As investor sentiment shifts by the day, the U.S. stock market’s rally in recent weeks may be at risk again as rising real yields threaten to undercut the market’s performance relative to the rest of the world.

That’s the view of James Reilly, an assistant economist at Capital Economics. In a note released Thursday, he said Capital Economics expects “equities in general to fall over the rest of 2022” and suspects that “stocks in the U.S. may slightly underperform those in the rest of the world as U.S. real yields rise.”

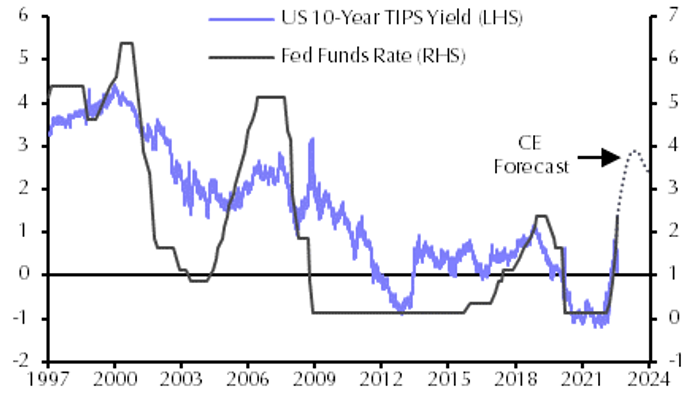

Real, or inflation-adjusted, yields matter because they’re seen as the true cost of capital for corporations after factoring in inflation. When they go up, real yields are bad for investors in stocks and other risky assets as they make it more expensive for, say, technology companies to undertake development, as one example. And Reilly says real yields are likely to keep rising in line with the expected trajectory of the Fed’s main policy interest rate which currently sits between 2.25% and 2.5%.

The chart below reflects how Capital Economics’ forecast for the fed funds rate is consistent with real yields resuming their own rise shortly.

Sources: Refinitiv, Capital Economics

See also: Have stocks bottomed? Not until this ‘gorilla’ in equity markets budges, warns BofA

“We doubt the FOMC [the rate-setting Federal Open Market Committee] will be content to watch real yields fall into negative territory,” Reilly wrote, citing recent remarks by Fed Chairman Jerome Powell. “Instead, we suspect that real yields will rise over the rest of this year, contributing to a fall in U.S. equities and probably driving some underperformance relative to stocks elsewhere.”

Since mid-June, U.S. equities have generally been rising on the view that an impending domestic recession would likely curtail the Fed’s aggressive rate-hike campaign, and help bring inflation down.

Now that fears of an imminent economic downturn have somewhat faded, stocks have gotten support from signs that inflation pressures are already easing, as seen in Wednesday’s consumer price index report and Thursday’s producer price data. In particular, the decline in July’s annual headline CPI rate renewed some investors’ faith that the Federal Reserve will pivot toward a less-hawkish policy stance and back away from aggressive rate hikes.

Real yields had been falling at the end of last month and in early August, with the 5-year yield on Treasury inflation-protected securities closing below zero, according to Tradeweb data. That yield has since moved up to 0.319% as of Thursday afternoon — along with 10- and 30-year TIPS yields, which also continue to trend higher.

In the final hour of trading on Thursday, U.S. stocks were off their best levels of the day, with Dow industrials

DJIA,

up by less than 0.1%, and the S&P 500 and Nasdaq both down.