For investors aiming to take advantage of stock market declines, the obvious question is: How far is too far for stocks to fall?

The semiconductor industry, a standout performer during the reopening of the global economy last year, is now languishing in a down cycle. But the stock market looks ahead — and the long recovery for the industry group may have already started.

In the world of semiconductor stocks, Nvidia Corp.

NVDA

rules the roost, with a market capitalization of $356 billion, but it has fallen far. The stock has plunged 51% this year, while its consensus rolling 12-month earnings-per-share (EPS) estimate has declined 30% since June 30.

Below is a survey of how earnings estimates have moved for semiconductor companies and a list of stocks that analysts expect to lead the eventual industry rebound.

Semiconductor stocks may have bottomed

The Federal Reserve isn’t finished raising interest rates, and it is too early to predict when the central bank will change course. The strong dollar makes it more difficult for U.S. companies to sell products and services overseas, and and the coming wave of tech-industry layoffs cannot make anyone comfortable. Companies have cited the strong dollar while lowering their guidance for sales and earnings.

Last week, Qualcomm Inc.

QCOM

reported a reduction in demand for chips used in smartphones, sending its share price to its lowest level in two years.

In October, Taiwan Semiconductor Manufacturing Co.

TSM,

the world’s largest semiconductor foundry, surprised to the upside for third-quarter earnings, but also warned of weakening demand.

But the stock market has a way of looking far ahead. Check out the 2022 action for Nvidia’s stock through Nov. 7:

Nvidia’s shares fell to their 2022 closing low of $112 on Oct. 14.

FactSet

The stock has risen 27% since hitting its 2022 closing low on Oct. 14. The previous low, at the end of June, also generated a bounce.

Consensus earnings estimates are important to investors because they incorporate analysts’ expertise and companies’ own outlooks for sales, and provide the denominator to forward price-to-earnings ratios.

On Nov. 16, Nvidia is scheduled to announce results for its fiscal third quarter ended Oct. 31. Analysts are expecting revenue of $5.8 billion, an 18% decline from $7.1 billion a year earlier. That estimate makes for a sharp contrast from the year-earlier sales increase of 50%. Analysts expect Nvidia to show a quarterly profit of 71 cents a share, down from 97 cents.

Three months ago, Nvidia’s stock took a 12% tumble during the week after the company provided an outlook for the fiscal third quarter that was roughly $1 billion lower than analysts had expected.

Read: Nvidia’s big reset has analysts wondering whether company is now in the clear

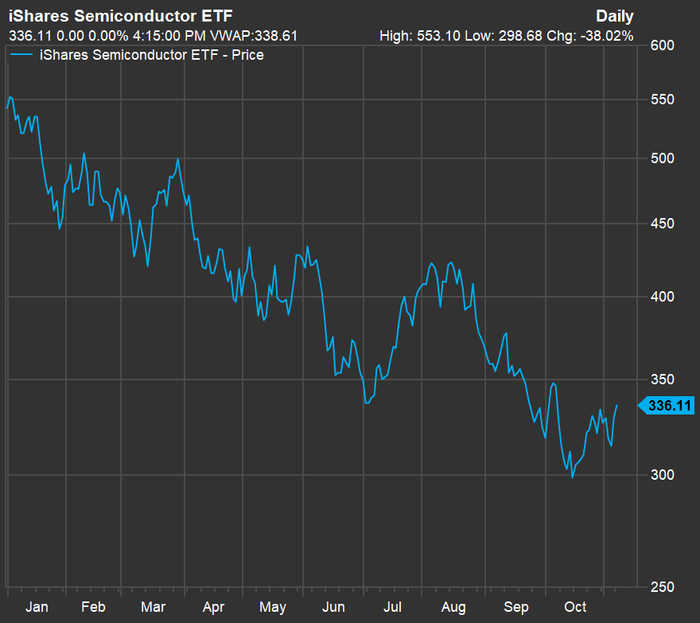

Investors seem to believe the worst news is baked into the share price. And maybe the stock market is indicating something similar for the entire chip industry. Here’s a year-to-date price chart for the iShares Semiconductor ETF

SOXX

SOXX:

FactSet

The pattern is similar, with SOXX’s 2022 closing bottom on Oct. 14, followed by an increase of 13% since then.

Pain to be followed (eventually) by gain

To screen semiconductor stocks, we began with the 30 held by SOXX and then added companies in the S&P Composite 1500 Index

XX:SP1500

(made up of the S&P 500 SPX

SPX,

the S&P 400 Mid Cap Index

MID

and the S&P Small Cap 600

SML

Index) in the “Semiconductors and Semiconductor Equipment” Global Industrial Classification Standard (GICS) industry group.

The initial list included 56 stocks. One interesting result of the screen is that consensus 12-month earnings estimates are positive for all 56 companies.

But the cuts have been made. Here are the 20 companies for which rolling 12-month EPS estimates have declined the most since June 30, along with forward price-to-earnings and those at three earlier dates:

| Company | Ticker | Change in rolling 12-month EPS estimate since June 30 | Current P/E | Sept. 30 P//E | June 30 P/E | Dec. 31 P/E |

| Micron Technology, Inc. | MU | -91% | 58.1 | 78.6 | 5.2 | 9.5 |

| SiTime Corp. | SITM | -54% | 42.9 | 20.1 | 34.3 | 85.3 |

| FormFactor, Inc. | FORM | -51% | 20.4 | 14.6 | 19.7 | 25.8 |

| MKS Instruments, Inc. | MKSI | -50% | 12.6 | 9.0 | 9.5 | 14.4 |

| Intel Corp. | INTC | -43% | 14.3 | 10.3 | 10.8 | 13.9 |

| Ultra Clean Holdings, Inc. | UCTT | -42% | 11.5 | 6.0 | 6.0 | 12.2 |

| Kulicke & Soffa Industries, Inc. | KLIC | -40% | 10.8 | 9.7 | 6.5 | 10.6 |

| Qorvo, Inc. | QRVO | -39% | 13.0 | 8.7 | 8.5 | 12.2 |

| Teradyne, Inc. | TER | -30% | 21.8 | 15.9 | 15.9 | 25.2 |

| Power Integrations, Inc. | POWI | -30% | 25.2 | 18.0 | 19.0 | 28.3 |

| Nvidia Corp. | NVDA | -30% | 34.5 | 29.7 | 25.8 | 58.0 |

| Alpha and Omega Semiconductor Ltd. | AOSL | -27% | 9.2 | 6.4 | 6.7 | 14.5 |

| Synaptics Incorporated | SYNA | -25% | 9.1 | 7.8 | 8.7 | 24.4 |

| Smart Global Holdings, Inc. | SGH | -25% | 6.2 | 5.1 | 5.1 | 11.0 |

| Applied Materials, Inc. | AMAT | -21% | 14.4 | 10.3 | 11.0 | 19.0 |

| Semtech Corp. | SMTC | -20% | 9.9 | 10.3 | 15.5 | 28.7 |

| Entegris, Inc. | ENTG | -20% | 18.2 | 18.1 | 20.3 | 35.5 |

| Advanced Micro Devices, Inc. | AMD | -19% | 17.1 | 13.6 | 16.8 | 43.1 |

| Ichor Holdings Ltd. | ICHR | -19% | 8.0 | 6.2 | 6.5 | 11.1 |

| Onto Innovation, Inc. | ONTO | -18% | 16.9 | 11.5 | 13.0 | 22.4 |

| Source: FactSet | ||||||

The P/E ratios underline valuations being brought down to earth for Nvidia and Advance Micro Devices Inc.

AMD,

with the latter trading below the S&P 500’s P/E of 17.8 — down from a P/E of 43 at the end of 2021, when the S&P 500 traded at 24.5 times weighted aggregate forward earnings estimates.

Micron Technology Inc.

MU

typically trades at a low P/E and the valuation had been declining. But now the P/E is distorted by a low forward earnings estimate.

Why should investors bother looking at semiconductors now? Because during the good times, chip makes can grow at a much faster pace than the broad market.

If we compare SOXX with the iShares S&P 500 ETF Trust

SPY,

which tracks the benchmark index, for five calendar years through 2021, SOXX’s sales per share increased by 45% while its EPS increased 400%. This compares to the S&P 500’s 32% increase in sales per share and 74% increase in EPS.

On a total return basis, with dividends reinvested, SOXX returned 650% for 10 years through Nov. 7, while SPY returned 231%.

Analysts expect a return to growth for the semiconductor group, but not for a while.

From 2022, analysts expect a slight decline in sales per share for SOXX in 2023, followed by a 14% increase in 2024. For SPY, analysts expect sales per share to rise 3% in 2023 and another 4% in 2024.

For EPS, analysts expect an 8% decline in 2023 and a resumption of profit growth in 2024 as EPS increases 14%. For SPY, analysts expect an EPS increase of 5% in 2023 and another 14% in 2024.

If you believe the time is right …

Despite the recent price gains, continuing revenue warnings from major players mean the jury is out on whether the semiconductor industry group of stocks has bottomed for this cycle.

Going back to the initial list of 56 semiconductor stocks, if we limit the group to companies with market capitalizations of at least $1 billion that are covered by at least five analysts, here are the 20 with the most upside potential over the next 12 months implied by consensus price targets:

| Company | Ticker | Share “buy” ratings | Nov. 7 price | Consensus price target | Implied 12-month upside potential |

| Marvell Technology Inc. | MRVL | 90% | $39.51 | $71.21 | 80% |

| FormFactor Inc. | FORM | 75% | $19.67 | $31.25 | 59% |

| SolarEdge Technologies Inc. | SEDG | 69% | $211.30 | $335.21 | 59% |

| Entegris Inc. | ENTG | 82% | $66.20 | $100.11 | 51% |

| MaxLinear Inc. | MXL | 92% | $32.74 | $49.00 | 50% |

| STMicroelectronics NV ADR | STM | 58% | $32.35 | $47.89 | 48% |

| Advanced Micro Devices Inc. | AMD | 68% | $63.08 | $89.45 | 42% |

| Wolfspeed Inc. | WOLF | 75% | $75.17 | $105.72 | 41% |

| MKS Instruments Inc. | MKSI | 70% | $67.71 | $95.00 | 40% |

| Qualcomm Inc. | QCOM | 65% | $110.09 | $152.75 | 39% |

| Taiwan Semiconductor Manufacturing Co. Ltd. ADR | TSM | 94% | $62.76 | $86.80 | 38% |

| Broadcom Inc. | AVGO | 92% | $475.22 | $652.88 | 37% |

| Cirrus Logic Inc. | CRUS | 67% | $67.43 | $91.99 | 36% |

| Nvidia Corp. | NVDA | 71% | $143.01 | $188.75 | 32% |

| Lattice Semiconductor Corp. | LSCC | 73% | $53.23 | $70.00 | 32% |

| Synaptics Inc. | SYNA | 82% | $91.94 | $120.50 | 31% |

| Universal Display Corp. | OLED | 73% | $104.09 | $135.90 | 31% |

| Diodes Inc. | DIOD | 71% | $72.93 | $94.40 | 29% |

| Axcelis Technologies Inc. | ACLS | 100% | $69.17 | $88.80 | 28% |

| Monolithic Power Systems Inc. | MPWR | 92% | $352.96 | $450.22 | 28% |

| Source: FactSet | |||||

Click on the tickers for more about each company.

Read Tomi Kilgore’s detailed guide to the wealth of information for free on the MarketWatch quote page.

Don’t miss: 20 dividend stocks that may be safest if the Federal Reserve causes a recession