Hello! In this week’s ETF Wrap, I spoke with BlackRock’s U.S. head of bond ETFs, Steve Laipply, and also caught up with Invesco’s John Hoffman, the firm’s head of ETFs and indexed strategies for the Americas.

Please send feedback and tips to [email protected]. You can also follow me on Twitter at @cidzelis and find me on LinkedIn.

Investors this year have been pouring capital into BlackRock’s iShares exchange-traded funds that buy U.S. Treasurys, as 2022’s climb in bond yields opens up alternatives to stocks and riskier credit.

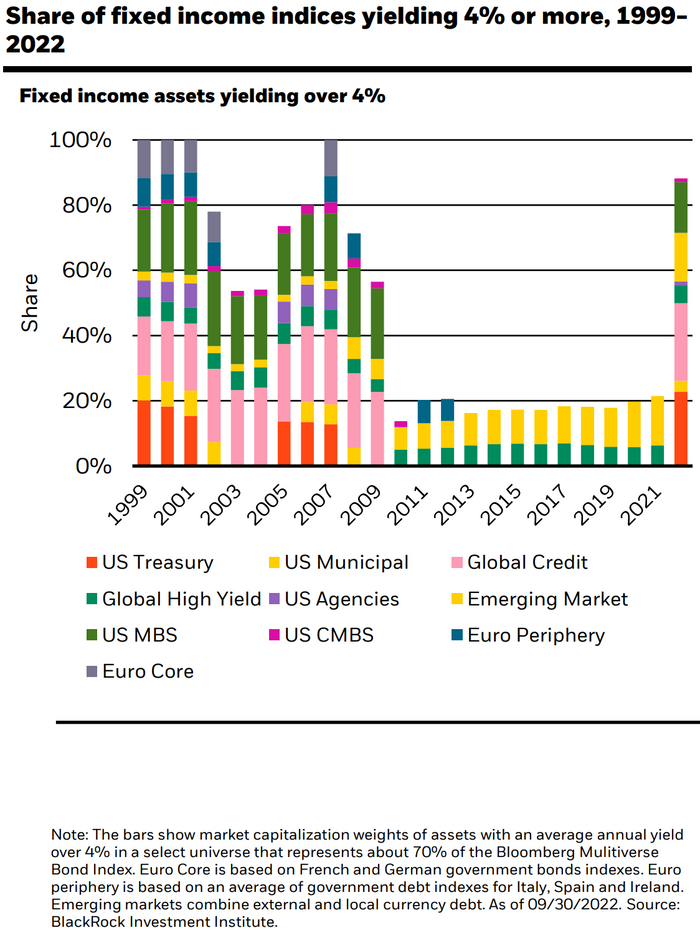

For the first time in 15 years, almost 90% of fixed-income indexes were yielding more than 4% at the end of September, according to BlackRock. “Investors now are looking at these yield levels and making an assessment that they can actually derisk their portfolios relative to where they’ve been,” said Steve Laipply, BlackRock’s U.S. head of bond ETFs, in a phone interview.

“For many, many years, to achieve certain yield targets, investors had to take on a fair amount of risk,” said Laipply. “They probably took on more equity risk than they normally would,” while also taking on “more credit risk relative to decades past.”

But bond yields have jumped in 2022 as the Federal Reserve tightens its monetary policy by raising its benchmark interest rate at an aggressive pace in an effort to tame surging inflation. That has created steep losses for investors this year, as bond prices fall as yields rise, but investors now can find rates of more than 4% across several areas of fixed income, including U.S. Treasurys, according to BlackRock.

SOURCES: BLACKROCK INVESTMENT INSTITUTE

“It gives investors the ability to construct portfolios with more degrees of freedom, with a better risk profile than they were able to do even a few years ago, just by bringing fixed income more firmly back into the fold,” said Laipply.

The yield on the two-year Treasury note

BX:TMUBMUSD02Y

rose Thursday to a new peak this year of 4.608%, the highest since Aug. 8, 2007, based levels at 3 p.m. Eastern, according to Dow Jones Market Data. Ten-year Treasury yields

BX:TMUBMUSD10Y

also carved out a new 2022 high on Thursday, climbing 9.8 basis points to 4.225%, the highest level since June 17, 2008.

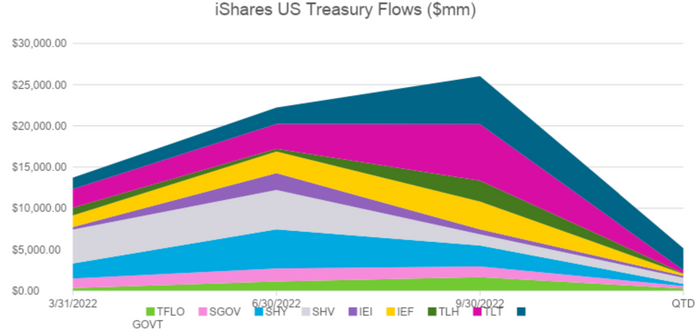

iShares bond ETF flows

About $67 billion of the roughly $80 billion of capital flowing into iShares bonds ETFs this year has targeted U.S. Treasurys, according to Laipply, citing data as of Oct. 18. He described “the big theme” in the iShares flow data as investors’ preference for “high-quality fixed income.”

Investors have expressed interest across the yield curve in the U.S. Treasury market, he said.

The iShares 20+ Year Treasury Bond ETF

TLT

has seen the largest inflows among iShares U.S. Treasury-focused exchanged-traded funds this year, attracting around $12.5 billion, according to BlackRock data as of Oct. 18.

The iShares U.S. Treasury Bond ETF

GOVT

has captured the second-largest inflows at BlackRock this year, with about $11.9 billion, while the iShares Short Treasury Bond ETF

SHV,

which provides exposure to ultra-short-term U.S. debt securities, took in the third-largest inflows at $11 billion.

The chart below also tracks flows captured this year by the iShares Treasury Floating Rate Bond ETF

TFLO,

iShares 0-3 Month Treasury Bond ETF

SGOV,

iShares 1-3 Treasury Bond ETF

SHY,

as well as the iShares 3-7 Year Treasury Bond ETF

IEI,

iShares 7-10 Year Treasury Bond ETF

IEF

and the iShares 10-20 Year Treasury Bond ETF

TLH.

BLACKROCK

Each of the nine ETFs has seen inflows so far this quarter, with the iShares U.S. Treasury Bond ETF, the iShares Short Treasury Bond ETF and the iShares 20+ Year Treasury Bond ETF leading the pack, according to BlackRock’s data as of Oct. 18.

Beyond Treasurys, iShares ETFs that buy municipal debt saw $9.4 billion of inflows this year through Oct. 18, while investment-grade credit took in $7.1 billion, according to BlackRock. By contrast, iShares investors have withdrawn $8.1 billion from high-yield bonds, a risky form of corporate credit, amid heightened concern over a potential recession.

‘All sorts of possibilities’

Meanwhile, Invesco has seen “repositioning” within its fixed-income lineup in 2022, with investors gravitating toward “the shorter end of the curve” as the Fed raises rates, according to John Hoffman, head of ETFs and indexed strategies for the Americas at Invesco.

For example, the firm has seen a pickup in interest in the Invesco Bulletshares 2023 Corporate Bond ETF

BSCN,

the Invesco Bulletshares 2024 Corporate Bond ETF

BSCO

and the Invesco Bulletshares 2025 Corporate Bond ETF

BSCP,

he said.

While the Fed’s aggressive monetary tightening has been painful to bond investors, the higher rates have opened up “all sorts of possibilities in terms of having a much more diversified portfolio with lower risks,” according to BlackRock’s Laipply.

“There has been this huge repricing where investors are now able to get yield that they have not seen in many, many years” within fixed income, he said.

As usual, here’s your look at the top- and bottom-performing ETFs over the past week through Wednesday, according to FactSet data.

The good…

| Top performers | %Performance |

|

AdvisorShares Pure US Cannabis ETF MSOS |

4.7 |

|

U.S. Global Jets ETF JETS |

4.4 |

|

VanEck Oil Services ETF OIH |

4.0 |

|

SPDR S&P Aerospace & Defense ETF XAR |

3.4 |

|

Invesco Aerospace & Defense ETF PPA |

3.2 |

| Source: FactSet data through Wednesday, Oct. 19, excluding ETNs and leveraged products. Includes NYSE, Nasdaq and Cboe traded ETFs of $500 million or greater. |

…and the bad

| Bottom Performers | %Performance |

|

Goldman Sachs MarketBeta U.S. 1000 Equity ETF GUSA |

-8.7 |

|

ETFMG Prime Junior Silver Miners ETF SILJ |

-5.7 |

|

KraneShares CSI China Internet ETF KWEB |

-5.6 |

|

VanEck Junior Gold Miners ETF GDXJ |

-5.2 |

|

Global X Silver Miners ETF SIL |

-4.9 |

| Source: FactSet |