U.K. house prices fell at its fastest rate in October in 21 months, after mortgage rates soared in reaction to the ill-fated mini budget.

According to the latest data from one of the U.K.’s biggest mortgage lenders, Halifax, house prices in the U.K. declined by 0.4%, the third consecutive fall in four months and faster than the 0.1% recorded in September.

Halifax Mortgages director Kim Kinnaird said “there’s no doubt the housing market received a significant shock as a result of the mini-budget which saw a sudden acceleration in mortgage rate increases.”

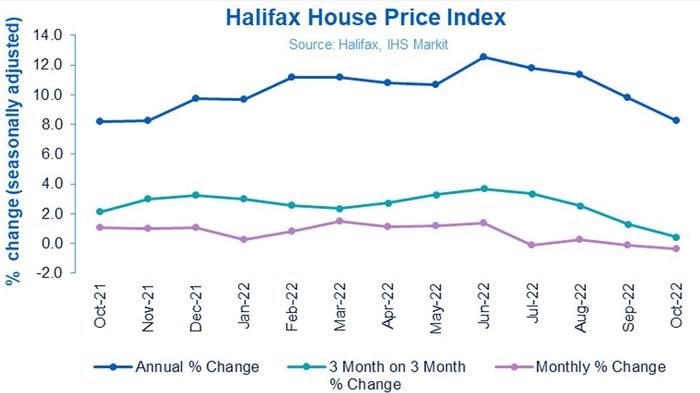

Halifax U.K House Price Index October 2022

Halifax, IHS Market

Fixed rates on mortgages hit their highest since 2008 in the wake of the mini-budget, that ultimately led to the resignations of both Chancellor Kwasi Kwarteng and then Prime Minister Liz Truss.

According to the Bank of England, average two-year fixed rates (with a 75% LTV) hit 6.01% at the end of October, shooting up from 4.17% at the end of September. This time last year, the rate was 1.29%.

Average five-year fixed rates (with a 75% LTV) increased from 3.96% in September to 5.61% in October 2022. Last October, the rate stood at 1.3%.

Read: Here’s One Way to Profit From Higher Mortgage Rates

“While it is likely that those rates have peaked for now – following the reversal of previously announced fiscal measures – it appears that recent events have encouraged those with existing mortgages to look at their options, and some would-be homebuyers to take a pause,” Kinnaird added.

The latest Bank of England figures show the number of mortgages approved fell by 10.3% in September to 66,789. Year-on-year, that figure is 7.3% below the same period last year.

The market is continuing to cool as annual price growth has been pulled down from 9.8% to 8.3%. This means the average U.K. property now costs £292,598 ($335,072), down from £293,664 last month.