Today’s highlight will be the release of the consumer price index, which could show inflation hitting a four-decade high. But for now, let’s look further out into the future — okay, Thursday — when second-quarter earnings season begins.

Make what you will of summer price action, but nothing has quite seen highs and lows over the last two months like the energy sector. Up as much as 66% as recently as June 8, the Energy Select Sector SPDR ETF

XLE

has dropped so much that it now is trading more or less where it stood before Russia invaded Ukraine. In fact, the ETF has seen the second-highest outflows of any equity fund — $1.87 billion — over the last month, according to FactSet data. The proverbial macro tourists have come and gone.

Of course, the ETF, whose holdings include Exxon Mobil

XOM,

Chevron

CVX

and EOG Resources

EOG,

has traded almost exactly in line with the direction of crude prices. But perhaps investors have fled too quickly. Maxwell Grinacoff, an equity strategist at French bank BNP Paribas, says the value space is looking compelling heading into second-quarter earnings season. Granted, there are some value traps right now, given that both corporate and macroeconomic commentary suggest that consensus earnings estimates are too high. “Energy though is the one sector where we do have more confidence, and is seeing strong earnings momentum heading into Q2 earnings,” he says.

Energy, industrials and utilities are seeing the strongest earnings momentum — that is, analysts lifting rather than cutting their estimates on earnings. The bank is more pessimistic toward techs, even with the recent relief on the bond yield front. “We think it is too early to see rotation back into growth given the potential further rolling over in the ‘E’ in the Nasdaq 100 P/E multiple,” he said, referring to earnings.

One other trend of note is that while homebuilders are to no surprise struggling as interest rates have jumped, regional banks — also correlated to the housing market — have held up.

The buzz

The CPI report is due at 8:30 a.m. Eastern, and expected to show a 1.1% surge in prices to stretch the year-over-year rise to 8.8%. Core CPI, which excludes food and energy, is expected to show a slight easing to 0.5% from 0.6%. Strategists at TD Securities say the headline number will be boosted by rising gasoline prices and still-strong food prices, and for shelter inflation to offset a retreat in airfares for the first time this year and a continued drop in used vehicle prices.

The Bureau of Labor Statistics said a release circulating on the internet purporting to show an even stronger spike in CPI than expected was a fake.

The Fed’s Beige Book of economic anecdotes is due at 2 p.m. The International Monetary Fund late Tuesday cut its estimate for U.S. growth for the second time in two months, moving down to 2.3% from 2.9%. A new Fed paper estimates the probability of recession by the end of next year to be 35% — which it said was consistent with the 1994 soft-landing scenario.

Twitter

TWTR

as expected sued Elon Musk for seeking to terminate the $44 billion acquisition, saying the world’s richest person has “cast a pall over Twitter and its business.”

Alphabet’s Google

GOOGL

plans to scale back hiring this year, Bloomberg News reported, citing a memo from CEO Sundar Pichai. Delivery startup Gopuff is cutting 1,500 jobs and closing 76 U.S. warehouses.

Citi trimmed its price target on Apple

AAPL

to $175 from $200 but gave several reasons it’s still a buy, including expectations of a foldable phone.

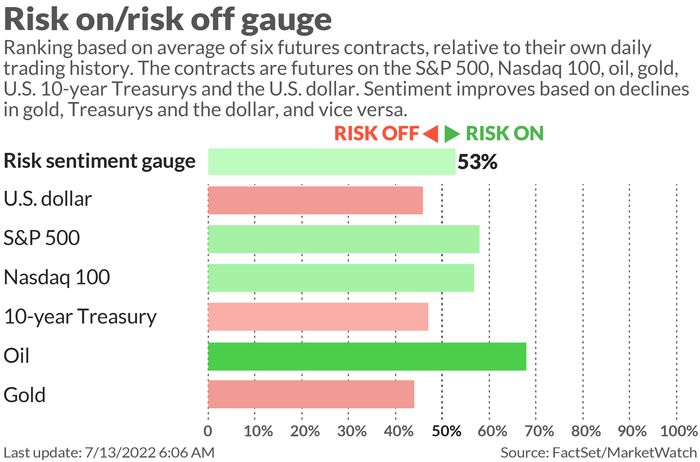

The market

U.S. stock futures

ES00

NQ00

edged higher ahead of the CPI report. The yield on the 10-year Treasury

BX:TMUBMUSD10Y

was 2.96%. The euro

EURUSD

was trading above parity.

Top tickers

Here are the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

The chart

Barclays has published its 66th annual Equity Gilt study, which provides data and analysis on long-term asset returns. Not shown in this chart of the distribution of annual equity returns is the current year, but if it were to end today, the 19% drop in the total returns index of the S&P 500 as well as 9% inflation implies the fifth-worst year since 1925.

Random reads

Here’s the heated exchange between Sen. Josh Hawley, a Missouri Republican, and Berkeley professor Khiara Bridges that captivated Twitter.

This “I voted” sticker features a gremlin-like six-headed creature with a bloodshot stare.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.