China’s ongoing housing mortgage crisis will end up being much more significant than just the Evergrande default a year ago. This is largely because of the scale of the problem and the fact that the solution requires Beijing to spend considerable political capital rather than just financial capital.

Although Beijing’s “whack a mole” approach in saving the most distressed property developers will allow it to muddle through and avoid contagion in the banking system, it comes at the expense of eroding government credibility and undermining confidence in the “pre-sale” business model that constitutes more than 80% of all property developer revenue.

At risk are hundreds of billions of Chinese home buyers’ money tied up in pre-sale accounts that they may not get back. That figure will likely grow as more property developers enter into default in coming months. Nearly half of all listed property developers now trade at a P/E ratio of less than 0.5, which is where Evergrande was at four months before its default. Moreover, nearly 100 cities, including major municipalities like Chongqing, are reportedly experiencing incomplete project problems.

The growing scale of stranded property projects means that the more than 300 mortgage boycotts, based on a rough social media tally, is likely just the tip of the iceberg. As more defaults ensue, these boycotts will grow in size accordingly.

On the face of it, the solution is obvious: bail out distressed developers because this is mainly a cash-flow problem of not being able to pay construction firms to finish projects. Once construction restarts, the units get completed, buyers get their homes, and mortgage payments will start to flow again.

But what is obvious is not simple politically. In fact, Beijing has been quite timid in stepping in because it is concerned about a massive moral hazard problem that would shift all the cost onto the central government.

As of now, containing the problem has been left to local governments’ own devices. But they are increasingly being overwhelmed as the problem grows, since incomplete projects are highly concentrated in cities with weak property markets and anemic growth. This means that the size of bailouts needed are disproportionately large relative to these local governments’ fiscal capabilities.

If local government guarantees on pre-sale units are no longer credible, then the buck has to stop with Beijing. In essence, Beijing needs the equivalent of a “deposit insurance” guarantee on pre-sale units: a promise to buyers that they will get their units irrespective of what happens to the developer.

But such an open-ended commitment will come at exorbitant cost. Since 2020, about $5 trillion worth of residential property has been sold through the pre-sale model. If assuming just 10% of the projects require bailouts equal to half the value of the property, then the total bailout cost is $250 billion.

That cost could quickly escalate when local governments realize they will be off the hook and punt all outstanding bailout responsibilities. This is quite the pickle for Beijing, which likely explains why it seems to be paralyzed by inaction because guaranteeing full bailouts is a tough pill to swallow.

As a result, Beijing will likely be behind the curve as it adopts a wait-and-see approach, directing most of its energies toward bailing out projects by already defaulted developers. But Chinese households are impatient and growing pessimistic, and this uncertainty over whether their stranded projects will get bailed out does not bolster their confidence in the Chinese economy.

And confidence is precisely what Chinese consumers need. There are already signs that home buyers are voting with their feet and ditching pre-sales. When mortgage boycotts began to make headlines by mid-July, pre-sale units fell even in major cities where incomplete projects are rare.

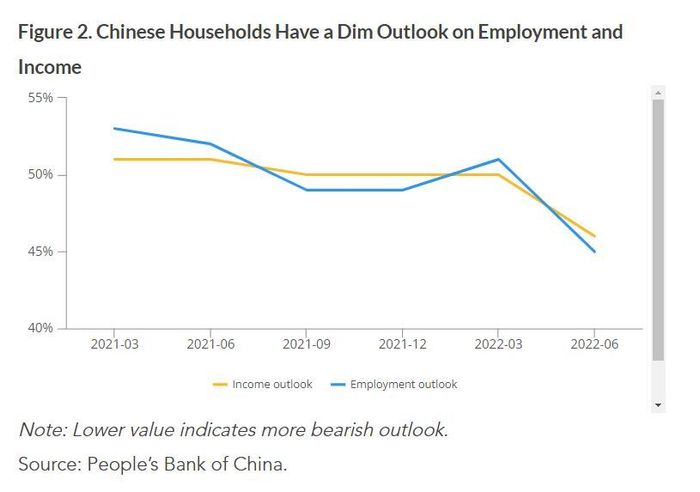

Chinese households also seem to have a very pessimistic outlook on employment and income, according to a survey by China’s central bank. Even before the COVID lockdowns, urban wage growth was more than three percentage points lower than during pre-COVID.

In short, the property sector is now flanked by both supply and demand constraints. It can’t deliver units to the people who want them, and it may lose future buyers because of the ebbing of confidence.

In the near term, this all but ensures fairly weak property sales. If left unattended, this vicious cycle will certainly exacerbate. But with an improving economy and the upcoming political transition, Beijing has strong incentives to wait it out a little longer before taking more drastic action.

But the longer Beijing waits, the bigger the bailout bill, as more defaults and disappointing property sales figures pop up in the interim. This will likely force Beijing to bite the bullet on a blanket guarantee, thereby increasing the likelihood of a meaningful bailout by the end of the year.

Houze Song is a fellow at MacroPolo, the think tank of the Paulson Institute in Chicago. Follow him on Twitter @hzsong.This was first published by MacroPolo—“China’s Mortgage Fiasco: To Bail Out or Not To Bail Out?“