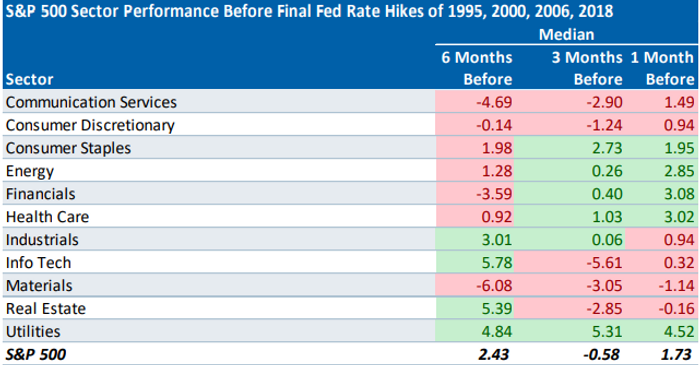

While hopes for a pivot by Federal Reserve policy makers away from aggressive rate increases appeared to once again be a mirage, investors remain eager to know which stock-market sectors tend to perform best in the period leading up to the final increase of a rate-hike cycle, according to a top strategist at RBC Capital Markets.

Stocks in classic defensive sectors such as consumer staples, healthcare, and utilities, tend to outperform ahead of the final rate hikes, along with energy and financials, said Lori Calvasina, head of U.S. equity strategy at RBC Capital Markets, in a Monday note.

All five of these areas have outperformed the S&P 500

SPX,

in 2022 on a year to date basis. They tended to perform the best within the major index in the six, three and one month periods before the final hikes in the past four Fed tightening cycles (see chart below), Calvasina wrote.

“However, consumer staples and utilities have faded recently with utilities lagging over the past month and staples underperforming since late September,” she said. “Healthcare has been the strongest performer of late among the classic defensives over the past month, lagging only energy whose performance has far outstripped the benchmark. Financials has also outperformed a bit.”

SOURCE: RBC US EQUITY STRATEGY, BLOOMBERG

The S&P 500 is down 24.6% year to date, according to Dow Jones Market Data. Except the energy sector, which had jumped 46.4% year over year, all other sectors are trading deep in the red so far in 2022.

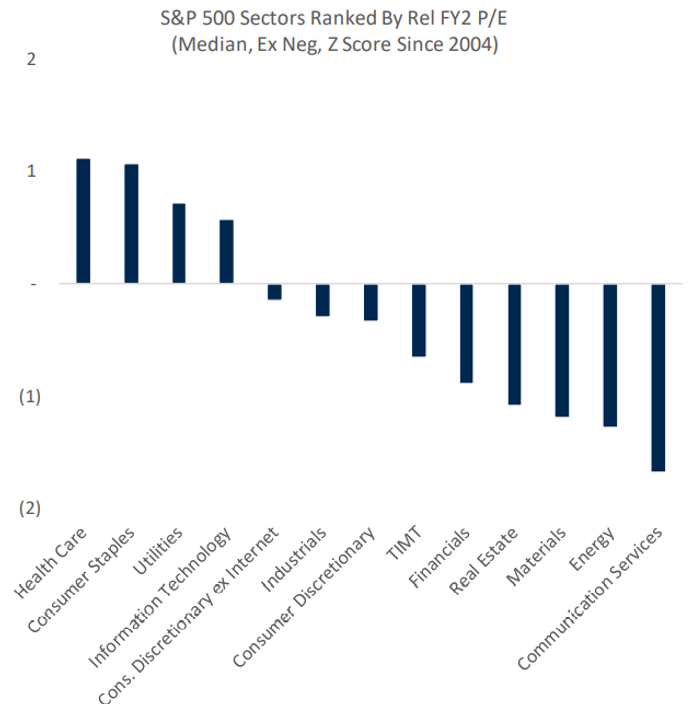

Stocks in consumer staples and utilities have been “extremely expensive” based on RBC’s valuation, with their median price-earnings ratio close to historical peaks relative to the S&P 500 earlier this year. Meanwhile, healthcare has been the only defensive sector that is “reasonably valued” on their valuation model, and as of Friday’s close, energy and financials sectors looked “deeply undervalued,” according to Calvasina.

“To the extent that the narrative in the equity community swings back towards the idea that an end to the hiking cycle can be expected in the not so distant future, we think energy and financials are the most interesting ways to position for that idea,” said Calvasina.

SOURCE: RBC US EQUITY STRATEGY, BLOOMBERG

Despite the recent turmoil in the large-cap equity market, small-caps remain stable in terms of performance. Calvasina pointed out the stability in small-cap performance has been present since January and they are still in a narrow trading range in comparison to large-caps.

“While this doesn’t necessarily tell us that a bottom in the broader U.S. equity market is imminent, it does tell us that the equity market is behaving rationally,” said Calvasina. “It has been our view for quite some time that small-caps, which underperformed large-cap dramatically in 2021, have already been de-risked and are baking in a recession.”

The U.S. stock indexes extended losses on Monday as investors still digested September jobs data while eagerly await key earnings, Fed minutes and inflation reports this week. The S&P 500 was off 0.4%, while the Dow Jones Industrial Average

DJIA,

declined 0.2%. The Nasdaq Composite

COMP,

was off 0.7%, after falling to over a two-year low, dragged down by a slump in semiconductor stocks.