While stocks didn’t completely roll over following that ugly consumer price index print, futures indicate they may take another whack at it on Thursday.

That’s thanks in part to a miss from JPMorgan, which is helping kick off earnings season. (Read more below).

How high will inflation reach and what lengths will the Federal Reserve go to combat it? Those are the questions without answers right now, though Wall Street has been busy taking a stab at them.

Nomura is putting its money on a 100 basis-point hike at the Fed’s next meeting. “A significant part of our 2022 recession call involves entrenched inflation and a single-mandate Fed determined to bring it lower,” said a team led by Aichi Amemiya.

Meanwhile, over at Jefferies, expectations are that the annual inflation peak has likely passed. They noted the bulk of the inflation upside surprise was due to housing “that should fade as seasonal factors come into play,” and energy prices that have already started easing up.

Still, one question for investors is what to do now with that grim, though backward-looking, inflation number rattling cages. Our call of the day from global wealth management chief investment officer Mark Haefele and his team at UBS offers up a three-prong playbook.

On the brighter side, Haefele said the market “is beginning to believe the Fed has the resolve to get on top of inflation, even if it continues to hit multidecade highs.” Market pricing, he noted, now points to an earlier end to the hiking cycle than before CPI data.

And he pointed to a “clear sign” that the market is growing more confident in the Fed’s ability to keep a lid on inflation — U.S. 10-year break-even inflation rates that have dropped from a 3.11% peak on April 21 to 2.32%. “All else equal, the risk of our ‘stagflation’ scenario in which markets begin to fear the Fed losing control of inflation appears to be receding,” said the UBS team.

On the whole, UBS sees inflation falling in the latter half of 2022 thanks to improved supply-chain issues that will create a better supply-and-demand balance. Squeezed household budgets will mean less demand for discretionary goods and services, he added.

But given a still fairly uncertain backdrop, investors will need a portfolio that can contend with various scenarios, said the UBS team:

- Invest in value: Expect inflation to thumb the nose at central bank targets this year, and based on analysis from 1975 onward, UBS finds value sectors tend to outperform growth stocks when inflation is above 3%. In a soft-landing scenario, it sees value performing well as increased confidence that company earnings will stay resilient bodes well for cyclical sectors such as financials and energy, with the U.K. market also one to consider.

- More defensives and quality, make volatility work. If a “slump” is coming, driving lower corporate profit expectations and further stock downside, investors should opt for quality-income stocks, healthcare, “resilient credits” and the Swiss franc. “Capitol-protected strategies may also allow let investors to use volatility to work in their favor and mitigate potential downside risks,” said Haefele and the team.

- Liquidity strategy and hedge funds. To manage risks of forced selling, earn yield and prepare for potential future opportunities, Haefele suggests a “liquidity portfolio” set up to meet three to five years of cash flow needs. That would include a mix of cash, cash alternatives and short-duration bonds. “Investors should also ensure an adequate allocation to hedge funds, which have the potential to deliver performance, even if both bonds and equities are falling.”

Final thoughts from Haefele: “Markets are likely to remain volatile in the coming months and trade based on hopes and fears about economic growth and inflation. A more durable improvement in market sentiment is unlikely until there is a consistent decline in both headline and core inflation readings to reassure investors that the threat of entrenched price rises is passing,”

The buzz

JPMorgan

JPM

shares are dropping on a fall in net income that missed forecasts. Morgan Stanley

MS

is also due to report, in the first of results from more than 70 S&P 500 companies before the end of July. Elsewhere, U.S.-listed shares of Ericsson

ERIC

are slumping on earnings disappointment. And Taiwan Semiconductor

TSM

is higher on forecast-beating results.

Tesla

TSLA

is losing its top artificial-intelligence guy, Andrej Karpathy. And taking on Elon Musk’s electric-vehicle giant, Hyundai Motor

KR:005380

has launched its first electric sedan.

Netflix

NFLX

has picked Microsoft

MSFT

as tech and sales partner for its ad-supported subscription service.

Treasury Secretary Janet Yellen says no level has been agreed yet on a Russian oil price cap proposal. She also termed inflation “unacceptably high,” and called on Congress to address prescription drug prices.

Data ahead include final June producer prices and weekly jobless claims.

Singapore and the Philippines have joined other central banks with surprise hikes, with the latter delivering a 75 basis-point increase in rates via a Facebook Live video on Thursday.

As the euro

EURUSD

continues to dangle around dollar parity, the European Union has ratcheted up inflation forecasts to 7.6% in 2022 from 6.1% and nudged down its growth forecast.

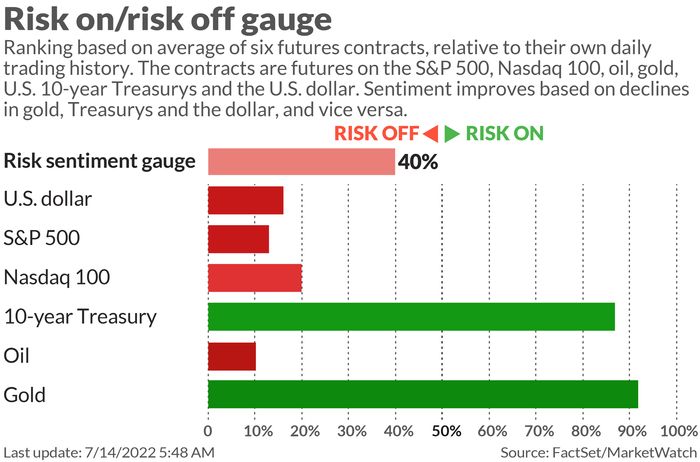

The markets

Stock futures

ES00

COMP

are lurching south, with bond yields

BX:TMUBMUSD10Y

BX:TMUBMUSD02Y

climbing, along with the dollar,

DXY,

putting the euro

EURUSD

on another parity watch. The Japanese yen

USDJPY

has shot above 139 against the buck for the first time since 1998. Elsewhere, oil

CL

is down and gold

GC00

is dropping further and bitcoin

BTCUSD

is holding at $19,948.

Read: Beleaguered crypto lender Celsius files for Ch. 11 bankruptcy

The tickers

These were the top-searched tickers on MarketWatch as of 6 a.m. Eastern:

Random reads

For 100 years, hidden behind “Head of a Peasant Women”, was Vincent van Gogh himself.

A revamp for the world’s biggest Lego store — in London — will include an 880,000 brick Tree of Discovery.

“Rowdy” by name. Meet the cat who spent three weeks on the lam at Boston’s Logan airport.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Special report: MarketWatch and Investor’s Business Daily are joining forces to identify the most trusted financial companies. Take the survey here.