The U.S. stock market’s latest leg down is spreading the pain for investors. Data from research firm Bespoke Investment Group shows just how broad-based and deep the 2022 selloff has been so far.

A 24% year-to-date drop for the broad Russell 3000

RUA,

which aims to track the 3,000 largest U.S. traded stocks, wiped out $13 trillion in market capitalization, the analysts said, with several former high flyers down more than 60% from their 52-week highs.

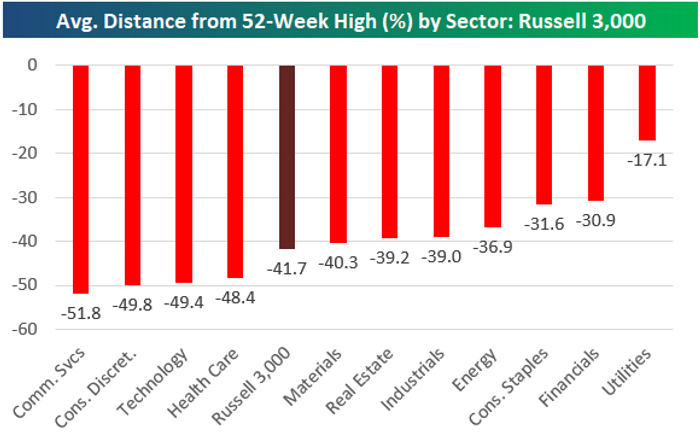

They also found the average stock was down 41.7% from its 52-week high as of Monday’s close. That means the average stock would need to see a rally of 71.5% to get back to its high.

“This is just true carnage in equities unlike anything we’ve seen since the Financial Crisis or the Dot Com bust,” the analysts wrote, referring to the bear market that accompanied the housing crisis in 2007-2009 and the bursting of the dot-com bubble in the early 2000s, respectively.

They noted that four sectors — communications services (-51.8%), consumer discretionary (-49.8%), tech (-49.4%) and health care (-48.4%) — were roughly 50% below their 52-week highs. Even energy stocks are now down 36.9% from their 52-week highs through Monday, Bespoke noted (see chart below).

Bespoke Investment Group

The Russell 3000 was holding near unchanged Tuesday, while the Dow Jones Industrial Average

DJIA,

erased a nearly 400 point gain to end with a loss of 125.82 points, or 0.4%, after falling Monday into a bear market. The S&P 500

SPX,

fell 0.2% after ending Monday at its lowest since November 2020.

While more than $13 trillion in market cap has been erased from the Russell 3000, the Bespoke analysts noted that five individual stocks have seen their market caps fall by more than $500 billion — Microsoft Corp.

MSFT,

Google parent Alphabet Inc.

GOOG,

GOOGL,

Facebook parent Meta Platforms Inc.

META,

Amazon.com Inc.

AMZN,

and Apple Inc.

AAPL,

Eighteen stocks have seen their market cap fall by more than $100 billion, including names like Tesla Inc.

TSLA,

JPMorgan Chase & Co.

JPM,

and Home Depot Inc.

HD,

while five names on the list — Meta, Nvidia Corp.

NVDA,

Netflix Inc.

NFLX,

Adobe Inc.

ADBE,

and Paypal Holdings Inc.

PYPL,

— down 60% from their 52-week highs.