The current bear market may be painful, but history indicates it may need to fall further to clear the way for a meaningful recovery, said analysts at Jefferies.

Stocks have bounced modestly in July, but remain down sharply for the year to date. The S&P 500

SPX,

entered a bear market in June, marking a 20% decline from its early January record close. The large-cap benchmark remains down more than 19% for the year to date, while the Nasdaq Composite

COMP,

has declined more than 27% and the Dow Jones Industrial Average

DJIA,

has shed 14%.

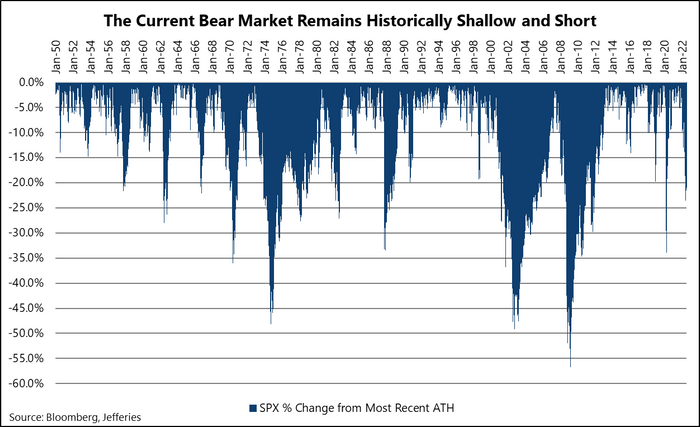

“While there isn’t really a point to reiterating how painful year-to-date price action has been, we did think that it would be worthwhile to reiterate how it stacks up historically: not terribly deep and still short-lived,” the analysts said in a Saturday note.

“For example, while the current drawdown is deeper than the one we saw in ’18, it’s still several weeks shorter. Notably, for S&P 500 bear markets that didn’t reach -25%, the average amount of days until the next all-time-high was 568 trading days…far more than the current duration of 131 days,” they said. “So despite extremely low sentiment readings, we are still churning around ‘no man’s land.’” (See chart below.)

SOURCE: BLOOMBERG, JEFFERIES

The June consumer-price index came in hot last Wednesday with the year-over-year increase of 9.1%, reaching a 41-year high as gasoline prices surged. Data on Friday showed U.S. consumers boosted retail spending in June by a solid 1% in light of the stickier inflation and uncertain economic forecasts.

According to Jefferies, the markets found a way to digest the massive inflation reading and corporate earnings, but the fact that consumers and companies haven’t acted like a recession is near could prolong the current market dynamic.

The June quarter reporting season is entering its second week with Goldman Sachs

GS,

posting a stronger-than-expected profit this morning, yet its earnings fell from a year ago. Bank of America Corp.

BAC,

along with other Wall Street megabanks such as Wells Fargo & Co.

WFC,

and JP Morgan Chase

JPM,

fell short of analyst expectations.

Read more: The stock market’s next big rally might just be a bear in bull’s clothing

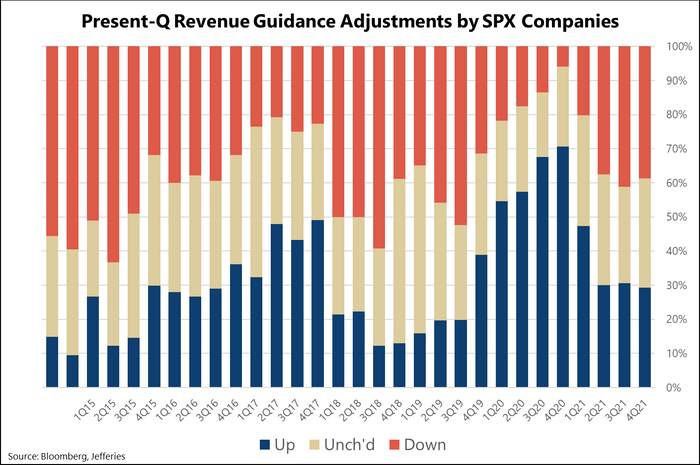

“2Q Sales guidance changes look even more normal from the historical perspective, with just 39% of companies who have issued a tweak making it a decrease,” wrote Andrew Greenebaum at Jefferies’ Equity Product Management in the report (see chart below). “Given still strong consumption and the difficult cost environment, the dichotomy between the top and bottom lines makes some sense. But it also highlights the fact that we haven’t really seen the type of pervasive lack of optimism on the corporate side that typically provides a proper reset for stocks.”

SOURCE: BLOOMBERG, JEFFERIES

“And while market participants may be tiring of the prolonged plunge, it actually hasn’t been either very long nor remarkably deep,” according to Greenebaum. “We last made a new high 131 days ago, and even the 2H18 slide lasted 145 sessions. As we suggested when we first offered the analysis in May, the S&P may need to break down substantially further to actually spark a real recovery trade, no matter the recession timing.”

Read more: Stock investors are still in danger, but history says bear markets are relatively brief