For years, Ray Dalio has made his disdain for cash abundantly clear.

The founder and co-chief investment officer of Bridgewater Associates, the world’s largest hedge fund, told everyone who would listen that cash was trash, a point he repeated to the MarketWatch “Best New Ideas In Money” festival just two weeks ago. Dalio said cash was still a “trash investment,” though perhaps he showed signs of tweaking his long-held worldview, as he said the true utility of cash depends on how it compares to others.

Now, he’s changed his mind. “I no longer think cash is trash,” said Dalio, in a late Monday tweet. “At existing interest rates and with the Fed shrinking the balance sheet, it is now about neutral—neither a very good or very bad deal. In other words, the short-term interest rate is now about right.”

This is a view that investment bank Morgan Stanley has been espousing for some time. At virtually no risk, the 6-month Treasury bill

TMUBMUSD06M,

on Tuesday morning yielded just under 4%. That compares to the 1.74% dividend yield on the S&P 500

SPX,

the 3.57% yield on the 10-year Treasury

TMUBMUSD10Y,

and the 2% yield on the iShares Core U.S. aggregate bond ETF

AGG,

Granted, if the market turns higher, cash will be left behind. That’s the risk/return tradeoff. Stocks rallied on Monday and stock futures were stronger early Tuesday. Dalio typically has a defter touch than, say, Jim Cramer, but perhaps his throwing in the towel on cash is the sign that now is the time to get out of it and put money to work.

The markets

After Monday’s 765-point outburst for the Dow Jones Industrial Average

DJIA,

U.S. stock futures

ES00,

NQ00,

were pointing higher on the second day of the fourth quarter. The yield on the 10-year Treasury

TMUBMUSD10Y,

fell to 3.57%. Bitcoin

BTCUSD,

was back above $20,000.

The buzz

The U.S. economics calendar includes a number of Fed speakers, including Philip Jefferson’s first speech as a governor. Job openings and factory orders data from August are due for release at 10 a.m. Eastern.

Is that a pivot? The Reserve Bank of Australia made a smaller-than-expected 25 basis point hike, hurting the Aussie dollar

AUDUSD,

with financial markets now forecasting the terminal rate to slip to 3.6% from 4.3% on Monday.

The likely successor to Warren Buffett, Greg Abel, made his biggest investment in Berkshire Hathaway

BRK.B,

with a $68 million purchase. Abel this summer had sold to the company his $870 million stake in a utility division he used to lead.

South Korea’s Naver

035420,

agreed to pay $1.6 billion, or $17.90 per share in cash, for online fashion reseller Poshmark

POSH,

Poshmark went public in 2021 at $42.

Best of the web

A utility has received billions in government green subsidies for cutting down environmentally-important forests.

Some retailers are sticking with “Made in Myanmar” after the coup.

Georgia senatorial candidate Herschel Walker reimbursed a woman for an abortion, according to the Daily Beast, a claim the Republican ally of Donald Trump denies. Walker’s adult son, Christian, criticized his father for running for office.

Top tickers

Here were the most active stock market tickers as of 6 a.m. Eastern.

| Ticker | Security name |

|

TSLA, |

Tesla |

|

GME, |

GameStop |

|

AMC, |

AMC Entertainment |

|

AAPL, |

Apple |

|

NIO, |

Nio |

|

APE, |

AMC Entertainment preferred |

|

BBBY, |

Bed Bath & Beyond |

|

AMZN, |

Amazon.com |

|

NVDA, |

Nvidia |

|

AMD, |

Advanced Micro Devices |

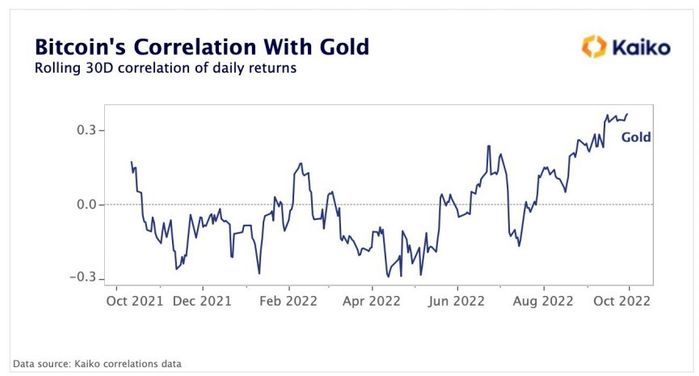

The chart

Bitcoin

BTCUSD,

suddenly is moving in the same direction as gold

GC00,

Granted, it’s hardly a one-to-one relationship, but the correlation with gold is at its highest level in more than a year, according to analysis from digital assets data provider Kaiko. The firm said as the U.S. dollar continues to strengthen, it’s negatively impacted both asset classes.

Random reads

The Onion filed an amicus brief to U.S. Supreme Court, telling the nation’s highest court that it has a daily readership of 4.3 trillion, with manual labor camps spanning the globe.

A company selling water in a can is valued at $700 million.

How this spray-on dress worn by model Bella Hadid was created.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton