Bond yields fell on Wednesday, but moves were meagre and trading was thin as the market awaited the latest gauge of U.S. inflation.

What’s happening

-

The yield on the 2-year Treasury

TMUBMUSD02Y,

3.243%

fell 4 basis points to 3.226%. Yields move in the opposite direction to prices. -

The yield on the 10-year Treasury

TMUBMUSD10Y,

2.779%

retreated 3 basis points to 2.772%. -

The yield on the 30-year Treasury

TMUBMUSD30Y,

2.994%

fell 1 basis point to 2.985%.

The 10-year to 2-year spread of minus 46 basis points means the yield remains near its most inverted in 20 years, potentially a strong signal of an economic downturn.

What’s driving markets

The U.S. consumer price index (CPI) report due at 8.30 a.m. Eastern is the main focus for fixed income investors.

Bond bulls will be hoping that the previous report covering June, which showed year-on-year CPI at a 40-year high of 9.1%, will mark the peak for headline inflation. Consensus forecasts show the headline dropping to 8.7% because of declining energy prices.

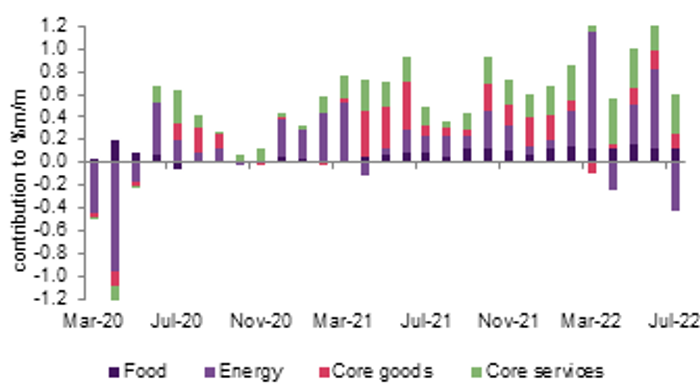

Hopes that the pace of inflation may soon start to wane have helped benchmark 10-year Treasury yields fall from roughly 3.5% in June to 2.778%. But analysts warn that the market will need to see evidence that core inflation, which strips out volatile commodities like food and energy, is also starting to satabilise for the bond rally to be maintained.

Economists forecast year-over-year core CPI will inch up from 5.9% in June to 6.1% in July.

Source NatWest Markets

Jan Nevruzi, U.S. rates strategists at NatWest Markets said that if the core figure matched economists’ forecasts then investors may price in a slightly less hawkish Fed.

“As far as market reaction goes, I think a print in line with those [forecasts] would bring the September Fed expectations closer to 50 [basis points], while anything above would raise the 2022 terminal profile by ~15-20bps, but pricing more cuts from Q2 23.”

But Nevruzi warned that such a view may be premature.

“There is more inflation data before the September meeting and a lot can change, but those sound like some potential knee-jerk reactions to me. A one-off sharp drop in CPI at this point should not mean that much to the Fed as they need to see at minimum a consistent multi-month trend to turn around, while acceleration in inflation means that a lot more has to be done on the tightening front,” Nevruzi wrote in a note to clients.

Alan Ruskin, Macro Strategist at Deutsche Bank, said in a note: “In terms of reactions, the market will initially get more excited by a downside core CPI surprise than an upside surprise, especially as it relates to risk appetite. A downside surprise plays to ‘hopes’ that an oil/food commodities peak, plus slower demand, will filter quickly into US inflation data. This is probably wishful thinking, as inflation typically lags demand by at least a year.”

Ruskin added that a softer CPI reading nevertheless will support the ‘peak inflation theme’. “It will also play to the market’s recent proclivity to buy risk dips, and will be a broad-based negative for the USD, notably versus high beta EM.”

Markets are currently pricing in a 67.5% probability that the Fed will raise interest rates by another 75 basis points to a range of 3.00% to 3.25% after its meeting on September 21st. The central bank is expected to take its borrowing costs to 3.66% by April 2023, according to Fed Funds futures.