than the decline of 4.8% in the sequential second quarter, and much better than FedEx’s latest-quarter volume decline of 11.4%.