Soft data out of China put a damper on U.S. stocks Monday, with investors pausing for breath after last week extending a bounce off mid-June lows.

How are stock futures trading

-

The Dow Jones Industrial Average

DJIA

fell 28 points, or 0.1%, to 33,733. -

The S&P 500

SPX

was off 13 points, or 0.3%, at 4,267. -

The Nasdaq Composite

COMP

lost 41 points, or 0.3%, to trade at 13,007.

The S&P 500 advanced 3.3% last week, its fourth straight weekly gain and longest such winning streak since November. The Dow rose 2.9% last week, while the Nasdaq Composite gained 3.1%.

What’s driving markets

Disappointing economic news out of China helped set the negative tone, with retail sales, investment and industrial output all slowing and missing forecasts. China’s central bank trimmed lending rates.

“Bad data from China also weighs on recession worries for the rest of the world,” said Ipek Ozkardeskaya, senior analyst at Swissquote Bank in a note.

Also, the New York Fed’s Empire State business conditions index, a gauge of manufacturing activity in the state, plummeted 42.4 points to negative 31.3 in August, the regional Fed bank said Monday.

The figure didn’t help sentiment, though economists were taking it with a grain of salt.

The Empire State data “wasn’t entirely bad: delivery times were steady for the first time in almost two years, employment managed to rise, and inflation pressures did not increase,” said Oren Klachkin, lead U.S. economist at Oxford Economics, in a note.

“At the same time, manufacturers were not cheerful about the outlook for the next six months. We caution not to take too much away from this report since N.Y. manufacturing constitutes a small portion of the country’s manufacturing base,” he wrote.

Concerns about slower demand from China pressured the energy sector, with WTI crude oil futures CL.1 dropping 5.3% to trade near $87 a barrel. The Energy Select Sector SPDR ETF

XLE

fell 3.7%.

Stocks were struggling to maintain upward momentum after a strong run that saw the S&P 500 record a four-week winning streak that delivered its best percentage advance for such a period since November 2020.

Similarly, the tech-heavy Nasdaq Composite sits near a four-month high after surging 22.6% off its mid-June low. Stocks were buoyed last week as the U.S. consumer-price index and producer-price index showed inflation cooling, though still running quite hot.

“The good news on inflation coming on the heels of a very strong July payrolls report has reinvigorated belief in a ‘soft landing’ for the economy. This is an outcome that we thought was at least as likely as a recession, and now the markets are moving closer to pricing in this scenario,” said Solita Marcelli, chief investment officer for the Americas at UBS Global Wealth Management, in a note.

“The risk is that the markets get ahead of themselves, especially with investor FOMO starting to kick in,” she wrote, referring to the phenomenon known as “fear of missing out.”

Technical indicators speak to the improved tone of late. The Cboe Volatility Index

VIX,

a gauge of expected market volatility that usually rises when investors are fearful, closed last week below its long-term average of 20. However, the VIX, as it’s also known, was up 5.2% to 20.55 on Monday.

See: Can the stock market bottom without Wall Street’s fear gauge hitting ‘panic’ levels?

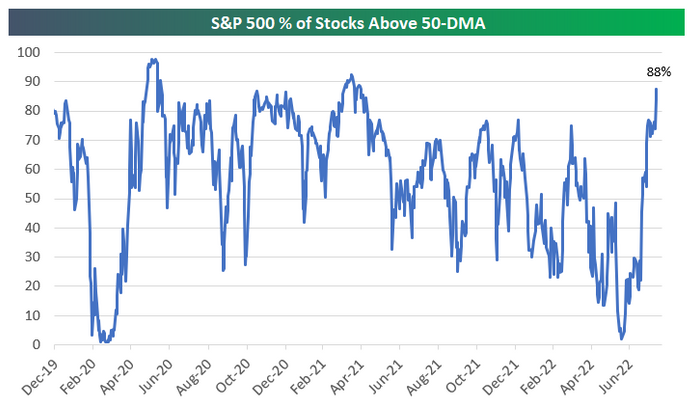

The breadth of the market’s latest bounce is also considered supportive, with Bespoke Investment noting the percentage of S&P 500 stocks trading above their 50-day moving average has jumped to 88% from just 2% on June 16th.

Source: Bespoke Investment

Also Friday, the S&P 500 closed above 4,231, marking a retracement of more than 50% of the 2022 selloff from its Jan. 3 record close to the June 16 low. Technical analysts noted that the S&P 500 in the past half-century hasn’t retraced 50% of a bear-market selloff and then went on to set new cycle lows, though they warned that there was still potential for sharp losses and near-term volatility.

Read: Why stock market bulls are applauding the S&P 500’s close above 4,231

In other economic data, the National Association of Home Builders’ monthly confidence index fell 6 points to 49 in August, the trade group said Monday — the first time since 2020 that it came in below a break-even measure of 50.

Companies in focus

-

Tesla Inc.

TSLA

chief executive Elon Musk noted a company milestone Sunday, tweeting that the electric-vehicle maker had produced more than 3 million vehicles, with a third of them made in China. Shares rose 1.7%. -

Shares of Bed Bath & Beyond Inc.

BBBY

rose 4.4%, putting the meme stock on track for a fourth-straight gain. The stock had run up 21.8% on Friday, and had soared 32.3% since it fell 14.2% on Aug. 9 to snap the longest win streak in 15 years. The home goods retailer’s meme stock is headed for the 13th gain in 14 sessions.

How are other assets faring

-

The 10-year Treasury yield

BX:TMUBMUSD10Y

fell 8.4 basis points to 2.764%. -

The ICE Dollar index

DXY

rose 0.4%, and the stronger buck helped push gold

GC00

down 1.2% to trade below $1,793 an ounce. -

Bitcoin

BTCUSD

rose above $25,000 for the first time since June, but then reversed, dropping 1.2% to $24,050. -

In Europe, the Stoxx 600

XX:SXXP

rose 0.1%, while London’s FTSE 100

UK:UKX

was down 0.2%. -

In Asia, the Shanghai Composite

CN:SHCOMP

ended fractionally lower, while the Hang Seng Index

HK:HSI

fell 0.7% in Hong Kong and Japan’s Nikkei 225

JP:NIK

advanced 1.1%.

Hear from Carl Icahn at the Best New Ideas in Money Festival on Sept. 21 and Sept. 22 in New York. The legendary trader will reveal his view on this year’s wild market ride.