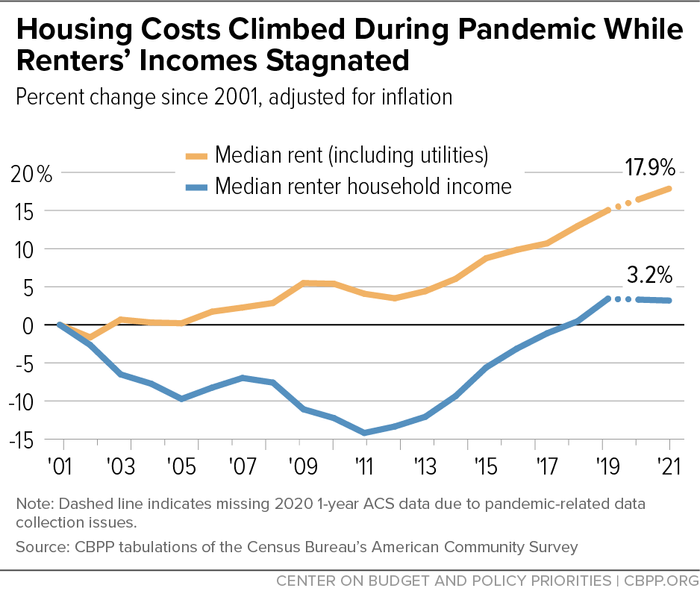

For years, there’s been a gap between renters’ housing costs and their incomes. And it got even worse during the pandemic, when rents soared and earnings stagnated.

That’s according to a recent report from Peggy Bailey, vice president for housing policy at the Center on Budget and Policy Priorities, a nonpartisan research and policy group.

Since 2001, median rent including utilities has increased by 17.9% while median renter household income has received a mere 3.2% bump when adjusted for inflation, the report said.

“These higher rents are especially hard for families with the lowest incomes to absorb,” Bailey wrote. “Closing the housing-affordability gap will require a comprehensive housing strategy, including developing new units, preserving existing affordable housing, and expanding rental assistance.”

Center on Budget and Policy Priorities

(Bailey, the center’s vice president for housing policy, also previously worked in the Biden administration as a senior advisor on rental assistance to Housing and Urban Development Secretary Marcia Fudge.)

In her report, Bailey said the most immediate solution would be to bump up funding for the Housing Choice Voucher Program — often referred to as “Section 8” among tenants — which the Biden administration has also advocated for.

President Biden’s fiscal year 2023 Department of Housing and Urban Development budget asked for $1.6 billion for 200,000 additional vouchers, for example. A House-passed Transportation-HUD spending bill, meanwhile, would help up to 140,000 families, Bailey said.

Increasing vouchers for tenants to rent in the private market would broaden their choices and potentially reduce segregation, Bailey said.

“‘Without rental subsidies, families are at risk of the negative outcomes caused by housing instability such as eviction, homelessness, and frequent moves.’”

“Without rental subsidies, families are at risk of the negative outcomes caused by housing instability such as eviction, homelessness, and frequent moves,” Bailey said. “The overwhelming research on the voucher program shows that the gains for families far outweigh concerns about impact on the housing market.”

Landlords, however, don’t always want to participate in the program, much to the distress of some tenants. The National Apartment Association, a trade group, has said that the voucher program’s potential success is stymied by inefficiencies and duplicative requirements, and that the government should work to appeal to housing providers.

In addition to greater funding for the voucher program, Bailey also said strategies to reduce the affordability gap could include expanding the capacity of the low-income housing tax credit to increase affordable housing development, while boosting funds for other affordable housing programs that could bring more units to the market.

Down-payment assistance for first-time homebuyers and preserving the federally assisted — but privately owned — housing stock would also address the affordability gap, among other measures, Bailey said.