U.S. stock futures rose on Monday as investors continued to shrug off the prospects for faster Fed tightening amid hopes a strong labor market signals the U.S. economy remains healthy.

How are stock-index futures faring

-

S&P 500 futures

ES00,

+0.19%

rose 11 points, or 0.3%, to 4,158 -

Dow Jones Industrial Average futures

YM00,

+0.14%

added 60 points, or 0.2%, to 32,811 -

Nasdaq 100 futures

NQ00,

+0.35%

climbed 51 points, or 0.4%, to 13,280

On Friday, the Dow Jones Industrial Average

DJIA,

rose 77 points, or 0.23%, to 32803, the S&P 500

SPX,

declined 7 points, or 0.16%, to 4145, and the Nasdaq Composite

COMP,

dropped 63 points, or 0.5%, to 12658. The S&P 500 is up for three consecutive weeks but remains down 13% for the year to date.

What’s driving markets

Firmer equity index futures point to Wall Street challenging its highest levels in more than two months. Since hitting its 2022 low in mid June, the S&P 500 is up 13% after investors made bets that pessimism over corporate prospects, in the wake of surging inflation and tighter central bank monetary policy, was overdone.

Stocks initially sold off on Friday in the wake of a much stronger than expected U.S. jobs report for July, when investors fretted that the data gave the Federal Reserve more leeway to quicken the pace of interest rate hikes in order to damp inflation.

But risk appetite has returned, with traders hoping that a robust labor market challenges recent evidence of a slowing U.S. economy and as a generally well-received second-quarter company earnings season comes to a close. Investors are also absorbing news that the U.S. Senate over the weekend approved Democrat’s big healthcare, climate and tax package.

“While it was all too easy for some to mock efforts to downplay the first half ‘recession,’ Friday’s payrolls print put the shoe on the other foot,” said analysts at Jefferies in a weekend note.

“As of the end of July, the U.S. workforce is officially larger than it was in Feb ’20. Calling the current economy strongest ever in the face of negative GDP just got a little less absurd. So in this context, the fact that the SPX bounced off Friday’s low to not totally kill off the torrid run we’ve observed since mid-July makes sense,” the Jefferies analysts added.

The market rally now faces some technical challenges, argue some observers. The S&P 500 surge of late has left its 14-day relative strength index, a closely-watched momentum gauge, at 71.6 and in “overbought” territory.

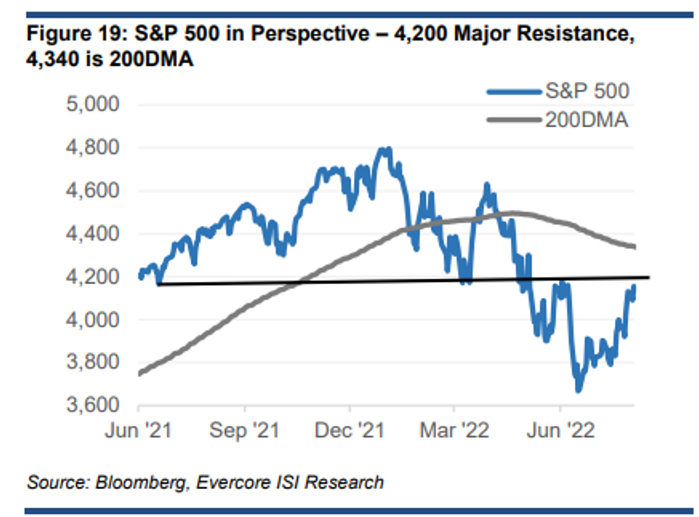

And the benchmark index now is also eyeing resistance at the 4,200 level, and if that is breached then the 200-day moving average looms into view.

Source: Evercore ISI

“Economic and policy uncertainty translating into continued trade in the S&P 500 below 4,200 and 4,340 leaves open the possibility of lower lows,” said analysts at Evercore ISI.

Supporting the market mood is a calmer tone in sovereign bonds, with the U.S. 10-year Treasury yield

TMUBMUSD10Y,

which had jumped on Friday following the jobs data, easing 3 basis points to 2.802%.

Also helping underpin the market’s risk appetite on Monday is a continued slide in energy costs, which should assist in reducing inflation in coming months. The WTI crude oil future

CL.1,

was down 0.2% to $89.40 a barrel, near its cheapest since Russia’s invasion of Ukraine in February.

How are other assets faring

-

The ICE Dollar index

DXY,

-0.08%

fell 0.2% to 106.42, helping to inspire gains for gold

GC00,

-0.01% ,

which rose nearly 0.1% to $1,793 an ounce. -

Bitcoin

BTCUSD,

+3.87%

advanced 2.6% to $23,866. -

Asia markets were mixed after another COVID-19 lockdown in a part of China impacted sentiment. Hong Kong’s Hang Seng

HSI,

-0.77%

fell 0.8% and Japan’s Nikkei 225

NIK,

+0.26%

rose 0.3%. In Europe, the Stoxx 600

SXXP,

+0.51%

rose 0.5%.