Markets continue to absorb the reverberations from this week’s Federal Reserve policy decision. The S&P 500

SPX,

has given up a chunk of its latest rally after Chair Jerome Powell suggested it was likely borrowing costs would peak at a higher level than investors had previously thought.

The benchmark remains down 22.5% for the year. The Nasdaq 100

NDX,

replete with former tech-darlings turned outcasts, is off 35.2%.

If stocks had an anthem it would be “Heaven Knows I’m Miserable Now” by 80’s indie popsters The Smiths. Playing on a loop.

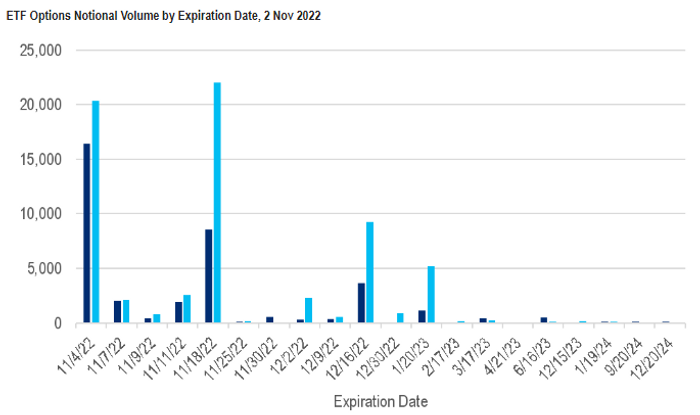

As the chart below from Citi shows, on Fed Day traders bought up piles of puts in ETFs tracking the likes of the S&P 500, Nasdaq 100 and Russell 2000, with the biggest batch expiring in just two weeks from today. Traders seem to be betting on more downside for stocks.

Source: Citi

However, this degree of negativity can provide a contrarian bullish indicator. Eventually even the pessimism is exhausted. Witness Peloton

PTON,

whose shares cratered nearly 20% to a fresh low after results on Thursday, but finished the session up 8%.

So does this mean we are ripe for another rebound? Don’t bet on it, says Citi. The bank’s global strategy team led by Jamie Fahy says investors should beware another leg lower in stocks.

“Despite some high-profile earnings misses throughout this current season, in aggregate, Q3 US earnings has been okay. With a 4% EPS surprise and 3% growth, it’s not too dissimilar a result to the prior season. Despite this, we would warn, all is not well in equities,” Fahy writes in a note to clients.

There are three main reasons for his caution.

First, and this really should not come as a surprise to anyone, the Fed is no longer the market’s friend, despite some still clinging on to the previous era of uber-loose coddling.

Powell has “failed to placate the market on its pivot dreams. As peak Fed pricing moves to a fresh high, equities are threatening to revisit the lows. Net short positioning is much cleaner now relative to 4 weeks ago,” says Fahy.

Secondly, equity market internals are what he terms “soggy.” “Despite the recent squeeze higher in the market, defensives continue to outperform cyclicals, whilst Citi’s probability of default basket remains at the lows….EPS recession is on the way, and that can add another 20% downside to the market”.

That would take the S&P 500 below 3,000, to its lowest since the spring of 2020.

Finally, it’s unlikely that seasonal tailwinds — on which many bulls are pinning their hopes — will come to the rescue.

“It might seem strange leaning short equities into a period of what has historically exhibited strong seasonal performance. But as noted by Citi quant strategists, the traditional Santa rally has not been delivered when the returns of the first 10 months of the year are negative,” Fahy says.

Citi conclude that they recommend staying short equities via S&P 500 put options.

Markets

Stocks are trying to break a four-day losing streak with the S&P 500 futures

ES00,

adding 0.7% to 3754. The dollar’s latest rally is pausing, the dollar index

DXY,

slipping 0.4% to 112.53 as sterling

GBPUSD,

and the euro

EURUSD,

nudge higher. The 2-year Treasury yield

TMUBMUSD02Y,

which is particularly sensitive to Fed policy, is barely changed at 4.73%, near its highest levels since 2007.

The buzz

It’s jobs report day again. The Fed’s Powell stressed in his comments on Wednesday, after delivering another 75 basis point rate hike, that the terminal interest rate level this tightening cycle will be determined by evidence inflation is receding notably. And the Fed reckons to achieve that the labor market will probably have to weaken.

Economists are forecasting that a net 205,000 jobs were created in the U.S. in October, down from the previous month’s 263,000. The unemployment rate is expected to stay at 3.5% and average hourly earnings growth is pinned at 0.3%, also the same as September.

PayPal’s stock

PYPL,

is down nearly 7% in premarket trading, flirting with five-year lows, after the digital payment group trimmed its revenue forecast for the full year in an after-hours statement.

Prepare for a longer wait. Starbucks

SBUX,

says “customizable beverages,” the kind ordered by someone requiring both jeans and latte to be skinny, and which are more fiddly to make, will help pick up the slack during an economic downturn. The shares were a touch higher after the coffee chain released results following Thursday’s closing bell.

Apple

AAPL,

is reportedly pausing hiring as it tightens its belt in line with other big tech groups. But at least they aren’t dumping workers en masse like Elon Musk allegedly plans to do imminently at Twitter.

Hong Kong’s Hang Seng index

HSI,

rebounded 5.4% as hopes continued to build that Beijing would soften its zero COVID-19 policy and after U.S. audit inspections of Chinese companies ended. The prospect of more China economic activity lifted U.S. oil futures

CL.1,

by 2.8% to $90.66 a barrel.

Best of the web

How long can Japan’s central bank defy global market forces.

There has to be a better way to lose $800 billion.

The world is missing its lofty climate targets. Time for some realism.

The chart

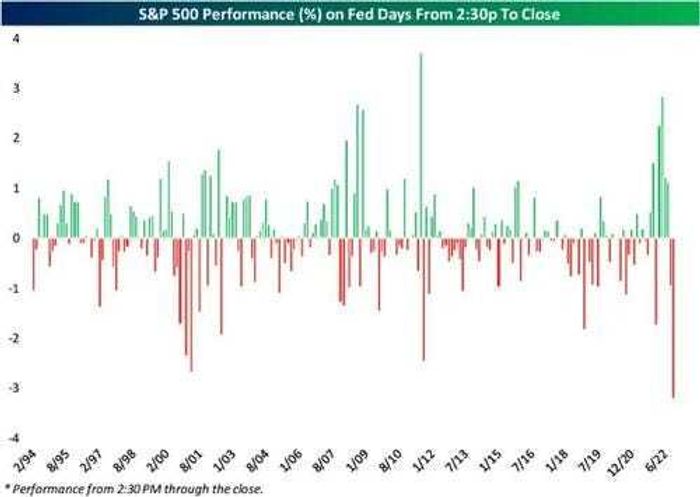

The market is still trying to regain some poise after Wednesday’s Fed-inspired reversal. Or, to be more accurate, the Powell Shellacking. That’s because it was the Fed chairman’s comments and not the Open Market Committee’s rate hike and accompanying statement that rattled traders.

The chart below shows how the S&P 500 performs in the final 90 minutes of action on Fed Day – in other words from 2:30 p.m. Eastern when Powell starts his press conference. The reaction to Powell’s latest chatter was the worst ever. If the Fed chair really does want a falling stock market to help in his battle against inflation then he just has to keep talking.

Source: Bespoke Investment

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security name |

|

TSLA, |

Tesla |

|

GME, |

GameStop |

|

NIO, |

NIO |

|

AAPL, |

Apple |

|

AMC, |

AMC Entertainment |

|

AMZN, |

Amazon |

|

MULN, |

Mullen Automotive |

|

BBBY, |

Bed Bath & Beyond |

|

BABA, |

Alibaba |

|

APE, |

AMC Entertainment preferred |

Random reads

Profiles in Ignorance – are America’s politicians getting dumber?

High temperatures can make planes too heavy for take off.

The Taylor Swift economy stretches to caskets.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton