If you’re trying to figure out how to make sure you’ve always got the best mix of investments, there are general rules, questionnaires about risk and all sorts of academic approaches. But it can be hard to translate the conclusions to your situation, especially if you, like most people, have a complicated financial life with many unrelated accounts.

A working adult might have a 401(k), IRA, Roth IRA, a taxable brokerage account and a money-market account. You might also have a crypto wallet or two, a high-yield savings account with CDs, a TreasuryDirect.gov account for I-bonds and other Treasurys, pensions, or other retirement plans lingering at old employers. Double that if you’re married.

Take the classic 60/40 portfolio construction, which means putting 60% of your investments in stocks and 40% in bonds, or other fixed-income investments. If you were relying on that, you’d be pretty confused right now. In today’s market, the 60/40 portfolio is either dying or rising from the dead, depending on whom you ask. And if you have money in many different places, what parts of it count toward that portfolio ratio?

You can always value the underlying message of the 60/40 portfolio, which is about diversification. You need both stocks and bonds as a hedge, because typically when one is up, the other is down, and you can cut your losses this way.

The bull market run-up after the 2008-2009 Great Recession seemed to change that equation. People needed extra convincing to stay in bonds, given how minuscule yields were.

Then this year both stock

DJIA,

SPX,

and bond markets

TMUBMUSD10Y,

tumbled (hence the death knells). Yet others already see the light at the end of the tunnel. “We think the long-term outlook has brightened quite a bit,” says Barry Gilbert, asset allocation strategist for LPL Financial.

Given today’s economic conditions, it’s time to think broadly about all of your accounts together and reassess what you need to do going forward into unknown economic territory, no matter what your personal ratio.

Messy accounts for a reason

It might seem like a mess, but you need an array of accounts because they serve different purposes for your goals, which have distinct time horizons. Your retirement, for instance, might be 20 years away, and you benefit from the tax deferment. But the money you keep in your brokerage account might be for a coming large purchase.

Diversifying your money across accounts also helps you avoid the biggest mistake most advisers see in a downturn, which is cashing out and missing the upswing. “A year ago, we were reminding people that fixed-income has a role. Now we’re reminding people that both stocks and bonds are important, because they all ask: Should I just be in cash?” says Nathan Zahm, head of goal-based investing research for Vanguard.

Consider those who have a trading account, like one of Robinhood’s

HOOD,

14 million monthly active users. Those accounts are mostly in stocks, as the platform doesn’t trade bonds (or mutual funds), although some might hold bond or money-market ETFs. These investors will want to calculate what portion of their financial holdings are in that taxable account and weigh that against their other money, to make sure they have a balance that’s appropriate for them.

Some brokerage overviews or services like Mint will aggregate a wide view for you. But at the end of the day, it might take a spreadsheet to really see what you have, because not all your accounts will talk to each other.

Remember that if you track this manually, it will just be for a moment in time. Your list would not update dynamically as the value of the accounts change, and that’s what matters most for the necessary rebalancing that would keep you aligned with your goals. You’d be 60/40 until the market close on that day, and then come what may.

Should your target asset mix really be 60/40?

For the most part, 60/40 is a philosophical starting point. “The 60/40 portfolio isn’t automatically best. Practically speaking, you’d want to be at the level that’s right for you,” says Gilbert.

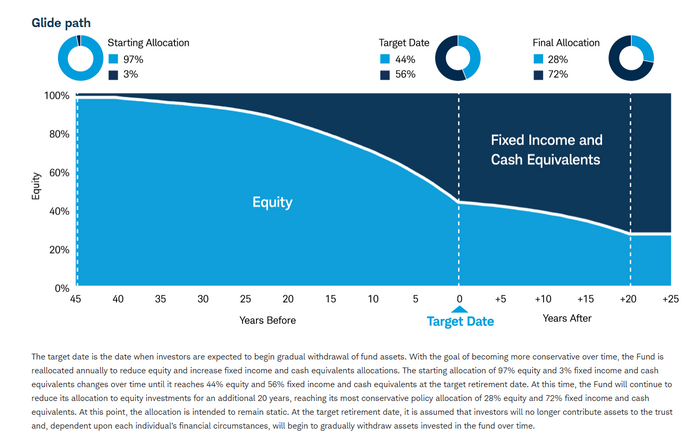

That optimal mix will depend on your age, the size of your nest egg and your goals, and it’s not a magic or a static number. It doesn’t even have to be a round number. One way to figure it out is to look at the way target-date funds for retirement use a “glide path” that shifts more conservative over time. Even if you don’t invest in target-date funds, you want to create a similar slope for yourself, and not just stick with 60/40 for decades.

For instance, Vanguard explains that its target-date funds basically only hit 60/40 around age 60, and then continue getting more conservative from there.

Schwab generally sets its funds to hit 60/40 at about five to six years from the target retirement age. “It’s one point in time. For any allocation, you have to evolve,” says Jake Gilliam, managing director for research at Schwab.

A sample from Schwab’s Target 2065 Index Fund

Schwab

Schwab also adjusts the stocks and bonds within the allocation. “Younger customers will have more international, small cap or emerging markets. As you move older, we’re adjusting those sub-asset class allocations,” Gilliam adds.

This kind of sloped setup still allows for side money if you want to take a portion of your holdings and put it in crypto, meme stocks or keep it in cash under your mattress. It’s just human nature. “We know behaviorally that it can actually drive better discipline,” says Zahm. “If somebody has a side pool of money that’s a few percent to have fun with, then they behave better with the main 95%.”

Just make sure to count your side account in with your big picture eventually and make sure you’re not letting those positions pull you away from your target asset mix, whether that’s 60/40 or another ratio.

“There’s nothing wrong with thinking in buckets, but eventually all the small buckets go into one big bucket,” says Gilbert.

More from MarketWatch

Investors have been tested this year — do you have what it takes to succeed?

No matter your age, here’s how to tell if your finances are on the right track

Why the 60/40 portfolio is a worthy strategy even though stocks and bonds are weak

Here’s one way to potentially get more from a 60/40 portfolio