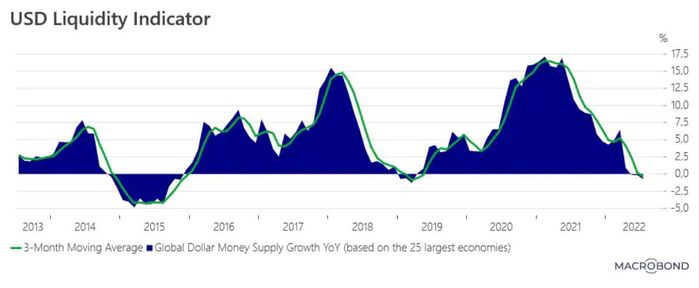

Global dollar liquity is probably the most important driver for global financial markets. Yet it’s also largely overlooked and, in a cautionary sign for markets, on the decline.

That’s according to Christopher Dembik, head of macroeconomic research at Saxo Bank. who notes the dollar liquidity is contracting for the first time since early 2019. “Usually, this is a synonym of market turmoil and higher risk aversion,” he said in a note to clients that published Tuesday.

Given it’s a dollar-based world, liquidity for that currency “serves as a key driver of the global economy and financial markets,” he said. Since mid-2021, it has slowly begun to decrease, but liquidity was still plentiful up to the recent crisis in U.K. financial markets.

“The liquidity issue on the U.K. bond market, which triggered an emergency intervention from the Bank of England, is one example of what may happen in the coming months if liquidity, especially U.S. dollar liquidity, is scarce,” said the analyst.

Saxo Bank

There have been two previous instances of crisis linked to dollar liquidity — in 2015, when China devalued its currency and in early 2019, during the stress of the China-U.S. trade war. In both cases, markets experienced emerging-market turmoil, deteriorating financial conditions and higher U.S. dollar funding costs.

“But there is one major difference compared to 2015 and 2019, there was no inflation at the time. It is now the single one major issue for policymakers,” said Dembik.

With inflation still not having peaked in many countries, outside of the U.S., central banks will have no choice but to keep tightening and normalizing policy, he said.

“This means that U.S. dollar liquidity will continue to fall in the short-term. It will have a net negative impact on financial markets, especially the equity segment, and the global economy,” he warned.

The dollar has been in high demand this year as investors have juggled concerns over central bank tightening, higher inflation and geopolitical tensions. The ICE Dollar Index

DXY,

has climbed nearly 18%.

Read: U.K. 30-year bond yields breach 5% after Bank of England stresses support will stop at end of week