Hi! In this week’s ETF Wrap, you’ll see how badly long-duration bonds have fared relative to other assets as investors look for places to hide in a brutal year for markets.

Please send feedback and tips to [email protected]. You can also follow me on Twitter at @cidzelis and find me on LinkedIn.

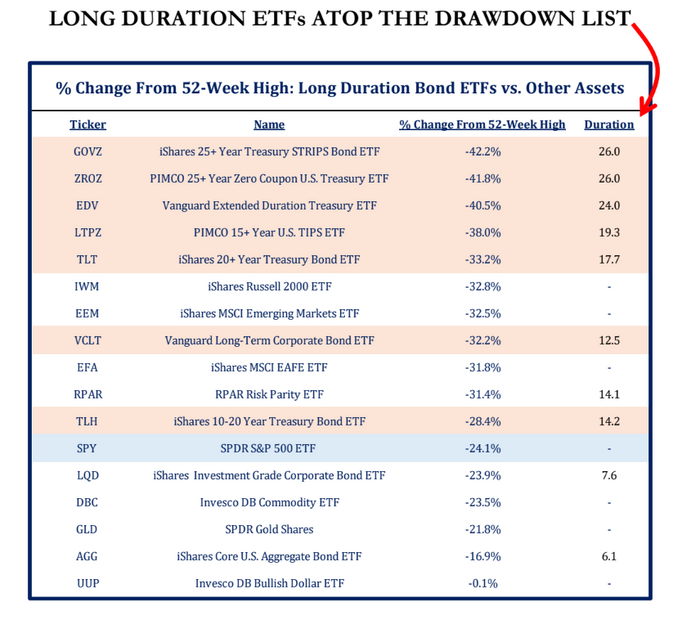

Investors have piled into long-duration fixed income ETFs this year, even as steep drawdowns since their peaks over the past year have exceeded slides seen in other major asset classes, Strategas research found.

The iShares 25+ Year Treasury STRIPS Bond ETF

GOVZ

topped the list of long-duration bond ETFs suffering massive drops from their 52-week highs, a Sept. 27 Strategas note shows. That fund, along with the PIMCO 25+ Year Zero Coupon U.S. Treasury ETF

ZROZ

and the Vanguard Extended Duration Treasury ETF

EDV,

have all plunged more than 40% from their 52-week peaks, according to the note.

STRATEGAS NOTE DATED SEPT. 27, 2022

The top five biggest declines among long-duration bond ETFs listed by Strategas, including the PIMCO 15+ Year U.S. TIPS ETF

LTPZ

and iShares 20+ Year Treasury Bond ETF

TLT,

exceeded losses seen in funds focused on small-cap stocks, emerging-market equities and the S&P 500.

For example, the iShares Russell 2000 ETF

IWM

dropped 32.8% from its 52-week high, while the iShares MSCI Emerging Markets ETF

EEM

was down 32.5% and the SPDR S&P 500 ETF

SPY

slid about 24.1%, according to the note.

“That’s painful,” said Todd Sohn, ETF strategist at Strategas, in a phone interview.

“If you think interest rates are going to rise, you want to avoid long-duration funds basically at all cost,” he said. “Duration is your sensitivity to moves in interest rates, and so the larger the move in interest rates, the more longer-duration funds will be hit harder.”

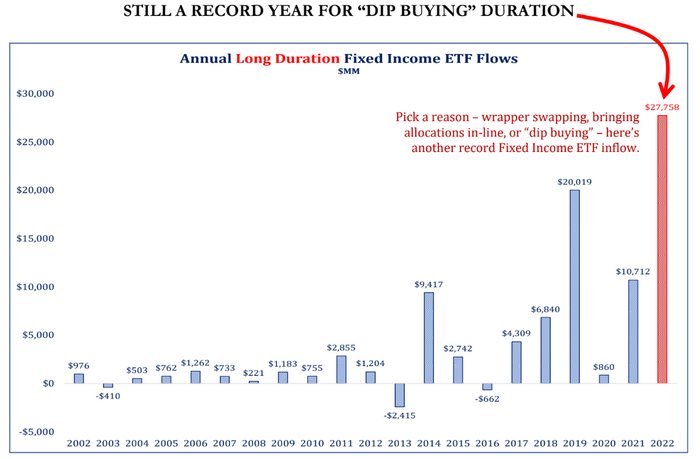

But investors appeared to be buying the dip in duration this year, according to Strategas.

STRATEGAS NOTE DATED SEPT. 27, 2022

Markets have been battered by soaring inflation and rising interest rates, with increasing concerns that the Federal Reserve’s monetary tightening will trigger a recession. Volatility in the stock market has climbed to elevated levels, with investors continuing to look for safe havens.

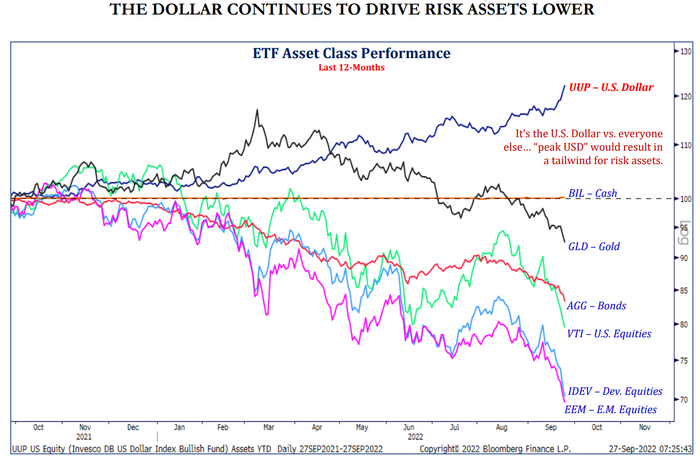

The U.S. has looked good relative to other economies, said Sohn.

Beyond the U.S., the Bank of England this week announced a surprise bond-buying program, intervening to help stabilize markets after the British pound sank and its government bond yields jumped in the wake of its tax cut plan. Europe has been dealing with an energy crisis amid Russia’s war on Ukraine, while Japan intervened earlier this month to support its currency.

Meanwhile, the U.S. dollar has soared, with the Invesco DB Bullish Dollar ETF off a mere 0.1% from its 52-week high, according to the Strategas note. By contrast, gold and commodities ETFs have plunged more than 20% from their peaks in the past year, the note shows.

“The only thing that’s really working is the dollar,” said Sohn. It’s been “a defensive haven.”

The Invesco DB Bullish Dollar ETF

UUP

has outperformed exchange-traded funds focused on cash, gold, bonds and stocks over the past year, including the SPDR Bloomberg 1-3 Month T-Bill ETF

BIL,

SPDR Gold Shares

GLD,

the iShares Core U.S. Aggregate Bond ETF

AGG,

Vanguard Total Stock Market ETF

VTI

and iShares Core MSCI International Developed Markets ETF

IDEV,

according to the Strategas note.

STRATEGAS NOTE DATED SEPT. 27, 2022

“If you’re going to start to play dollars here you have to keep a tight leash because it’s very overbought, just technically speaking,” said Sohn. “Momentum is great, but I think if you’re going to finally buy,” he said, “it’s from an extended position.”

Stock-market volatility has risen this week, with the CBOE Volatility Index

VIX

at around 30 on Wednesday, according to FactSet data. That was up from its 50-day moving average of around 24.

The index, known as the VIX, has soared about 75% this year through Wednesday as stocks and bonds sank, FactSet data show.

Sohn cautioned that VIX-related ETFs, such as the ProShares VIX Short-term Futures ETF, are “difficult” to use and shouldn’t be held for very long at all.

“They’re really just timing tools and timing volatility can be extremely difficult,” he said.

“You have to get both sides of the trade right,” explained Sohn. That means the entry, or “pre-volatility,” he said, “and then you have to get the exit correct, all within the space of a few days because they decay over time the way the products are structured.”

Shares of the ProShares VIX Short-Term Futures ETF

VIXY

fell 4.1% Wednesday for gains so far in 2022 of 7.2%, according to FactSet data. The ProShares VIX Mid-Term Futures ETF

VIXM

slipped 1.6% that same day, bringing its gains this year to 13.6%.

“VIXY and VIXM have performed as designed,” ProShares said in a statement emailed by a spokesperson for the firm. “These ETFs are benchmarked to indices tied to VIX futures, not the VIX, which relates to expected volatility during a different period and should be expected to perform differently.”

Simeon Hyman, global investment strategist and head of the investment strategy group at ProShares, said by phone that the “knife edge” that’s driving a lot of the uncertainty faced by investors is whether the U.S. economy has a “soft landing” as the Fed fights inflation.

“Our favorite equity strategy in this environment is, hands down, dividend growth,” said Hyman.

The ProShares S&P 500 Dividend Aristocrats ETF

NOBL

rose 1.7% Wednesday, paring its losses so far this year to 16.1%, according to FactSet data. The S&P 500 has seen steeper losses in 2022, tumbling about 22% through Wednesday.

“One of the best ways to identify the best odds of growth, particularly in a tough market, is dividend growth,” said Hyman. “I think there’s reason for optimism in the U.S., certainly on a relative basis compared to the rest of the world.”

As usual, here’s your look at the top and bottom performing ETFs over the past week through Wednesday, according to FactSet data.

The good…

| Top performers | %Performance |

|

SPDR S&P BIOTECH ETF XBI |

4.0 |

|

ARK Genomic Revolution ETF ARKG |

3.8 |

|

ARK Innovation ETF ARKK |

3.6 |

|

WisdomTree Cloud Computing Fund WCLD |

3.5 |

|

Global X Cloud Computing ETF CLOU |

2.7 |

| Source: FactSet data through Wednesday, Sept. 28, excluding ETNs and leveraged products. Includes NYSE, Nasdaq and Cboe traded ETFs of $500 million or greater. |

…and the bad

| Bottom performers | %Performance |

|

iShares Mortgage Real Estate ETF REM |

-13.4 |

|

WisdomTree Emerging Markets High Dividend Fund DEM |

-9.2 |

|

iShares Emerging Markets Dividend ETF DVYE |

-9.0 |

|

iShares MSCI Brazil ETF EWZ |

-9.0 |

|

AdvisorShares Pure US Cannabis ETF MSOS |

-8.0 |

| Source: FactSet |

New ETFs

-

John Hancock Investment Management announced Sept. 28 that it was offering the John Hancock U.S. High Dividend ETF

JHDV,

an actively managed fund that invests in dividend-paying, large- and mid-cap stocks in the U.S. - Putnam Investments said Sept. 28 that on Friday it would launch the Putnam BDC Income ETF (PBDC) to invest in business development companies and the Putnam BioRevolution ETF (SYNB) to provide exposure to companies that seek to benefit from the “convergence of technological developments in the life sciences sector.”

- Charles Schwab Asset Management announced Sept. 28 it was launching the Schwab Municipal Bond ETF (SCMB), with trading expected to begin on or about Oct. 12.