Exchange-traded funds tracking U.S. equity benchmarks have highlighted a split in the market created by struggling technology stocks, with the Nasdaq at a potential inflection point relative to the S&P 500 index, according to Bespoke Investment Group.

The tech-heavy Invesco QQQ Trust

QQQ,

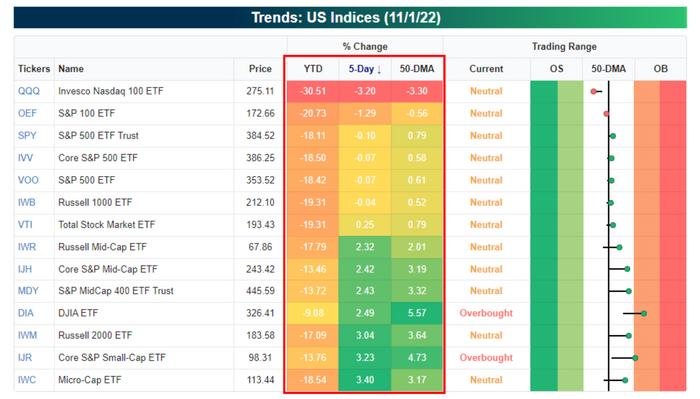

which tracks the Nasdaq 100, is the only major U.S. index ETF that remains “meaningfully” below its 50-day moving average, Bespoke said in an emailed note Wednesday. “After giving up all of its post-COVID outperformance versus the S&P 500, the Nasdaq’s decade+ uptrend in relative strength appears to be at a key inflection point.”

The U.S. stock market has tumbled in 2022 as the Federal Reserve hiked interest rates to combat high inflation. Growth and technology stocks have been particularly hurt by the increases.

Trading over the past five days has been “somewhat of a microcosm of the trend” seen this year in the performance of U.S. equity indexes, according to the note. So far this year, “QQQ is easily the worst performer of the major index ETFs with a drop of 30.5%,” the firm said.

Invesco’s Nasdaq-100 ETF (QQQ) is down 3.2% over the last week, while the S&P 500 is “flat” and indexes such as the Dow Jones Industrial Average

DJIA,

the S&P MidCap 400, and the small-cap-focused Russell 2000 are all up more than 2%, according to the note.

BESPOKE INVESTMENT GROUP

Among major U.S. index ETFs, the SPDR Dow Jones Industrial Average ETF Trust

DIA,

has been the best performer so far this year with a drop of less than 10% as of Nov. 1, the Bespoke chart shows. While QQQ is “materially” below its 50-day moving average, the ETF tracking the Dow is now around 5.5% above its moving average over that same period and well into “overbought” territory, the firm wrote.

U.S. stocks closed sharply lower Wednesday, as investors assessed the central bank’s statement on rate hikes and remarks made by Fed Chair Jerome Powell during his press conference that followed its release. The Dow fell 1.5%, while the S&P 500

SPX,

slid 2.5% and Nasdaq Composite

COMP,

dropped 3.4%, according to Dow Jones Market Data.

The Fed decided to hike its benchmark rate by three-quarters of a percentage point, a fourth straight jumbo increase of that size, to a targeted range of 3.75% to 4%. That’s the highest level in 15 years, with the Fed closely watching for signs of the rapid rise in borrowing costs potentially damaging the economy.

Read: Fed approves another jumbo interest-rate hike, but also signals go-slower strategy

The Dow, a blue-chip gauge of the stock market, is coming off its best October ever, rising 14% for its best monthly percentage gain since 1976, according to Dow Jones Market Data. The Dow’s relative outperformance was seen in ETFs tracking U.S. stock indexes Wednesday.

Invesco QQQ Trust finished 3.4% lower Wednesday, while the SPDR Dow Jones Industrial Average ETF Trust fell 1.5% and the SPDR S&P 500 ETF Trust

SPY,

dropped 2.5%, according to FactSet data. Meanwhile, the SPDR S&P Midcap 400 ETF Trust

MDY,

slid 2.9% and the iShares Russell 2000 ETF

IWM,

sank 3.3%.

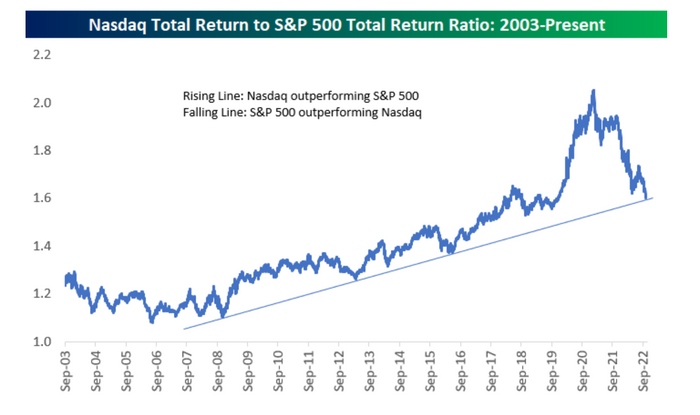

Bespoke also studied Nasdaq’s total return relative to the S&P 500’s index over the past two decades.

“Coming out of the Financial Crisis in early 2009, the Nasdaq experienced basically a decade of steady outperformance through 2019,” the firm said. “After COVID hit in early 2020, the Nasdaq’s outperformance went into overdrive for the next 12 months before peaking in early 2021.”

Since that peak, the Nasdaq’s outperformance has completely reversed, according to its note, which highlights a potential “inflection point” for the benchmark relative to the S&P 500.

BESPOKE INVESTMENT GROUP

As of Nov. 1, “the Nasdaq had given back ALL of its post-COVID outperformance and then some, taking the ratio back to December 2019 levels,” Bespoke wrote. “Currently, the ratio sits right at the bottom of the uptrend channel that formed off the Financial Crisis lows.”