Shares of RealReal Inc. fell Wednesday, after the luxury goods reseller blamed a sales labor shortfall and a shift in demand to lower-priced items for its mixed second-quarter results and reduced full-year outlook.

The results and outlook prompted BofA Securities analyst Michael McGovern to flip to bearish from bullish on the stock, and a host of other analysts to cut their price targets.

Co-Interim Chief Executive Rati Sahi Levesque stressed on a post-earnings conference call with analysts late-Tuesday that, given RealReal is a “supply driven company,” a sales labor shortfall that was exasperated by higher-than-normal attrition was the main reason for supply and gross merchandise value (GMV) missing expectations.

“When I talk about a labor shortfall, I’m talking about people out in the field, our sales team. So, like I mentioned…I just want to make sure it’s crystal clear: We saw attrition increase in Q2,” Levesque said, according to a FactSet transcript. “We called it the Great Resignation Part Two. And that’s what had the biggest effect to our numbers and to supply.”

Don’t miss: ‘The Great Resignation is real’ — service side of U.S. economy grows at slowest pace in a year.

Read more: Jobs shocker: U.S. adds 528,000 jobs and unemployment falls to pre-pandemic levels.

Levesque highlighted a number of actions taken to address the labor shortfall, such as “selectively increasing compensation” in key markets, and utilizing technology for consignors to self-serve, or basically reducing the need for salespeople. She said the actions taken, along with attrition returning to normal levels at the end of the second quarter, are “meaningful steps” to address the labor issue.

The stock

REAL,

slumped 1.2% in midday trading Wednesday, but pared earlier intraday losses of as much as 10.5%. On Tuesday, the stock had tumbled 15.5% ahead of the second-quarter report to snap a five-day win streak in which the stock soared 55.6%.

The company reported after Tuesday’s closing bell a second-quarter net loss that narrowed to $53.2 million, or 56 cents a share, from a loss of $71 million, or 78 cents a share, in the same period a year ago. Excluding nonrecurring items, the adjusted per-share loss of 40 cents beat the FactSet loss consensus of 47 cents.

Revenue grew 47.2% to $154.4 million, just topping the FactSet consensus of $154.1 million, while consignment revenue climbed 33.8% to $96.9 million but missed expectations of $101.4 million.

GMV jumped 30% to $454 million, but was below the FactSet consensus of $465 million.

In addition to supply pressures, the company said GMV was hurt by a shift in consumer buying habits, that more closely mirrored its pre-COVID product mix as consumers returned to the office, traveled more and attended more events.

“Starting in the first quarter and accelerating into the second quarter, there was a shift in consumer demand,” Levesque said. “The shift was from higher-priced items, like buying jewelry and watches, to lower-priced items, like ready-to-wear and shoes.”

She said that the higher proportion of GMV coming from apparel and shoes resulted in improved take rates from last year, but also in a reduction in average order value.

Orders rose 39% to 934,000 in the second quarter, while average order value (AOV) fell 7% to $486, as lower average selling prices (ASP) offset an increase in units per transaction (UPT).

Looking ahead, the company said it expects third-quarter revenue of $145 million to $155 million, below the FactSet consensus of $164.4 million.

For 2022, the company lowered its revenue guidance range to $615 million to $635 million from $635 million to $665 million, and its GMV outlook to $1.85 billion to $1.90 billion from $2.00 billion to $2.10 billion.

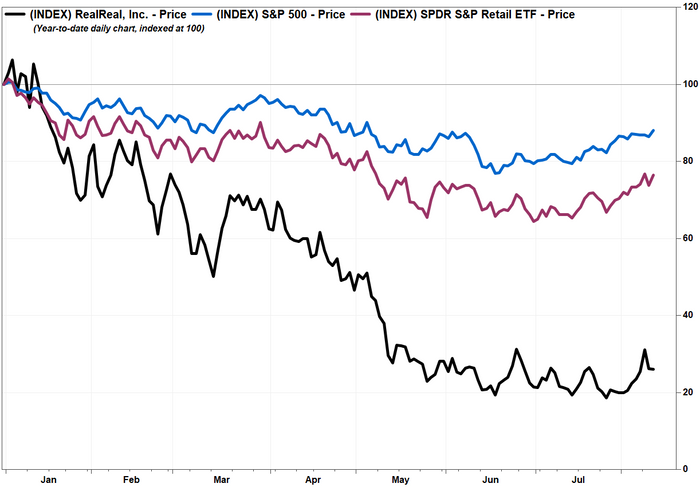

The stock has plunged 74.0% year to date, while the SPDR S&P Retail exchange-traded fund

XRT,

has dropped 23.5% and the S&P 500 index

SPX,

has lost 12.0%.

FactSet, MarketWatch

BofA Securities’ McGovern followed with a double downgrade of RealReal, to underperform from buy. He also slashed his stock price target to $2.75 from $7.00.

“Q3 guidance implies decelerating GMV growth, raising concerns on timeline to profitability, and ongoing cash burn,” McGovern said.

Co-Interim CEO and Chief Financial Officer Robert Julian tried to address cash concerns by saying the company was taking “proactive steps” to manage costs and cash flows. That included slowing hiring for support roles and cutting discretionary spending.

He also affirmed the target for reaching profitability, on adjusted earnings before interest, taxes, depreciation and amortization (Ebitda) basis, in 2024.

Of the 18 analysts surveyed by FactSet who cover RealReal, no less than nine others cut their stock price targets following the company’s results and downbeat outlook.

Wedbush’s Tom Nikic cut his target in half to $5, but reiterated is outperform rating as his new target still implied about 66% upside from current levels.

“Investors have clearly shunned unprofitable ecommerce companies this year, and as long as numbers continue to come down, that’s not going to change,” Nikic wrote in a note to clients. “Over the long run, we think the business will be fine (as we view resale as the online version of the highly successful off-price channel) and will be able to make the economics work (given the high AOV and gross profit per order).”

Analyst Scott Devitt at Stifel Nicolaus kept his rating at hold but lowered his price target to $3.30 from $4.00, saying there remains “limited visibility” into the path to annual profitability in 2024, especially given the cut to GMV guidance.