The U.K. is teetering on the edge of recession, say economists at Goldman Sachs, as inflation-battered Britons curtail spending and the Bank of England raises interest rates.

The bank’s economists Steffan Ball and Ibrahim Quadri forecast a 0.7% contraction for the second quarter and a 0.1% increase for the third quarter. (GDP data in the U.K. is presented in quarter-on-quarter, rather than annualized as in the U.S.) “This puts the U.K. economy on the edge of a technical recession, and suggests increased focus on U.K. activity data in coming months,” they said.

Recent weak U.K. retail sales data highlighted how households have been tightening purse strings in the face of soaring energy prices. The Goldman team observed that June’s Gfk measure of U.K. consumer confidence fell to its lowest level since records began in 1974.

“Indeed, the GfK report noted that the consumer mood is currently ‘darker’ than in the early stages of the Covid pandemic, the result of the 2016 Brexit referendum, and even the shock of the 2008 global financial crisis,” they said.

Goldman Sachs forecast

Meanwhile, downbeat commentary from purchasing managers illustrates caution across the corporate sector.

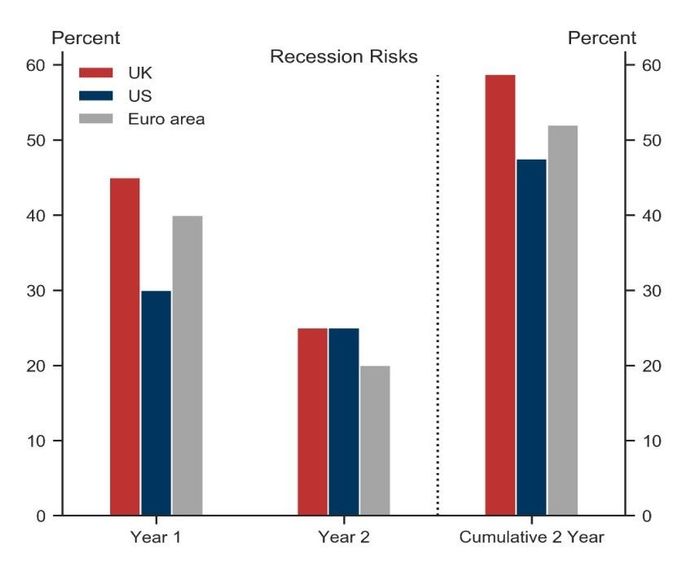

Consequently, Goldman sees a 45% probability that the U.K. may be in recession over the next 12 months. That’s more than the 40% probability they see in the eurozone and the 30% chance in the U.S. the firm forecasts.

Morgan Stanley CEO James Gorman this week put the odds of a U.S. recession at 50%.

The Bank of England appears unlikely to offer much support unless activity deteriorates markedly. Goldman expects the BoE will deliver further 50 basis point interest rate hikes in August and September, and 25 basis point increases in November and December.

“However, risks are skewed towards less rapid BoE tightening should the U.K. economy end up in a clear recession,” it added.

Ironically, political risk could provide a fiscal boost and help the U.K. avoid economic contraction later in the year. “Given the recent succession of policy interventions focused on supporting households, and the result of the no-confidence vote in PM [Boris] Johnson, we think the government is now more likely to respond further in the coming weeks if cost-of-living pressures do not fade.”

Concerns about the UK’s economic prospects have hit the pound

GBPUSD,

with sterling trading around $1.21, down more than 10% this year. The weaker currency tends to support the FTSE 100

UKX,

the U.K.’s large cap equity index, because a large weighting of its constituents are global corporations, like miners and energy companies, with a large proportion of their sales overseas. So, while the FTSE 100 is off less than 5% year-to-date, the more UK-focused FTSE 250

MCX,

mid-cap index is down 22%.