It’s go-time for the Fed, which is expected to deliver a fourth straight jumbo hike, though obviously bigger questions hang over December onward plans. Wall Street is understandably on the fence, especially after Tuesday’s batch of good-is-bad data.

Our call of the day from Stuck in the Middle blogger, Mr. Blonde, offers a simple strategy on what to do after three in four weeks of stock gains and on what he expects will be a “more of the same” Fed message.

Nothing.

“Don’t expect any pre-commitment on magnitude of rate hikes and continue to keep options open,” writes Mr. Blonde, who has been moving to a “more neutral tactical view” over the past few weeks on expectations of more “two-way risk” from here out. He identifies himself as a former equity strategist at a major firm and an advisor to a long/short hedge fund.

“Bottom line, Mr. Blonde feels tactically neutral at current levels with a core view that remains defensive. Shorting the FOMC meeting feels a bit too obvious, but chasing a +10% moves has not been rewarded this year. Sometimes it’s best to sit back, observe and wait for direction,” he said.

Like many, Mr. Blonde doesn’t see the Fed braking on rates until it is confident inflation is moving toward target, with any discussion on that unlikely until the first quarter of next year.

“Expect S&P 500 price stalls around 17.5x forward P/E, which currently equates to ~4075 (or +4%) based on consensus EPS of $233 (and falling) for 2023. Why 17.5x? Historically, valuation multiples compress as long as the Fed is hiking rates (yes even if hiking at slower pace) and rolling 2yr average acts as an area of resistance,” he said.

The S&P 500

SPX

ended Tuesday at 3856.

While the technical backdrop has improved and another 4% move higher for the S&P 500 isn’t impossible — leaving 80% of stocks above their 50-day average on par with mid-August highs — a Fed pivot may be needed to propel stocks higher, and that’s unlikely, he said.

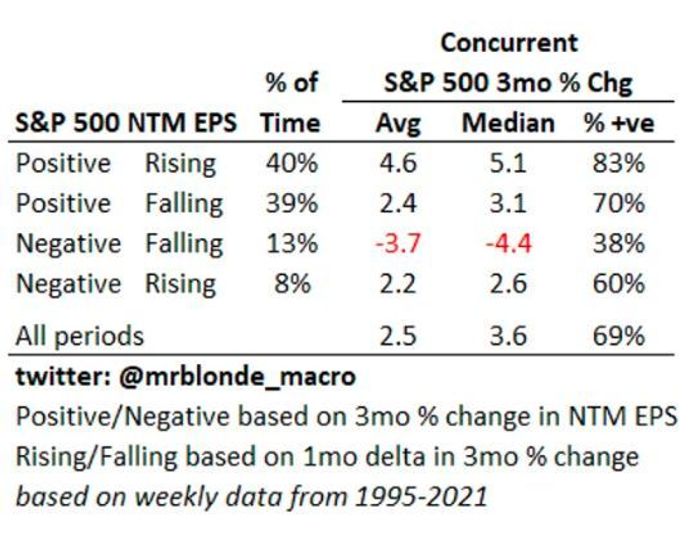

His below table shows that periods of falling next twelve months (NTM) EPS “are typically bad backdrop for equities with average 3mo returns of -3.7% and positive returns less than 40% of the time, both significantly below average. Selling rallies is a favorable strategy.”

@mrblonde_macro

Mr. Blonde also points out that doing nothing is more rewarding than it used to be, with U.S. 6-month Treasury bills

BX:TMUBMUSD06M

offering a 4.6% yield, not bad when stacked up against BBB corporate cash credit yield of 6.5%.

“This is a meaningful adjustment within capital markets and one that is likely to be felt over the course of several quarters as multiasset managers gradually, but consistently, shift toward no volatility, modest return offered by cash,” says Mr. Blonde.

The markets

Stock futures

ES00

NQ00

are mostly flat, along with bond yields

BX:TMUBMUSD10Y

BX:TMUBMUSD02Y,

with the dollar

DXY

lower. Oil prices

CL

BRN00

are also down. Hong Kong equities

HSI00

surged 2.4% on continued hopes for an ease in China’s zero-COVID policy.

Wheat futures are dropping

W00

after Russia rejoined a deal allowing grain exports to leave Ukraine.

Read: 20 dividend stocks that may be safest if the Fed causes a recession

The buzz

The Fed decision is due at 2 p.m. Eastern, followed by a news conference with Fed Chairman Jerome Powell at 2:30 p.m. Ahead of that, the ADP employment report is due at 8:15 a.m.

CVS

CVS

stock is up after news of a $5 billion deal to settle opioid lawsuits and claims. It also reported a revenue and earnings beat, though lowered guidance.

Paramount

PARAA

and Tupperware

TUP

are each dropping on earnings disappointment.

After the close, we’ll get a big batch including Robinhood

HOOD,

Zillow

Z,

Qualcomm

QCOM,

eBay

EBAY,

Etsy

ETSY

and Roku

ROKU,

along with Costco

COST

monthly sales.

Airbnb shares

ABNB

are dropping in premarket on a softer current-quarter outlook. Advanced Micro Devices

AMD

is up on solid sales and plans to get rid of excess inventory.

Tesla

TSLA

has shut its flagship store in China, Reuters reported, citing sources.

Shipping giant A.P. Moeller-Maersk

DK:MAERSK,

cut its forecast, saying freight rates have clearly peaked.

Best of the web

How Russia’s war in Ukraine helped the FBI crack one of the biggest cybercrime cases in years

A Russian mercenary group now has as much Kremlin influence as foreign minister Sergei Lavrov

Blue whales are ingesting millions of microplastic particles a day

The chart

Will major indexes keep going with this bear market rally? A big clue lies in the iShares Russell 2000 ETF

IWM,

which has seen the lion’s share of gains, says Michele “Mish” Schneider, director of trading education at MarketGauge.com, in a post for See It Market.

Schneider provides several charts showing how the ETFs for major U.S. indexes — the SPDR S&P 500 ETF Trust

SPY

and Invesco QQQ Trust Series I

QQQ

along with IWM — are nearing 50 or 200 daily moving averages headed into the Fed decision.

But the “leadership performance of the IWM suggests that it is the one to watch for insight into whether the equity indexes will continue higher or roll over at their respective resistance levels,” said Schneider, who sees it poised for a “strong breakout.”

See It Market

Read the whole post here.

The tickers

These were the top-searched tickers on MarketWatch as of 6 a.m. Eastern:

| Ticker | Security name |

| GME | GameStop |

| TSLA | Tesla |

| AMC | AMC Entertainment |

| NIO | NIO |

| AMZN | Amazon |

| AAPL | Apple |

| MULN | Mullen Automotive |

| AMD | Advanced Micro Devices |

| BBBY | Bed Bath & Beyond |

| META | Meta Platforms |

Random reads

Giant balls of chaos on the streets of London.

Shunned U.K politician heads for jungle stardom.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.