U.S. stock futures rose to 8-week highs as the rally sparked by weaker than expected inflation maintained its momentum.

How are stock-index futures trading

-

S&P 500 futures

ES00,

+0.42%

rose 21 points, or 0.5% to 3982 -

Dow Jones Industrial Average futures

YM00,

+0.42%

added 176 points, or 0.5% to 33888 -

Nasdaq 100 futures

NQ00,

+0.54%

gained 98 points, or 0.9% to 11730

On Thursday, the Dow Jones Industrial Average

DJIA,

rose 1,201 points, or 3.7%, to 33715, the S&P 500

SPX,

increased 208 points, or 5.54%, to 3956, and the Nasdaq Composite

COMP,

gained 761 points, or 7.35%, to 11114.

What’s driving markets

Equity indices on Friday looked to extend the previous session’s strong surge — taking S&P 500 futures to their highest since mid-September — amid optimism that slower inflation means the Federal Reserve may not need to raise borrowing costs by as much as feared.

News that China was easing its COVID-19 curbs, was adding to the bullish tone, and pushing up prices of industrial metals and oil, with WTI futures

CL.1,

up 2.5% to $88.64 a barrel.

“A softer than expected inflation reading in the U.S. has lit a fire under markets, with investors scrambling to deploy some of the mountain of cash which had been sitting on the sidelines,” said Richard Hunter, head of markets at Interactive Investor.

Data released on Thursday, showed the headline consumer price index rose by a slower-than-forecast 7.7% over the year to October, and core inflation for the period also came in at a lower-than-expected 6.3%.

The report has triggered a spectacular bounce across asset classes, with the S&P 500 jumping 5.5% on Thursday, its best daily gain since April 2020, and 2-year Treasury yields

TMUBMUSD02Y,

which move opposite to prices, plunging 33 basis points, the biggest daily decline since September 2008.

“The cool inflation print should mean the beginning of the end for inflation fears, and the Fed will feel much more comfortable ramping down. Indeed this is the kind of number that lifts all ships, as investors were not even close to being positioned for this type of inflation retreat,” said Stephen Innes, managing partner at SPI Asset Management.

Stocks have been roiled in 2022 as the Fed hiked interest rates by 375 basis points in the space of less than nine months as it battled to damp inflation running at 40-year highs. Benchmark 2-year bond yields had risen to their highest since the great financial crisis as the market priced in a high probability that the central bank would raise rates to 5.1% by spring 2023.

Futures now suggest the Fed’s terminal rate will peak at 4.9% in June next year, with chances of a 50 basis point hike by the Fed at its December meeting up to 85%. Earlier this week it was a toss up between a 50bp and 75bp hike.

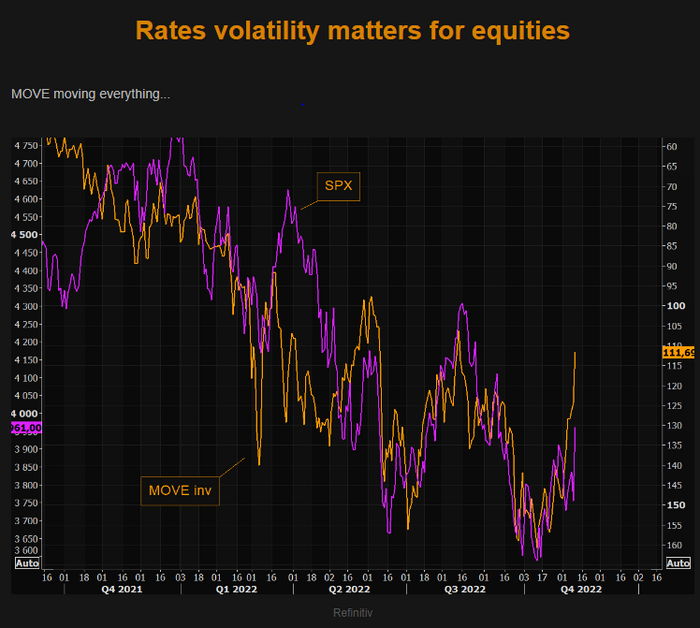

The better tone in bond markets ensured Thursday’s $21 billion auction of 30-year paper was “historically strong”, according to Jefferies. The CBOE MOVE index, a gauge of expected Treasury market volatiltiy, whose signs of stress have been closely correlated to stock market declines, is now down more than 28% over the past month.

Source: The Market Ear

The government bond market is closed on Friday for the Veterans’ Day holiday.

Jonathan Krinsky, strategist at BTIG noted the stock market’s latest rally delivered some supportive technical indicators, including the S&P 500 (SPX) closing back above 3,900, the dollar index

DXY,

falling below 109, and 10-year [Treasury] yield

TMUBMUSD10Y,

dropping through 3.90%.

But he cautioned: “While these are clearly positives and could open the door for the SPX to test approximately 4,083 (the 9/13 gap-fill and 200 DMA), Thursday’s action alone is insufficient evidence to change our primary cautious view”.

“For example, the Nasdaq 100 (NDX) gained 7.49%. Of the 20 largest NDX daily gains since 1990, 16 of them happened either between April 2000 and May 2002, or in October 2008, none of which marked the end of those bear markets,” Krinsky wrote in a note to clients.